(Bloomberg) — Bajaj Housing Finance Ltd.’s shares are set to begin trading on Monday following an initial public offering that was oversubscribed by more than 60 times.

Most Read from Bloomberg

The unit of India’s largest shadow lender, whose IPO raised 65.6 billion rupees ($781 million) in the nation’s biggest deal so far this year, drew bids exceeding $39 billion last week. That’s more than 1% of the country’s gross domestic product. Shares were sold at 70 rupees each. Trading begins at 10 am in Mumbai.

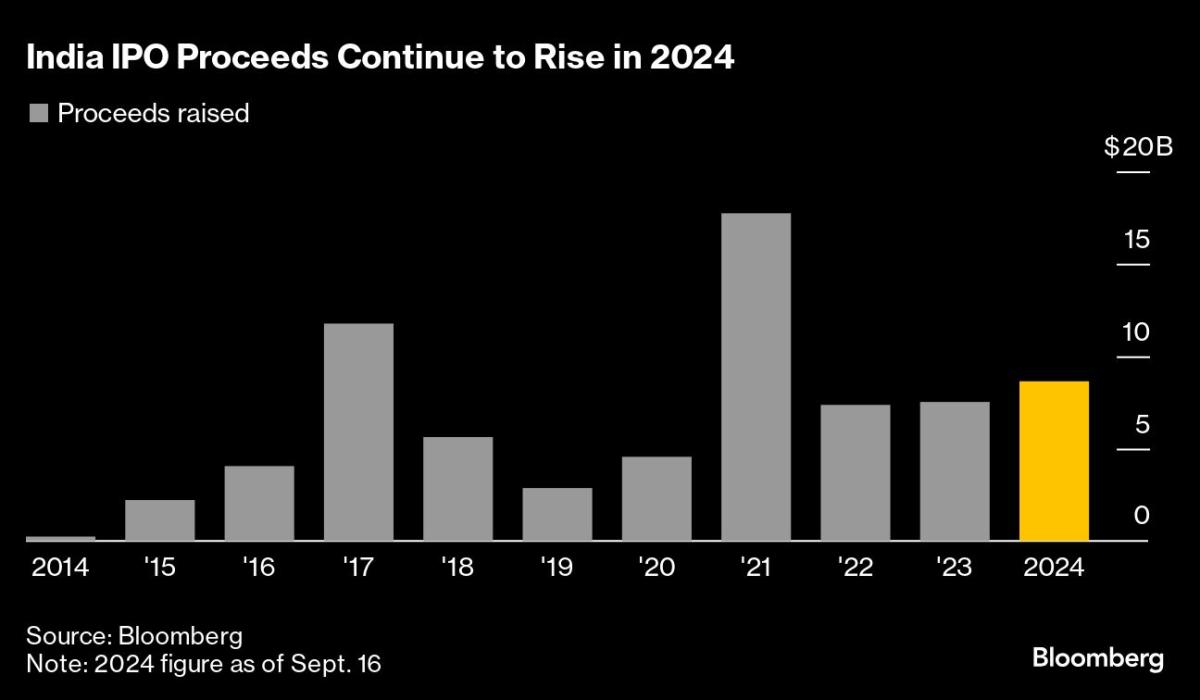

The stellar response underscores the strong appetite for first-time share sales in India, a bright spot globally for capital raising, as investors see businesses booming in the world’s fastest-growing major economy. Helped by buoyant demand retail investors, new listings in the South Asian nation have raised $8.6 billion in 2024, exceeding proceeds for each of the last two years, data compiled by Bloomberg show.

Investors have been drawn to first-day gains, which have averaged about 30% this year.

“There is strong demand for new paper and I don’t see this abating as long as listing gains continue,” said Sunil Shah, group chief executive officer at Mumbai-based Khambatta Securities Ltd.

While most of India’s IPOs this year have been for deals under $50 million, larger offerings are now coming to market. Last month, Ola Electric Mobility Ltd. raised more than $730 million, and baby-products retailer Brainbees Solutions Ltd. garnered about $500 million. Shares of both companies are trading more than 40% above their issue prices.

More major IPOs are expected — Hyundai Motor Co. will likely raise as much as $3.5 billion from the listing of its Indian unit in the coming months, Bloomberg News reported in July. South Korea’s LG Electronics Inc. has picked banks for a potential IPO of its Indian business that could raise as much as $1.5 billion, according to people familiar with the matter.

Separately, Indian food-delivery platform Swiggy Ltd. is also said to be considering filing publicly for a listing as soon as this week, according to people familiar with the matter, who added that the firm may seek to raise more than $1 billion.

Bajaj Housing’s IPO included sale of new shares worth as much as 35.6 billion rupees, while founder Bajaj Finance offered shares worth 30 billion rupees. On Sept. 6, anchor investors, including the Government of Singapore, Goldman Sachs Group Inc. and JPMorgan India subscribed to 251.14 million shares worth 17.6 billion rupees.

The company’s assets of about 971 billion rupees have grown at an average 33% during the past three years, making it the second-largest housing finance firm in India, said Rajiv Mehta, an analyst at Yes Securities. He anticipates the mortgage company to add “significant value” next 12-15 months based on expectation of continued growth.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.