Over the last 7 days, the Canadian market has risen by 1.0%, and over the past year, it has climbed 22%, with earnings expected to grow by 15% per annum in the coming years. In this promising environment, identifying high growth tech stocks such as Constellation Software can be key for investors looking to capitalize on innovation and robust market performance.

Top 10 High Growth Tech Companies In Canada

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Docebo | 14.54% | 34.05% | ★★★★★☆ |

| HIVE Digital Technologies | 48.71% | 94.27% | ★★★★★☆ |

| Constellation Software | 16.17% | 23.55% | ★★★★★☆ |

| GameSquare Holdings | 38.08% | 86.64% | ★★★★★☆ |

| Blackline Safety | 22.29% | 121.23% | ★★★★★☆ |

| Medicenna Therapeutics | 62.37% | 57.20% | ★★★★★☆ |

| Cineplex | 7.22% | 179.27% | ★★★★☆☆ |

| BlackBerry | 24.17% | 79.50% | ★★★★★☆ |

| Alpha Cognition | 62.98% | 69.54% | ★★★★★☆ |

| Sernova | 76.56% | 74.04% | ★★★★★☆ |

Click here to see the full list of 23 stocks from our TSX High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Constellation Software Inc., along with its subsidiaries, specializes in acquiring, building, and managing vertical market software businesses across Canada, the United States, Europe, and internationally, with a market cap of CA$92.57 billion.

Operations: The company generates revenue primarily from its Software & Programming segment, amounting to $9.27 billion. It focuses on acquiring and managing vertical market software businesses across various regions globally.

With a robust 33.5% earnings growth over the past year outstripping the software industry’s average of 1.9%, Constellation Software demonstrates a compelling trajectory in tech innovation. This growth is underpinned by significant R&D investment, aligning with an industry-wide shift towards SaaS models which promise recurring revenue streams. Recent financials underscore this momentum, with Q2 revenues soaring to $2.47 billion from $2.04 billion year-over-year and net income nearly doubling to $177 million. Looking ahead, forecasts suggest an annual earnings increase of 23.6%, potentially outpacing broader market expectations by a substantial margin, positioning Constellation as a dynamic player in Canada’s tech landscape.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Docebo Inc. is a company that offers an AI-powered learning management software platform, serving clients in North America and internationally, with a market cap of CA$1.81 billion.

Operations: Docebo generates revenue primarily from its educational software segment, totaling $200.24 million. The company leverages AI technology to enhance its learning management platform for clients globally.

Docebo’s strategic focus on R&D, with expenses hitting 14.5% of revenue, underscores its commitment to innovation in AI-driven learning platforms. This investment aligns with its recent 34% forecasted annual earnings growth, reflecting robust financial health and market positioning. Notably, the company’s partnership as the official business learning partner at TEDAI Vienna highlights its pivotal role in shaping AI applications in professional development, further solidifying its influence in tech-driven educational solutions.

