The Canadian market has shown a robust performance, climbing 1.4% over the past week and 22% in the last year, with earnings forecasted to grow by 15% annually. In this favorable environment, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation and scalability potential to capitalize on these market conditions.

Top 10 High Growth Tech Companies In Canada

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Docebo | 14.54% | 34.05% | ★★★★★☆ |

| Constellation Software | 16.17% | 23.55% | ★★★★★☆ |

| HIVE Digital Technologies | 49.31% | 94.00% | ★★★★★☆ |

| GameSquare Holdings | 38.08% | 86.64% | ★★★★★☆ |

| Medicenna Therapeutics | 62.37% | 57.20% | ★★★★★☆ |

| Sabio Holdings | 12.97% | 122.50% | ★★★★☆☆ |

| Blackline Safety | 22.29% | 121.23% | ★★★★★☆ |

| BlackBerry | 24.17% | 79.50% | ★★★★★☆ |

| Alpha Cognition | 62.98% | 69.54% | ★★★★★☆ |

| Sernova | 76.56% | 74.04% | ★★★★★☆ |

Click here to see the full list of 22 stocks from our TSX High Growth Tech and AI Stocks screener.

We’ll examine a selection from our screener results.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Constellation Software Inc. acquires, builds, and manages vertical market software businesses across Canada, the United States, Europe, and internationally with a market cap of CA$93.45 billion.

Operations: The company generates revenue primarily from its Software & Programming segment, which amounts to $9.27 billion.

Constellation Software demonstrates robust growth dynamics, evidenced by a 21% increase in revenue to USD 2.47 billion in Q2 2024 compared to the previous year, underscoring its capacity to expand significantly within the competitive tech landscape. The company’s strategic emphasis on R&D is notable, with a sustained investment that aligns with its revenue growth rate of 16.2% per year, outpacing the Canadian market average of 7%. This commitment not only fuels innovation but also positions Constellation effectively against industry norms where it has surpassed software industry earnings growth by over 31%. Moreover, an expected annual profit surge of 23.6% further solidifies its standing as a formidable entity in high-tech sectors, poised for continued upward trajectory amidst evolving digital demands.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Docebo Inc. is a learning management software company that offers an AI-powered learning platform across North America and internationally, with a market cap of CA$1.87 billion.

Operations: The company generates revenue primarily from its educational software segment, which contributed $200.24 million.

Docebo, a key player in the e-learning sector, is leveraging its strategic partnerships and executive leadership to enhance its market position. Recently, the company announced a significant partnership with TEDAI for an upcoming event in Vienna, emphasizing AI’s role in learning—a move that aligns with Docebo’s innovative approach to corporate training solutions. This collaboration could potentially expand their client base and influence within tech-driven educational platforms. Financially, Docebo has shown resilience with a robust 34% expected annual profit growth and a notable increase in revenue by 14.5%. Additionally, the firm has been proactive in capital management by repurchasing shares worth CAD 6.92 million recently, reflecting confidence in its operational stability and future prospects.

