As the Canadian market navigates a volatile fourth quarter, marked by geopolitical tensions and economic uncertainties, small-cap stocks present intriguing opportunities amidst broader market fluctuations. With the fundamentals of both U.S. and Canadian economies remaining solid and interest rates expected to decline through 2025, investors are increasingly focusing on companies with strong growth potential and insider buying as indicators of confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Trican Well Service | 7.2x | 0.9x | 18.25% | ★★★★★☆ |

| Nexus Industrial REIT | 3.6x | 3.6x | 23.07% | ★★★★★☆ |

| AutoCanada | NA | 0.1x | 49.35% | ★★★★★☆ |

| Rogers Sugar | 15.5x | 0.6x | 47.81% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 12.3x | 3.3x | 46.59% | ★★★★☆☆ |

| Sagicor Financial | 1.3x | 0.3x | -43.60% | ★★★★☆☆ |

| Vermilion Energy | NA | 1.2x | -7.31% | ★★★★☆☆ |

| Calfrac Well Services | 2.5x | 0.2x | -58.65% | ★★★☆☆☆ |

| Spartan Delta | 4.5x | 2.3x | -44.75% | ★★★☆☆☆ |

| Metalla Royalty & Streaming | NA | 61.2x | -119.32% | ★★★☆☆☆ |

Let’s explore several standout options from the results in the screener.

Simply Wall St Value Rating: ★★★★☆☆

Overview: Badger Infrastructure Solutions provides non-destructive excavating services and has a market capitalization of approximately $1.13 billion.

Operations: The company generates revenue primarily from its Non-Destructive Excavating Services, with recent figures showing a gross profit margin of 28.29%. Operating expenses, including depreciation and amortization, significantly impact net income margins, which recently stood at 5.81%.

PE: 24.3x

Badger Infrastructure Solutions, a smaller Canadian firm, demonstrates potential value with its recent financial performance. Earnings for Q2 2024 showed growth, with sales rising to US$186.84 million from US$171.89 million the previous year and net income increasing slightly to US$11.91 million. Despite high debt levels funded through external borrowing, insider confidence is evident as they consider a share repurchase program announced in August 2024. The company maintains shareholder engagement by affirming a quarterly dividend of C$0.18 per share payable in October 2024, reflecting stable cash flow management amidst growth forecasts of 36% annually in earnings.

Simply Wall St Value Rating: ★★★☆☆☆

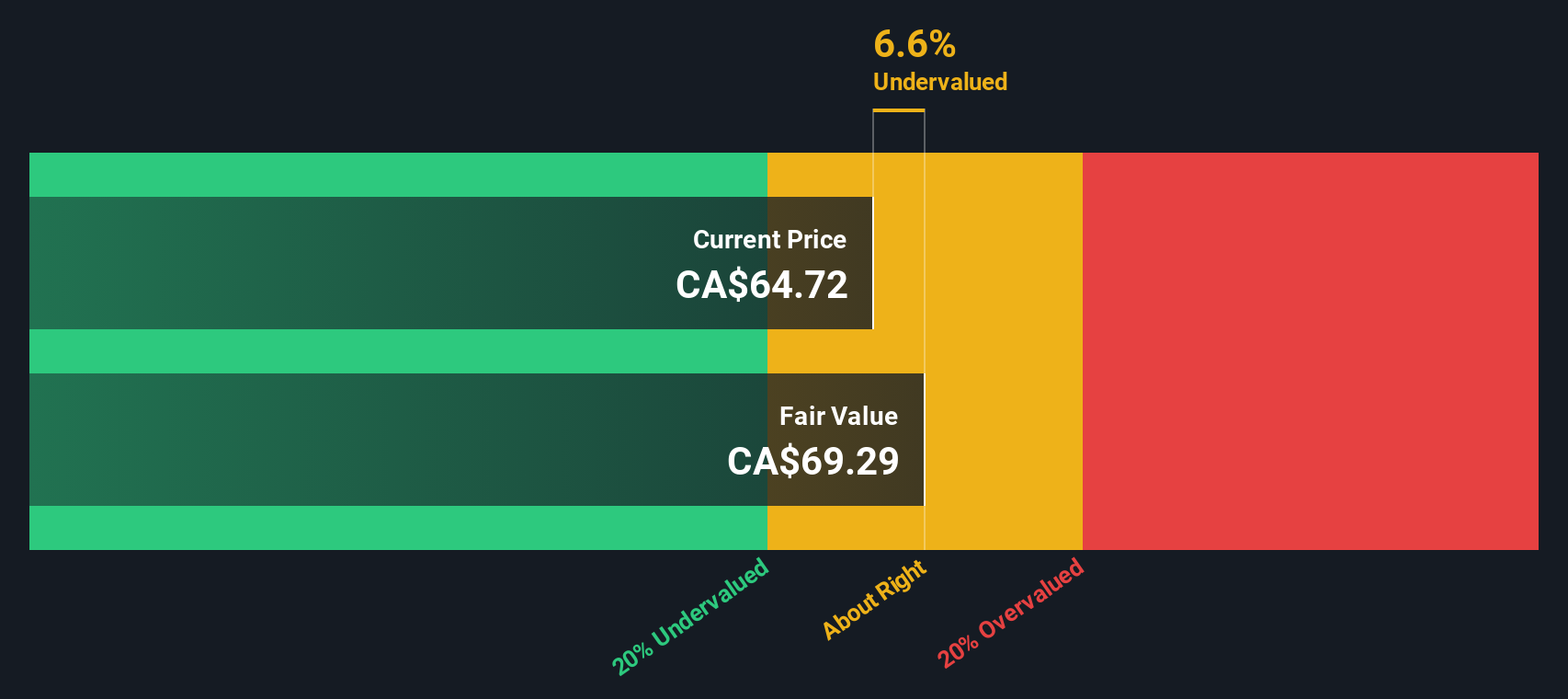

Overview: Calian Group operates in diverse sectors including IT and Cyber Solutions, Health, Learning, and Advanced Technologies with a market cap of CA$0.78 billion.

