The Canadian market has recently experienced a rollercoaster ride, with stocks staging an impressive recovery from early August corrections, supported by a resilient economy and positive earnings growth. As the focus shifts towards growth amidst easing monetary policies, we explore three high-growth tech stocks in Canada that may benefit from these evolving conditions and broader market sentiment.

Top 10 High Growth Tech Companies In Canada

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Docebo | 14.74% | 34.09% | ★★★★★☆ |

| Constellation Software | 16.17% | 23.55% | ★★★★★☆ |

| HIVE Digital Technologies | 54.20% | 100.27% | ★★★★★☆ |

| GameSquare Holdings | 38.08% | 86.64% | ★★★★★☆ |

| Stingray Group | 4.94% | 69.22% | ★★★★☆☆ |

| Medicenna Therapeutics | 62.37% | 57.20% | ★★★★★☆ |

| Sabio Holdings | 12.97% | 122.50% | ★★★★☆☆ |

| BlackBerry | 20.61% | 76.74% | ★★★★★☆ |

| Cineplex | 8.05% | 179.27% | ★★★★☆☆ |

| Alpha Cognition | 62.98% | 69.54% | ★★★★★☆ |

Click here to see the full list of 23 stocks from our TSX High Growth Tech and AI Stocks screener.

Let’s explore several standout options from the results in the screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cineplex Inc., along with its subsidiaries, operates as an entertainment and media company in Canada and internationally, with a market cap of CA$691.61 million.

Operations: Cineplex generates revenue primarily from three segments: Media (CA$120.16 million), Location-Based Entertainment (CA$132.08 million), and Film Entertainment and Content (CA$1.05 billion). The company operates in Canada and internationally, leveraging its diverse entertainment offerings to drive its business model.

Cineplex reported a net loss of CAD 21.44 million for Q2 2024, compared to a net income of CAD 176.55 million last year, highlighting substantial volatility. Despite this, the company announced a share repurchase program to buy back up to 6.32 million shares by August 2025, potentially boosting shareholder value. Revenue for the quarter was CAD 277.34 million versus CAD 367.92 million in Q2 2023, indicating an ongoing challenge in regaining pre-pandemic performance levels.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Docebo Inc. operates as a learning management software company that provides an artificial intelligence-powered learning platform in North America and internationally, with a market cap of CA$1.74 billion.

Operations: Docebo Inc. generates revenue primarily from its AI-powered educational software, which accounted for CA$200.24 million. The company’s market cap is approximately CA$1.74 billion.

Docebo’s recent performance showcases its robust growth trajectory, with earnings surging 130.2% over the past year and projected to grow by 34.1% annually for the next three years. The company reported Q2 2024 sales of $53.05 million, up from $43.59 million a year ago, illustrating strong revenue momentum at a forecasted annual rate of 14.7%. Additionally, Docebo’s R&D expenses reflect its commitment to innovation; it invested $10.3 million in Q2 2024 alone, ensuring continuous enhancement of its SaaS learning platform for an expanding client base.