Simply Wall St Growth Rating: ★★★★☆☆

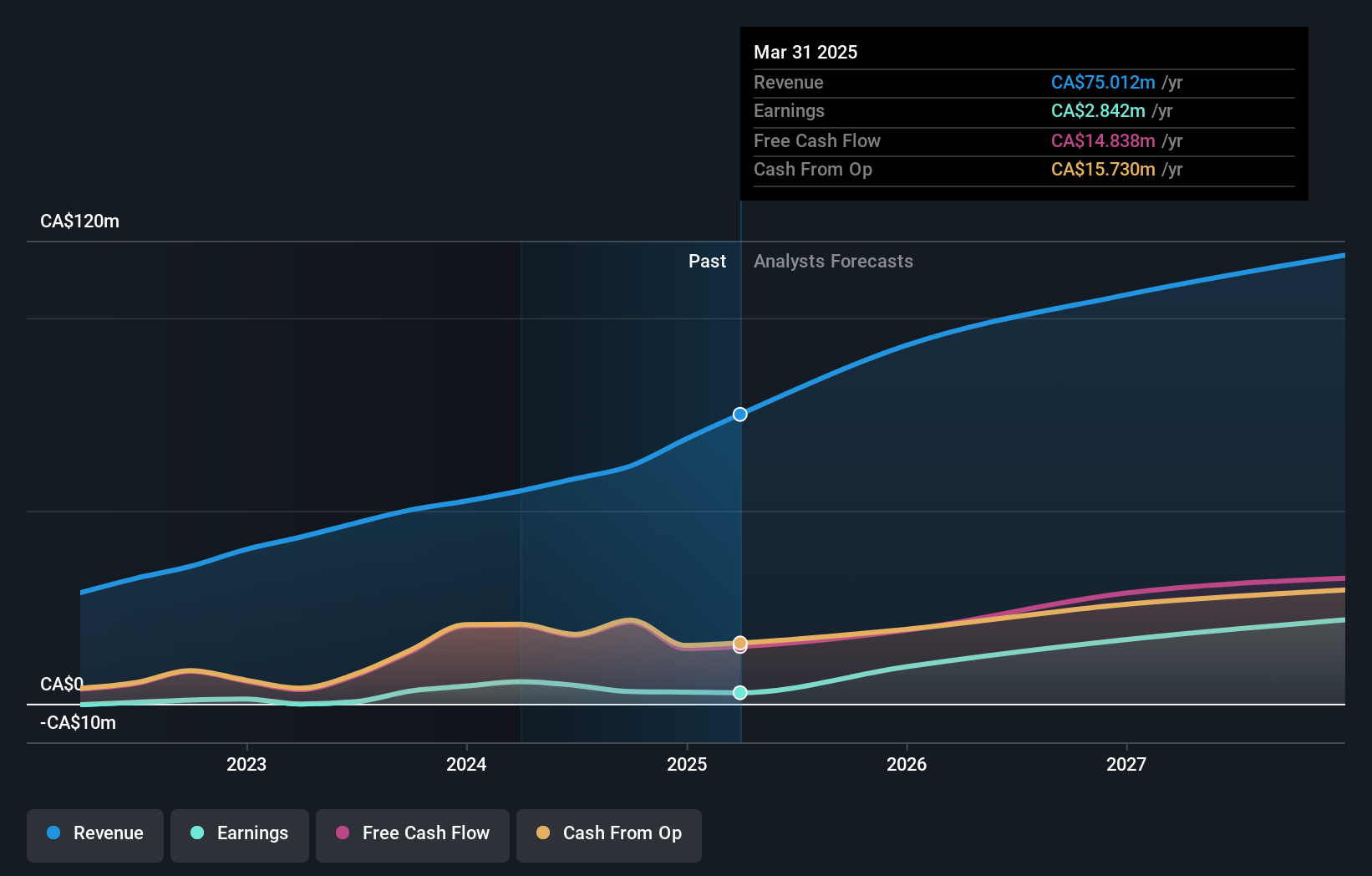

Overview: Vitalhub Corp. develops technology solutions for health and human service providers across several countries, including Canada, the United States, the United Kingdom, and Australia, with a market cap of CA$487.87 million.

Operations: Vitalhub Corp. generates revenue primarily from its healthcare software segment, amounting to CA$58.32 million. The company operates internationally, providing technology solutions for health and human service providers across various regions including Canada, the United States, the United Kingdom, Australia, and Western Asia.

Vitalhub’s recent inclusion in the S&P Global BMI Index and its active participation in high-profile conferences underscore its growing influence in the tech sector. Despite a challenging quarter with a net loss reported, the company’s year-over-year revenue growth of 13.5% and an impressive forecast of 65.9% annual earnings growth highlight its resilience and potential for rapid expansion. With R&D expenses strategically aligned to foster innovation, Vitalhub is poised to capitalize on emerging tech trends, ensuring it remains integral to healthcare technology advancements.

Taking Advantage

Seeking Other Investments?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com