Simply Wall St Growth Rating: ★★★★★☆

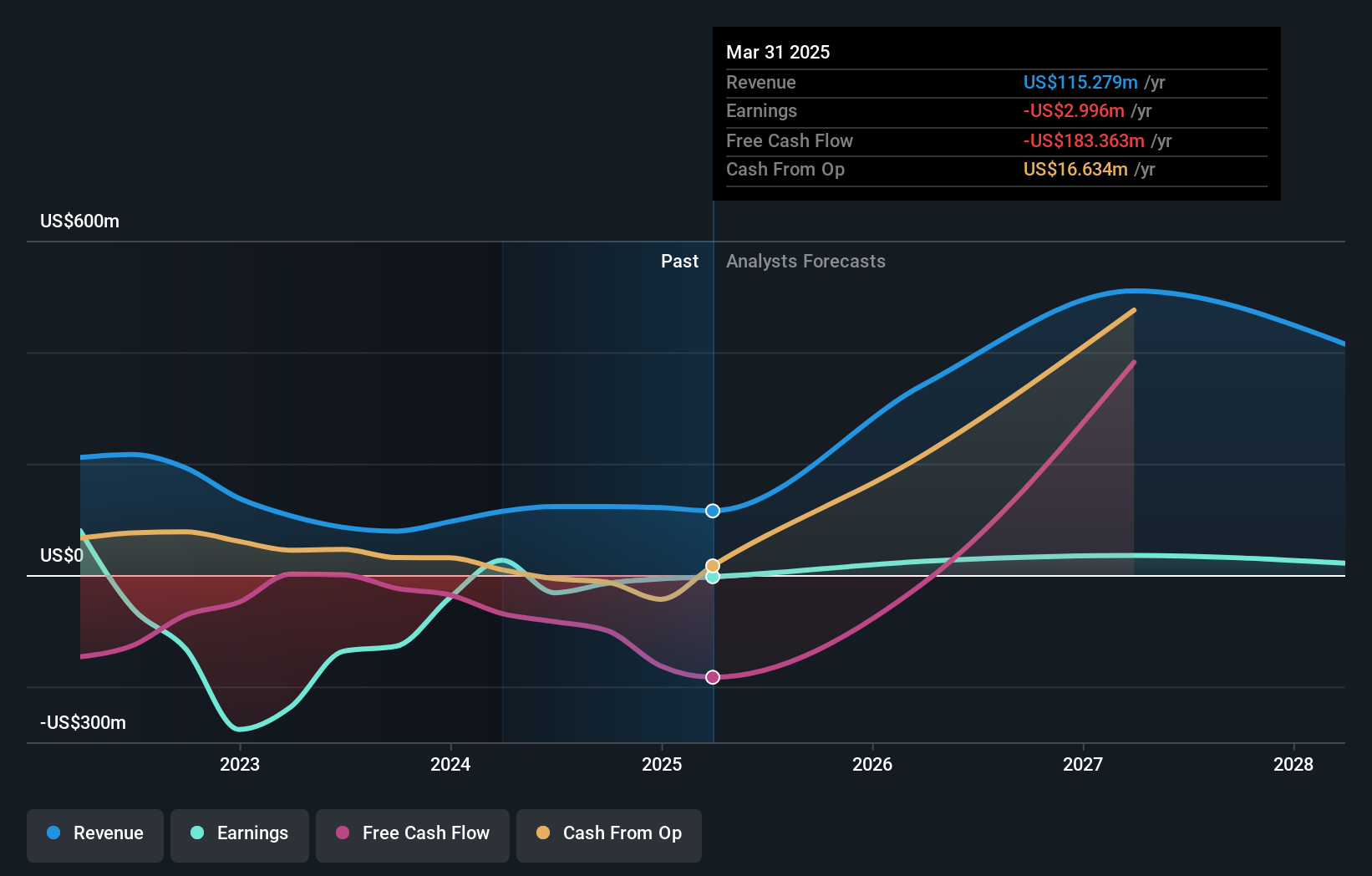

Overview: HIVE Digital Technologies Ltd. operates in the mining and sale of digital currencies across Canada, Sweden, and Iceland, with a market capitalization of CA$546.12 million.

Operations: HIVE Digital Technologies Ltd. focuses on the mining and sale of digital currencies, generating revenue of $123.14 million. The company operates in Canada, Sweden, and Iceland with a market capitalization of CA$546.12 million.

HIVE Digital Technologies, a player in the blockchain and cryptocurrency mining sector, is navigating a dynamic industry landscape with strategic maneuvers aimed at bolstering its market position. The company’s recent announcement of plans to seek acquisitions and raise up to $200 million through an equity distribution agreement underscores its proactive approach to scaling operations. Notably, HIVE’s revenue growth is projected at an impressive 49.3% per year, outpacing the Canadian market average of 7%. This growth trajectory is complemented by an anticipated earnings surge of 94% per year, positioning HIVE for potential profitability within three years. Moreover, the firm’s commitment to research and development (R&D) remains robust, aligning with its strategic goals and innovation in digital asset technologies.

Key Takeaways

Looking For Alternative Opportunities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com