The Canadian market, like many others, has been closely monitoring the U.S. Federal Reserve’s annual symposium in Jackson Hole, where discussions on potential rate cuts have kept investors on edge. With markets treading water and anticipation building around monetary policy decisions, it’s an opportune moment to explore high-growth tech stocks that could thrive under these evolving economic conditions.

Top 10 High Growth Tech Companies In Canada

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Docebo | 14.74% | 34.09% | ★★★★★☆ |

| Bitfarms | 73.50% | 163.23% | ★★★★★☆ |

| Constellation Software | 16.17% | 23.55% | ★★★★★☆ |

| HIVE Digital Technologies | 54.20% | 100.27% | ★★★★★☆ |

| GameSquare Holdings | 38.08% | 86.64% | ★★★★★☆ |

| Medicenna Therapeutics | 62.37% | 57.20% | ★★★★★☆ |

| Cineplex | 8.05% | 179.27% | ★★★★☆☆ |

| Sabio Holdings | 12.97% | 122.50% | ★★★★☆☆ |

| BlackBerry | 20.61% | 76.74% | ★★★★★☆ |

| Alpha Cognition | 62.98% | 69.54% | ★★★★★☆ |

Click here to see the full list of 23 stocks from our TSX High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Constellation Software Inc., along with its subsidiaries, acquires, builds, and manages vertical market software businesses across Canada, the United States, Europe, and internationally with a market cap of CA$91.28 billion.

Operations: Constellation Software generates revenue primarily from its Software & Programming segment, which accounted for CA$9.27 billion. The company focuses on acquiring and managing vertical market software businesses internationally.

Constellation Software’s revenue surged to $2.47 billion in Q2 2024, a 21% increase from the previous year, while net income rose to $177 million from $103 million. The company’s earnings are projected to grow at 23.6% annually, outpacing the Canadian market’s average of 15.6%. With R&D expenses accounting for a significant portion of its budget, Constellation’s focus on innovation is evident through initiatives like Omegro, which consolidates diverse software solutions and serves over 15,000 clients globally.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Docebo Inc. operates as a learning management software company that provides an AI-powered learning platform in North America and internationally, with a market cap of CA$1.80 billion.

Operations: Docebo generates revenue primarily from its educational software segment, which reported $200.24 million in sales. The company focuses on delivering AI-powered learning solutions across North America and international markets.

Docebo’s revenue is forecasted to grow at 14.7% annually, surpassing the Canadian market’s average of 6.9%. The company’s earnings are expected to surge by 34.1% per year, reflecting a robust outlook compared to the market’s 15.6%. In Q2 2024, Docebo reported $53.05 million in sales and $4.7 million in net income, reversing a previous year’s loss of $5.67 million. Notably, R&D expenses have been instrumental in driving innovation and growth within its SaaS model for learning management systems.