Operations: The company generates revenue from four main segments: ITCS, Health, Learning, and Advanced Technologies. Over recent periods, the gross profit margin has shown an upward trend reaching 33.17%. Operating expenses have risen alongside revenue growth, with significant allocations towards general and administrative costs as well as sales and marketing.

PE: 35.2x

Calian Group, a Canadian company with a market capitalization under C$1 billion, is gaining traction through strategic alliances and technology advancements. Recent collaborations with Walmart Canada and Microsoft highlight its focus on digital health and cybersecurity. Despite reporting lower net income of C$1.3 million for the third quarter, insider confidence remains evident as they continue to buy shares. The company’s share repurchase program further underscores potential value recognition amidst anticipated revenue growth between C$750 million to C$810 million for the year ending September 2024.

Simply Wall St Value Rating: ★★★☆☆☆

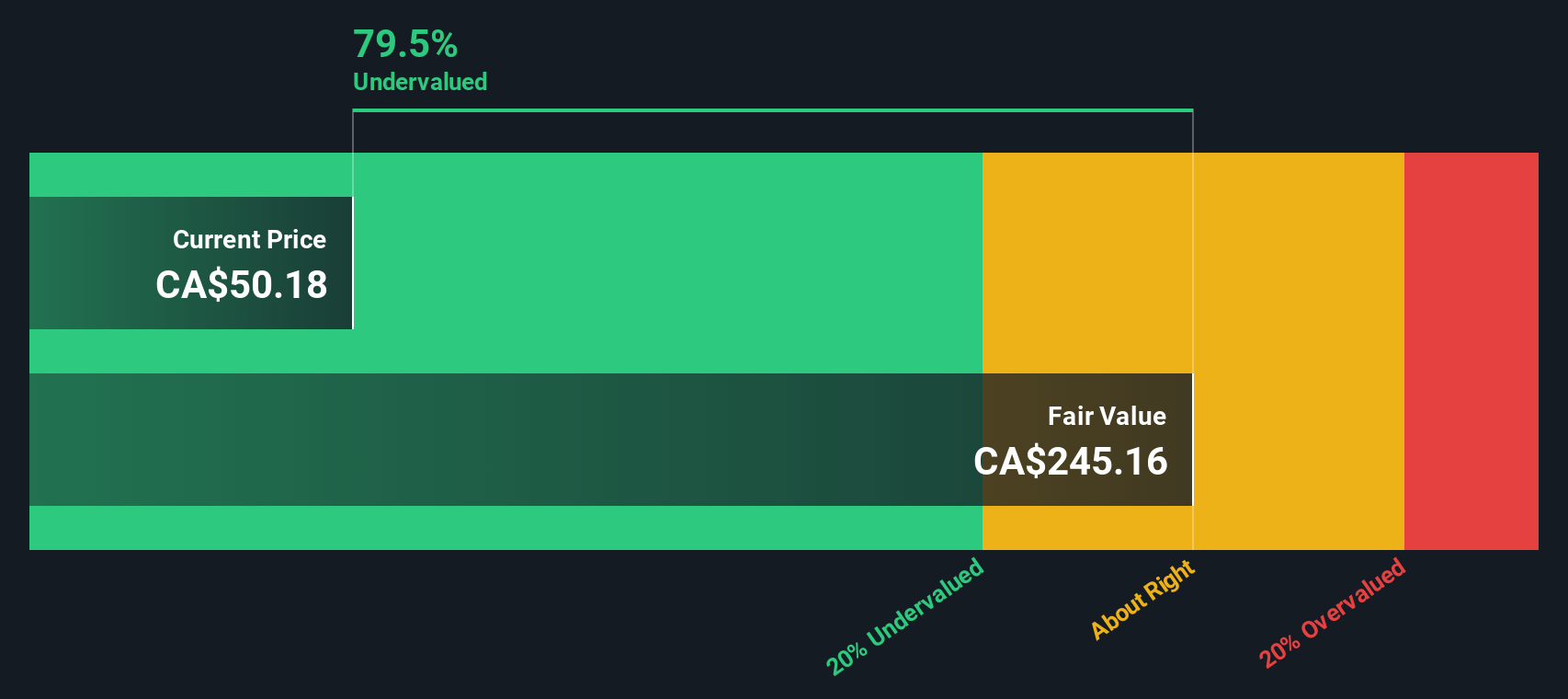

Overview: Exchange Income is a diversified company operating primarily in the aerospace, aviation, and manufacturing sectors with a market cap of approximately CA$2.36 billion.

Operations: The company generates revenue primarily from its Manufacturing and Aerospace & Aviation segments, with recent figures showing CA$1.01 billion and CA$1.60 billion respectively. The gross profit margin has shown variability, with the most recent figure at 34.72%. Operating expenses are significant, impacting net income margins which are currently at 4.44%.

PE: 22.0x

Exchange Income, a Canadian company in the aviation and manufacturing sectors, is characterized by its small market size yet diverse operations. Despite facing higher risk due to reliance on external borrowing, it shows potential with earnings forecasted to grow at 25.94% annually. The company maintains consistent dividends of C$0.22 per share monthly and recently celebrated the success of an Indigenous pilot training program in Nunavut. Insider confidence is evident with recent share purchases, indicating optimism about future prospects.

Summing It All Up

Interested In Other Possibilities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Exchange Income might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com