(Bloomberg) — President Xi Jinping’s boldest economic stimulus since the pandemic failed to impress global luminaries gathered in Washington this week, who called for more measures to rebalance China’s growth and greater clarity over Beijing’s policy plans.

Central bank governors and finance ministers threw cold water on China’s recent roll-out of rate cuts, more cash for banks and housing sector support on the sidelines of the annual meeting of the International Monetary Fund and World Bank. Others said there’s a lack of clarity around the crucial fiscal package as investors wait for a meeting of China’s top legislators to approve any additional stimulus.

US Treasury Secretary Janet Yellen criticized the stimulus blitz so far for failing to tackle the most-pressing problems of overcapacity and weak domestic demand. IMF director Kristalina Georgieva warned China’s annual growth could drop to “way below” 4% in the future without reforms to lift domestic consumption. Brazilian Finance Minister Fernando Haddad said there was “insecurity” about the stimulus measures, without elaborating.

“I haven’t really heard policy announcements on the Chinese side to address that in the way that I was hoping,” Yellen said, referring to the absence of steps to spur consumer spending, something she’s earmarked as crucial for rebalancing China’s economy away from manufacturing.

Closed-door conversations across the capital revolved around how big China’s “bazooka” was going to be, and how much weakening there was in the Chinese economy, according to one senior central banker. Those discussions unfolded as America was days away from a tight election that could redefine its relationship with Beijing, with Donald Trump threatening to impose tariffs on China that would decimate trade between the two biggest economies.

Senior Chinese central bank officials and Vice Finance Minister Liao Min traveled to the US for the meetings, including a Group of Twenty conclave, but none of the key figures in Beijing’s stimulus roll-out gave any public talks. While Chinese officials rarely brief openly at such huddles, their silence stood out even more this week, as investors clamor to know the contours of a government borrowing bundle that policymakers have hinted is imminent.

“They’re not here to sell the package to investors because if so, they would have used that opportunity,” said Alicia Garcia Herrero, Asia Pacific chief economist at Natixis SA. “They’re being cautious about dominating the agenda with a stimulus that people are doubtful about.”

One person who met with Chinese officials in private this week said Beijing was asking attendees to “wait and see” how measures announced so far would be implemented, and advising that policy would evolve as needed. Minister of Finance Lan Fo’an earlier this month suggested the central government still had room to raise deficits and borrowing limits, as officials simultaneously try to arrest the years-long property crash, and curb risks in local debt and the financial sector.

The next big window in China’s closely-watched stimulus program is a conclave of top legislators that’s expected to take place in the coming weeks and could rubber-stamp trillions of yuan in government borrowing. But authorities haven’t announced a date, prompting speculation the top leader is still calibrating how much fiscal firepower to discharge.

“I suspect they’re waiting for the American election to see how much they need to do,” Raghuram Rajan, a former governor of the Reserve Bank of India said at a panel, echoing a sentiment heard around Washington think tanks this week. “The bazooka could be really big if the American election turns negative for them.”