Simply Wall St Growth Rating: ★★★★★☆

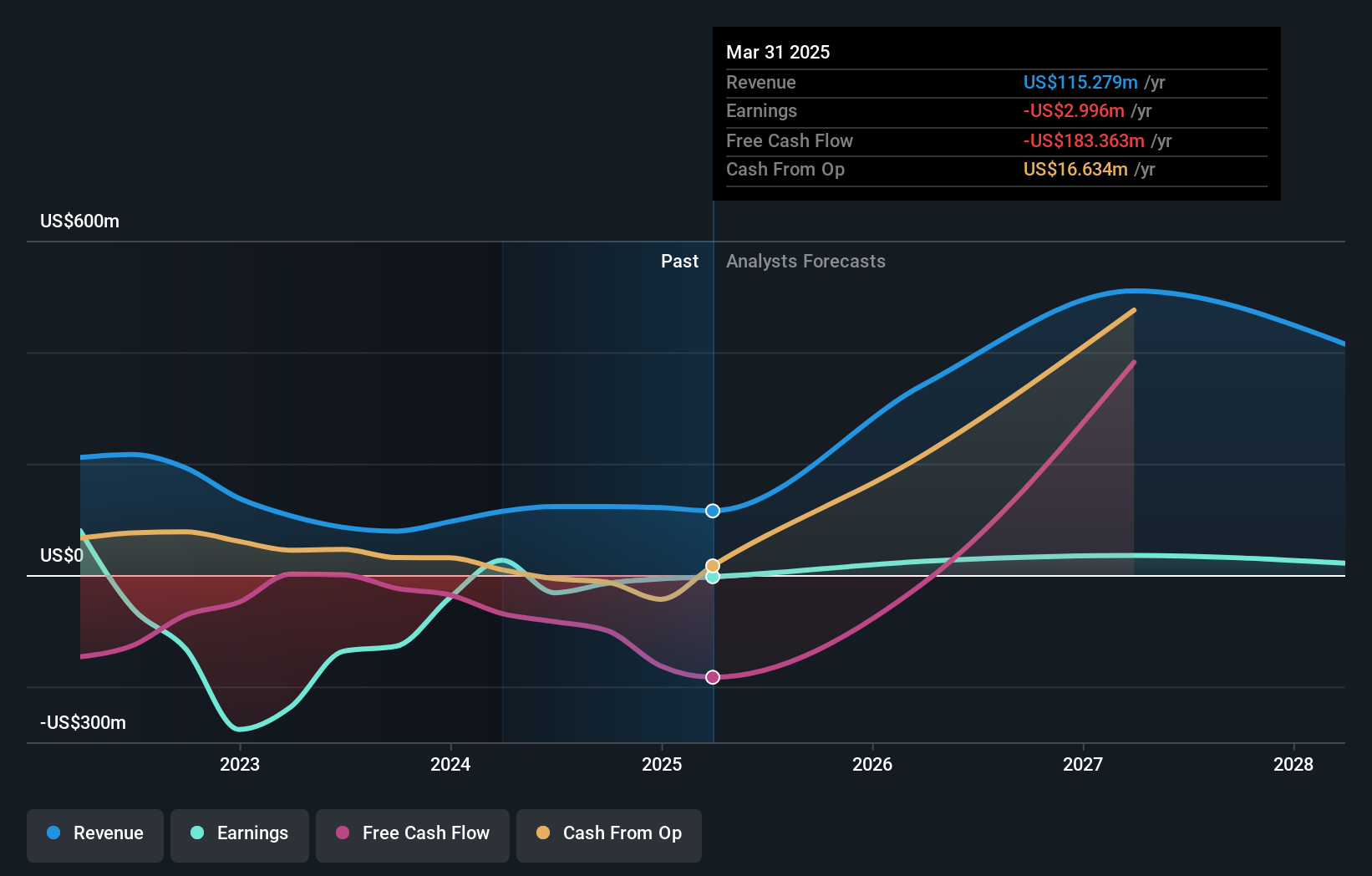

Overview: HIVE Digital Technologies Ltd. focuses on the mining and sale of digital currencies in Canada, Sweden, and Iceland with a market cap of CA$569.71 million.

Operations: HIVE Digital Technologies Ltd. generates revenue primarily through the mining and sale of digital currencies, with reported earnings of $123.14 million (CAD). The company operates in Canada, Sweden, and Iceland.

HIVE Digital Technologies has demonstrated significant growth, with revenue forecasted to increase by 54.2% annually, outpacing the Canadian market’s average of 6.9%. The company reported Q1 2024 earnings of $29.64 million, a notable rise from $23.34 million the previous year, alongside a net income of $3.26 million compared to a loss of $16.25 million last year. Their R&D expenditure is driving innovation in digital asset mining and blockchain technology, contributing to their projected annual earnings growth rate of 100.27%.

Summing It All Up

- Get an in-depth perspective on all 23 TSX High Growth Tech and AI Stocks by using our screener here.

- Shareholder in one or more of these companies? Ensure you’re never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St’s app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com