Simply Wall St Growth Rating: ★★★★☆☆

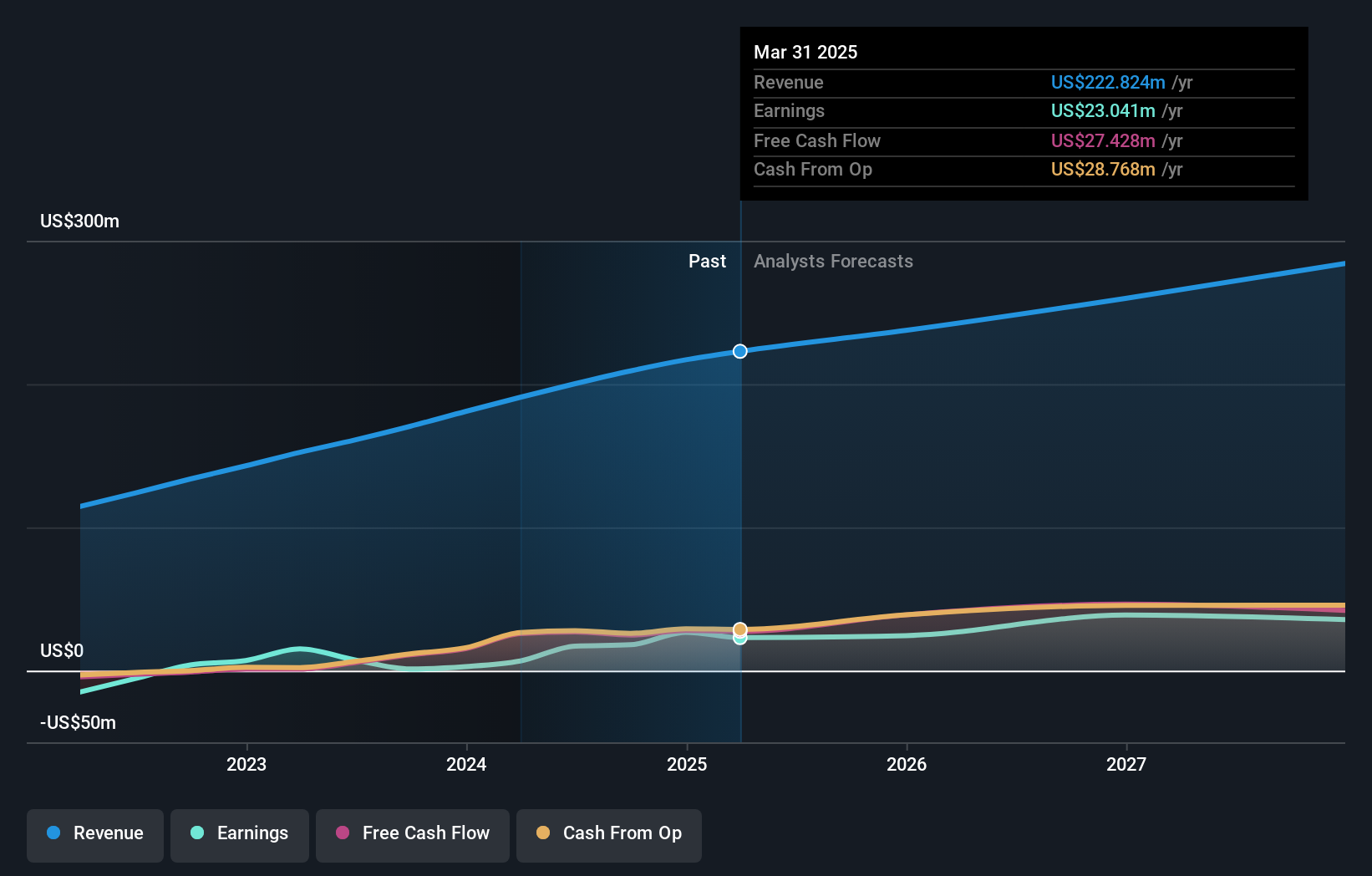

Overview: Vitalhub Corp., along with its subsidiaries, offers technology solutions for health and human service providers across Canada, the United States, the United Kingdom, Australia, Western Asia, and other international markets with a market cap of CA$405.81 million.

Operations: Vitalhub generates revenue primarily through its healthcare software segment, which accounted for CA$58.32 million. The company operates in multiple international markets, including Canada, the United States, the United Kingdom, Australia, and Western Asia.

Vitalhub’s recent performance highlights its dynamic growth within the tech sector, with revenue for Q2 2024 reaching CAD 16.24 million, up from CAD 13.09 million a year ago. Despite a net loss of CAD 0.34 million this quarter compared to net income of CAD 0.62 million last year, the company’s earnings are projected to grow at an impressive annual rate of 65.9%. Notably, Vitalhub’s R&D expenses underscore its innovation commitment; it invested significantly in developing new solutions tailored for healthcare clients, ensuring future scalability and market relevance.

Next Steps

- Click through to start exploring the rest of the 20 TSX High Growth Tech and AI Stocks now.

- Shareholder in one or more of these companies? Ensure you’re never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com