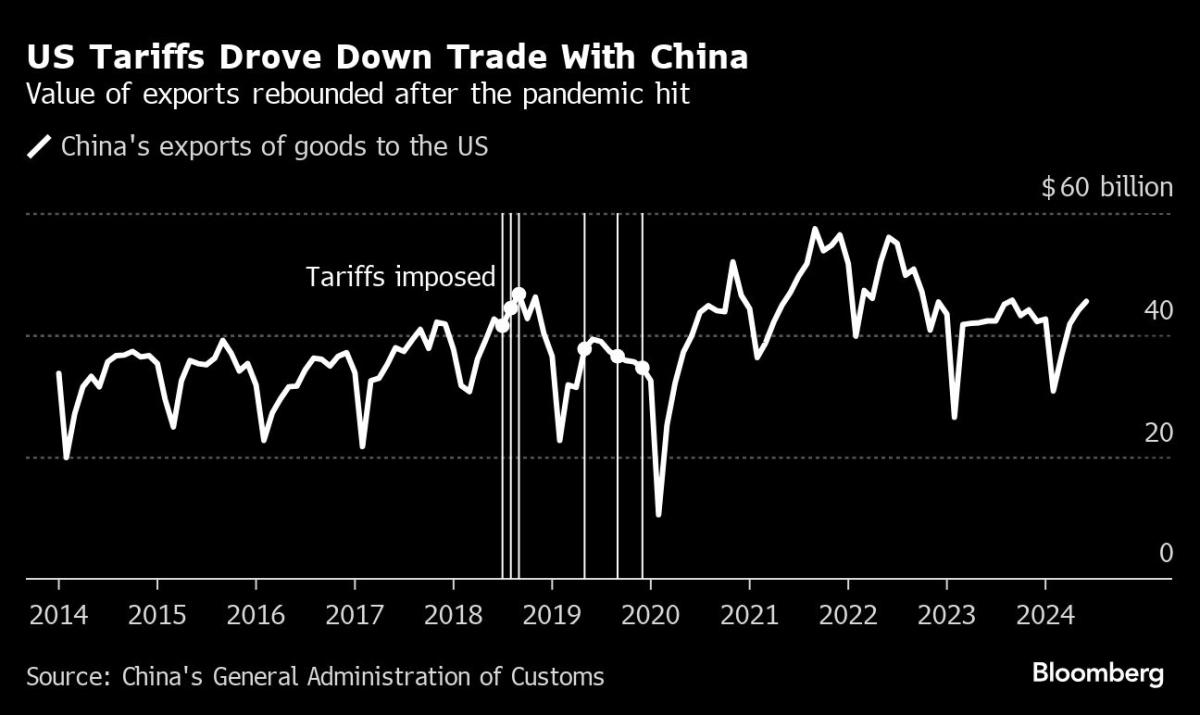

Trump has vowed to unleash a 60% flat fee on Chinese exports if he wins the November vote, a move UBS Group AG economists estimate could slash China’s annual growth rate by half. Now is the time for “bazooka-like actions” to reflate the economy, Rajan added, rather than relying on the “moderate measures” used on numerous previous occasions.

Beijing’s announcements so far have led a number of Wall Street banks to upgrade their forecasts for the country’s growth this year, to a pace closer to the official target of around 5%, and set off a powerful rally in Chinese stocks. But they haven’t represented a “whatever it takes” package, Haibin Zhu, chief China economist at JPMorgan Chase & Co., told a panel event, where he predicted that Xi will likely continue to focus on advanced manufacturing to propel the economy.

That will likely rankle trade partners. The US and European Union have responded to a flood of cheap Chinese exports with tariffs aimed at protecting their markets. Germany’s Finance Minister Christian Lindner slammed Beijing’s policies during the IMF meetings, saying “China knows it is not as competitive, for example, as the US over the next decades” and was trying to “harm” the international world order simply to improve its bargaining position.

While Chinese central bank governor Pan Gongsheng and others have given a flurry of press briefings in China this year, such events are carefully orchestrated with questions vetted in advanced, a level of control officials wouldn’t have abroad — where they would likely be asked to respond to criticisms.

“You don’t want to be ahead of the leader and say something you’d regret when you get back to Beijing,” said Neil Thomas, a fellow for Chinese politics at the Asia Society Policy Institute’s Center for China Analysis. “They wouldn’t want to get over their skis.”

As Chinese officials kept their conversations to private huddles, Vice Finance Minister Liao was occasionally glimpsed in the labyrinth-like IMF complex, traveling between closed-door meetings that will likely only be publicized when he’s back home.

“Everyone is absolutely interested in learning about the details of China’s plans,” Brad Setser, senior fellow at the Council on Foreign Relations, said in IMF’s central atrium, where participants chatted over coffee. “And figuring out, frankly, if China is going to be able to grow next year without relying on the rest of the world.”

–With assistance from Eric Martin, Philip Aldrick, Kamil Kowalcze and Christopher Anstey.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.