A business lobby group is calling on provincial workplace regulator WorkSafeBC to return excess funds to small businesses in B.C., saying the funds will offer relief amid rising costs and economic pressures.

The latest report from the Canadian Federation of Independent Business (CFIB) estimates the province’s workers’ compensation board has a surplus of $2 billion, which the CFIB says should be circulated to local businesses.

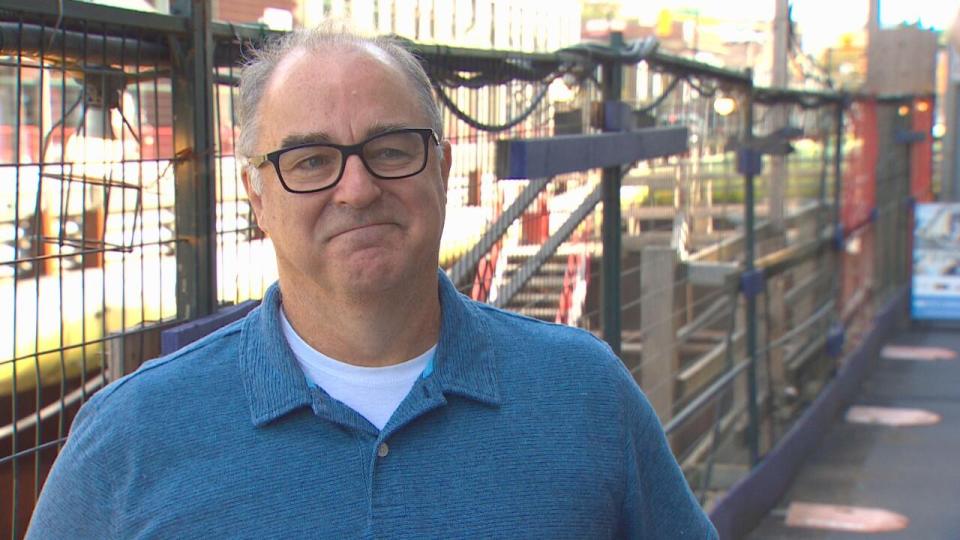

“WorkSafeBC is significantly overfunded,” said Jairo Yunis, the federation’s director of B.C. and western economic policy.

The provincial workers’ compensation board currently exceeds its funding level by 42 per cent, above its target of operating with a 30 per cent surplus, says the federation, which represents 10,000 small and medium-sized businesses in B.C.

“That means they aim to have 30 per cent more assets than liabilities as a buffer for unexpected costs or financial downturns,” Yunis added.

Jairo Yunis, CFIB’s director of B.C. and western economic policy, says providing rebates using even a portion of the surplus will not put WorkSafeBC’s financial stability at risk. (CBC News)

Over the past three years, the CFIB reports that WorkSafeBC has consistently exceeded its target funding. By the end of 2022, the organization recorded a 46 per cent surplus, which grew to 55 per cent in 2023, resulting in excess funds totalling $3.5 billion that year alone.

This surplus, CFIB suggests, could be partially returned to employers, potentially providing a typical small business with five employees up to $3,810.

While nine out of 12 workers compensation boards across Canada have implemented rebate policies, WorkSafeBC has yet to follow suit, says Yunis.

In recent years, other provinces have taken similar steps. Manitoba’s Workers Compensation Board returned $118 million to employers in 2024, while the board in Prince Edward Island returned $21 million in 2023.

“It’s time for WorkSafeBC to step up, to follow the example,” said Yunis.

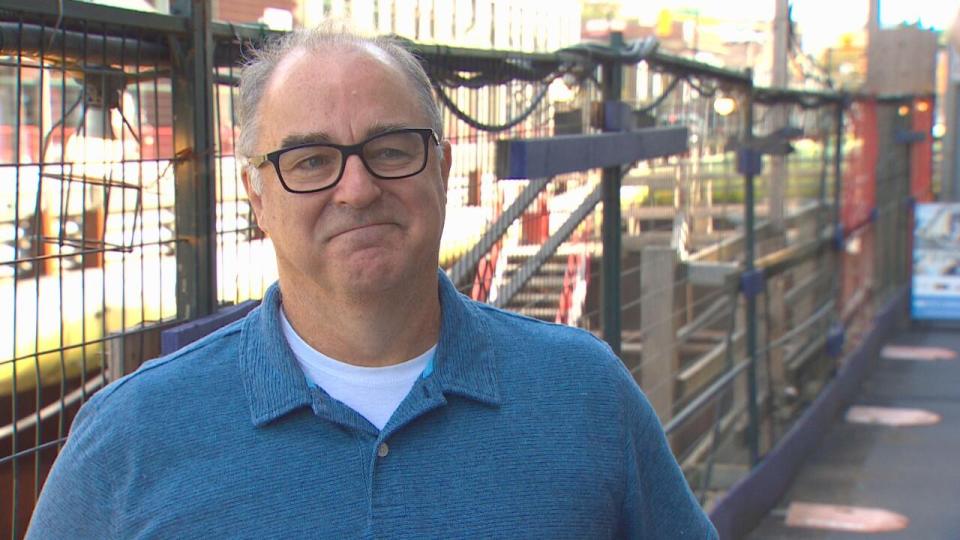

Neil Wyles, executive director of the Mount Pleasant Business Improvement Area, is pictured on Sept. 1, 2024. (Shawn Foss/CBC)

Neil Wyles, executive director of the Mount Pleasant Business Improvement Area in Vancouver, echoed Yunis’ concerns, emphasizing that the excess funds belong to small businesses.

“I don’t think there’s a small business in B.C. who wouldn’t like that money back in their pocket,” he said.

Wyles said local shops and restaurant along Broadway in the Mount Pleasant neighbourhood are in even more dire need of support due to ongoing construction of the Millennium Line SkyTrain extension.

WorkSafeBC not funded by gov’t

However, WorkSafeBC says surplus funds have been used to maintain lower premium rates for employers.

The regulator is required by the Workers Compensation Act to set the amount that employers must pay each year to fund the workers’ compensation system.

This money is used to cover costs related to work-related injuries or diseases, including health care, lost wages, rehabilitation, and administration.

In a statement to CBC, the board says it has been in a strong financial position and has been able to set the average amount, that employers pay in premiums, lower than what it actually costs to cover these claims.

“The average base rate has been flat since 2018, despite some of the highest inflation in decades,” a spokesperson said. “In 2025, for example, if there was no surplus, the average premium base rate would need to increase from $1.55 to $1.78, a 15 per cent increase.”

WorkSafeBC doesn’t get any money from the provincial government, according to the workplace regulator.

“We are funded by premiums paid by employers and investment returns,” the spokesperson said.

Harry Bains, the labour minister and MLA for Surrey-Newton, says WorkSafeBC’s surplus is mainly due to its return on investments. (Michael McArthur/CBC)

Labour Minister Harry Bains acknowledged the challenges faced by small businesses, but highlighted the importance of maintaining the stability of the workers’ compensation system.

“We are taking action to help small businesses with costs and support them so they can succeed, including increasing the employer health tax threshold exemption so 90 per cent of businesses are exempt, and keeping the small business tax rate low,” he said in a statement.