As the Canadian market continues to ride a wave of optimism fueled by recent rate cuts from the U.S. Federal Reserve, ongoing enthusiasm for artificial intelligence, and robust corporate earnings, investors are keenly focused on identifying high-growth opportunities. In this environment of economic expansion and rising stock prices, we explore three high-growth tech stocks in Canada that stand out due to their innovative capabilities and potential for significant returns.

Top 10 High Growth Tech Companies In Canada

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Docebo | 14.71% | 33.96% | ★★★★★☆ |

| Constellation Software | 16.17% | 23.55% | ★★★★★☆ |

| HIVE Digital Technologies | 48.71% | 94.27% | ★★★★★☆ |

| GameSquare Holdings | 38.08% | 86.64% | ★★★★★☆ |

| Blackline Safety | 22.29% | 121.23% | ★★★★★☆ |

| Medicenna Therapeutics | 62.37% | 57.20% | ★★★★★☆ |

| BlackBerry | 24.19% | 79.50% | ★★★★★☆ |

| Alpha Cognition | 62.98% | 69.54% | ★★★★★☆ |

| Cineplex | 7.22% | 179.27% | ★★★★☆☆ |

| Sernova | 76.56% | 74.04% | ★★★★★☆ |

Click here to see the full list of 24 stocks from our TSX High Growth Tech and AI Stocks screener.

Let’s review some notable picks from our screened stocks.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kinaxis Inc. offers cloud-based subscription software for supply chain operations across the United States, Europe, Asia, and Canada with a market cap of CA$4.42 billion.

Operations: The company generates revenue primarily from its cloud-based subscription software for supply chain operations, amounting to $457.72 million. Operating in multiple regions including the United States, Europe, Asia, and Canada, it focuses on providing solutions that enhance supply chain efficiency.

Kinaxis, a leader in supply chain management software, is poised for significant growth with a forecasted annual revenue increase of 14.9% and earnings growth of 48.9%. The company’s recent partnership with Mahindra & Mahindra Ltd. enhances its presence in the complex mobility sector, further solidifying its market position amid strategic shifts and investor activism calling for potential sale explorations. With R&D expenses accounting for a substantial part of its budget, Kinaxis remains committed to innovation and excellence in an industry driven by rapid technological advancements and increasing demand for end-to-end supply chain solutions.

