The Bank of Canada says the Canadian financial system is stable, but risks remain due to debt servicing costs among households and businesses and stretched valuations of financial assets.

The central bank released its Financial Stability Report on Thursday, which evaluates the risks and stability within the Canadian financial system.

“Over the past year, households, businesses, banks and other financial institutions have taken proactive steps to adjust to higher interest rates and to weather economic shocks,” said Bank of Canada Governor Tiff Macklem, during prepared remarks in Ottawa. “The second message is that this adjustment still has some way to go and continues to present risks to financial stability.”

Non-banking sector

The central bank highlights that stretched asset evaluations is a risk to the financial system. Among non-bank participants, such as pension funds and hedge funds, have significantly increased their leverage by 30 per cent over the last 12 months.

“This increases the risk of a sharp correction that could generate system-wide stress,” said Macklem. “The recent rise in the use of leverage in the non-bank financial sector could amplify the effects of such a correction.”

Among the firms the central bank surveyed in its Financial System Survey, asset managers did indicate they have increased their liquidity. More than half of asset managers have shifted their investments towards government bonds, since 2022.

However, the report points out that because many other market participants hold the same cash equivalent assets with the intention of selling them during periods of market downturn, the result could be a fire sale that could increase financial stress.

Household debt

The report indicates that non-mortgage holders are experiencing the most amount of financial distress. The financial stress appears to impact renters the most.

The rates of arrears on credit cards and car loans for household without a mortgage have returned to pre-pandemic levels, and continue to edge up.

According to research conducted by the central bank, non-mortgage borrowers who carry a credit card balance of 80 per cent of their credit limit, are more likely to miss a future debt payment.

“Renters tend to have lower incomes to start with, so they’ve got lower buffers,” said Macklem. “They’ve been particularly hard hit by inflation, food, inflation, rent inflation, as well as high interest rates. You’re seeing more indicators of stress there. That is certainly something that we need to keep an eye on.”

Among mortgage holders, half of borrowers still haven’t renewed their mortgages because they hold 5-year fixed mortgages. These borrowers will see higher median monthly payments than those who have already renewed.

For example, variable-rate mortgage holders could see their monthly payments increase by a median of over 60 per cent.

(Bank of Canada graphic)

The bank points to these higher monthly mortgage payments among households as a risk, if there is an economic shock or unemployment rises.

“We’ll also be watching how the labour market evolves, since the biggest factor that determines whether someone can service their debt is if they have a stable income,” said Bank of Canada Senior Deputy Governor Carolyn Rogers, during prepared remarks in Ottawa on Thursday.

Canadian businesses

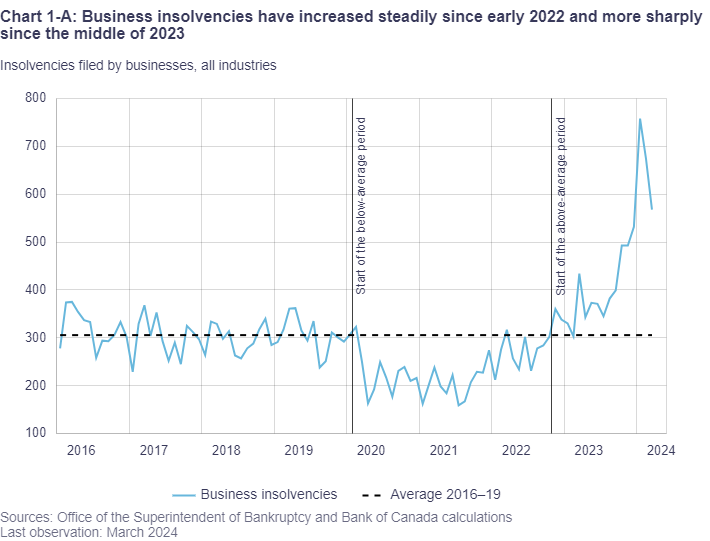

Insolvencies increased sharply among businesses between 2022 and into 2023. As of March of this year, businesses insolvencies surpassed the average from before the pandemic.

The insolvencies were widespread across industries, but mainly impacted the small business sector. Factors that led to this financial distress include higher borrowing costs, slower economic activity and the phasing out of federal and provincial pandemic support programs.

“So far, the financial health of large businesses appears solid,” said Rogers. “But smaller businesses are showing more signs of financial stress. Insolvency filings by smaller firms have recently jumped after several years of below-average filings.”

(Bank of Canada graphic)

(Bank of Canada graphic)

Canadian banks

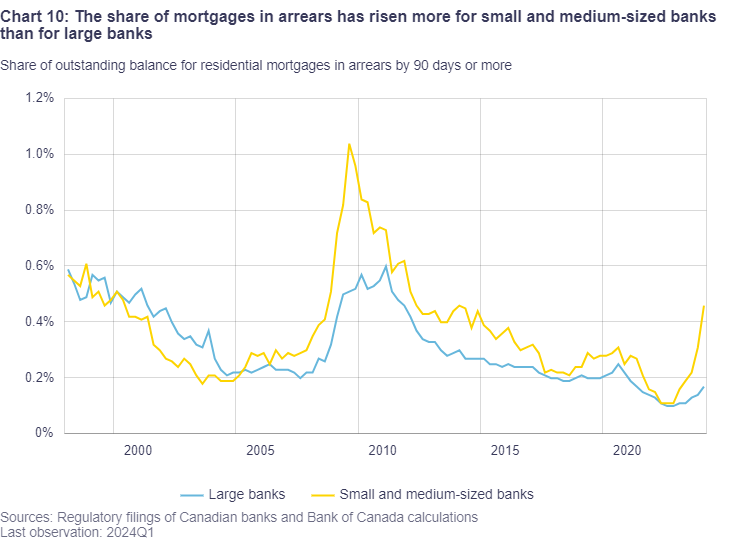

The report argues that Canadian banks remain stable. Credit performance among the large banks remains strong, with liquidity and capital requirements well above the regulatory minimums. However, the small and medium-sized banks are experiencing an increase in mortgage arrears.

(Bank of Canada graphic)

(Bank of Canada graphic)

David MacDonald, senior economist at the Canadian Centre for Policy Alternatives, thinks this is a point of concern.

“The only thing I think that would be concerning to the bank is the increase the increase in arrears for mortgages in small and medium sized banks,” he said in an interview with CTV News. “So these are people are banks rather who are going to provide mortgages to higher risk lenders or higher risk mortgages, as well as in shorter term. So you know, these are folks with less secure employment, for instance, or a bridge loan of some kind and here we’re seeing big increases in arrears.”