Simply Wall St Growth Rating: ★★★★☆☆

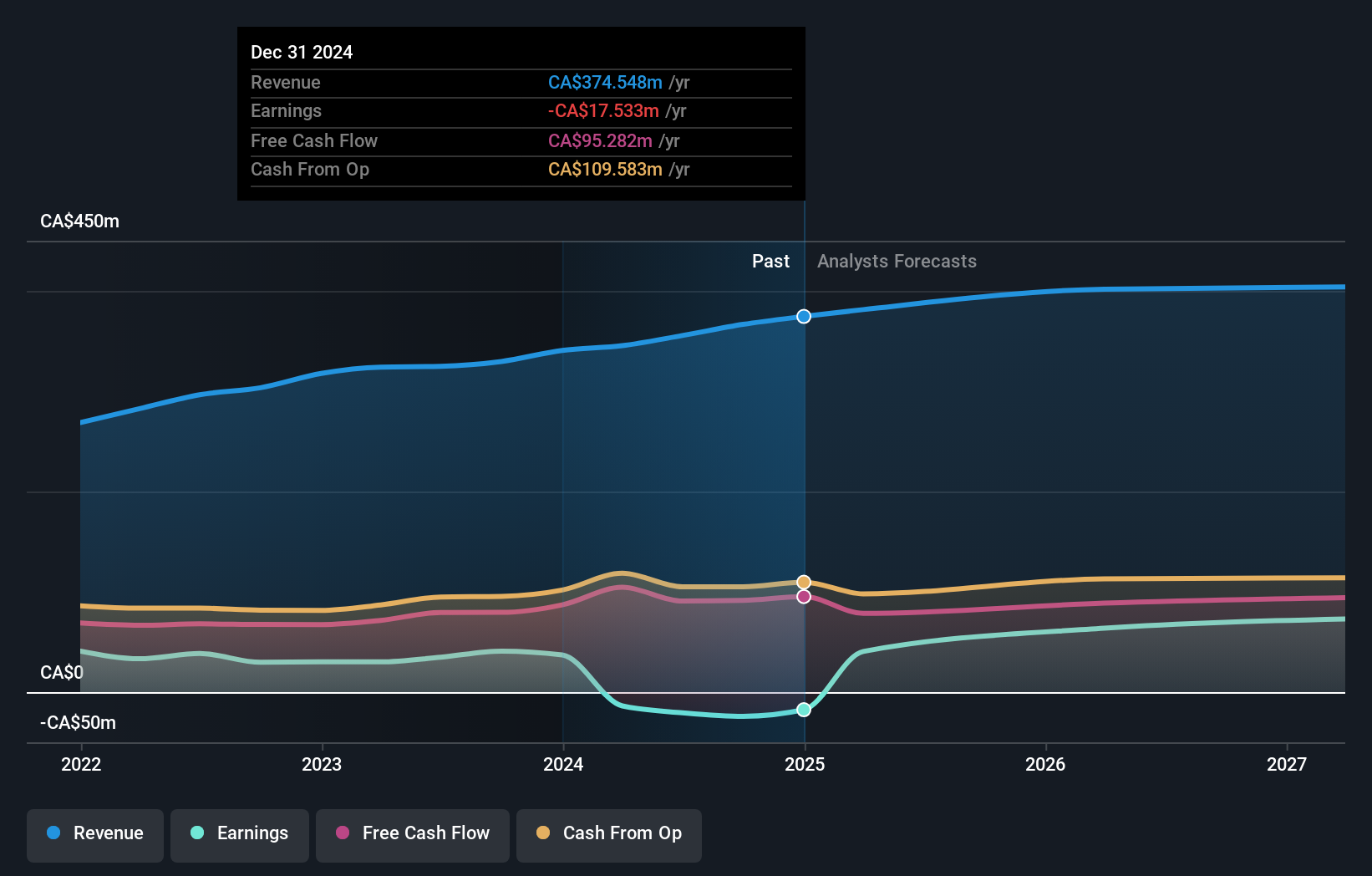

Overview: Stingray Group Inc. operates as a global music, media, and technology company with a market cap of CA$494.25 million.

Operations: The company generates revenue primarily from its Radio segment (CA$154.41 million) and Broadcasting and Commercial Music segment (CA$201.10 million). It operates globally in the music, media, and technology sectors.

Stingray Group, amidst a dynamic tech landscape, has announced a significant share repurchase program, signaling confidence in its financial health by planning to buy back 6.39% of its issued shares. This move coincides with the launch of innovative ad-supported TV channels on Amazon Fire TV and an intriguing partnership with Ford for in-vehicle karaoke services, showcasing Stingray’s commitment to diversifying its entertainment offerings. With R&D expenses reflecting a strategic focus on innovation—critical for staying relevant in the competitive media sector—the company’s recent ventures into digital and interactive platforms could set the stage for robust revenue streams. Despite a projected annual revenue growth rate of 4.9%, which trails the broader Canadian market average, earnings are expected to surge by 69.2% annually, highlighting potential profitability enhancements and an optimistic outlook for scaling operations effectively.

Simply Wall St Growth Rating: ★★★★★☆

Overview: HIVE Digital Technologies Ltd. engages in the mining and sale of digital currencies in Canada, Sweden, and Iceland with a market cap of CA$534.13 million.

Operations: HIVE Digital Technologies Ltd. generates revenue primarily through the mining and sale of digital currencies, amounting to $123.14 million. The company operates in Canada, Sweden, and Iceland with a market cap of CA$534.13 million.

HIVE Digital Technologies, navigating the volatile tech landscape, demonstrates robust potential with a forecasted annual revenue growth of 48.7%, significantly outpacing the Canadian market average of 7%. This growth is underpinned by strategic R&D investments that align with industry demands for innovative mining solutions. Notably, earnings are expected to soar by 94.3% annually as HIVE transitions towards profitability within three years. Recent operational enhancements, including an upgraded ASIC miner fleet post-Bitcoin Halving and a $300 million shelf registration, underscore its proactive approach to scaling amidst crypto market shifts and regulatory landscapes.

Seize The Opportunity

Interested In Other Possibilities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if HIVE Digital Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com