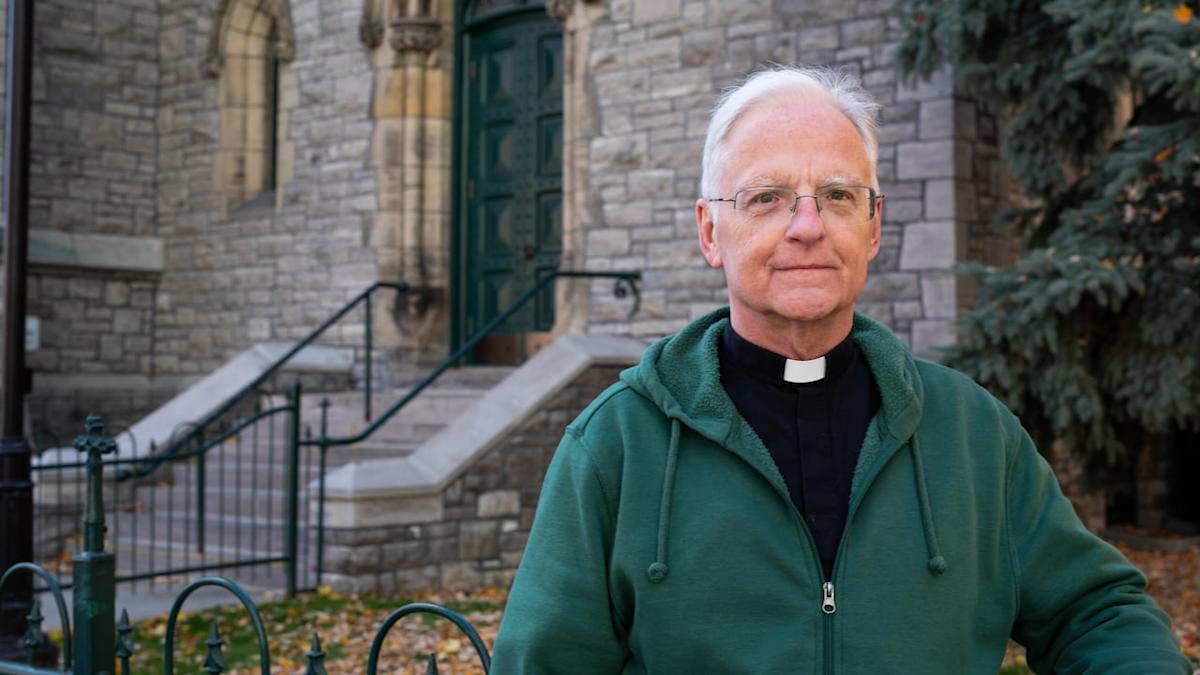

The rector of St. Patrick Basilica is heading to tax court after the Canada Revenue Agency (CRA) refused to accept thousands of dollars worth of receipts for donations he made to his own church.

Father Stephen Amesse said he donates a significant share of his salary to the basilica on Kent Street every year.

“I give a considerably amount of money,” he said. “I believe, as a pastor, I have to give example.”

He said CRA had never rejected his claims for tax credits for charitable donations before — until the 2022 tax year.

Amesse said CRA first asked for tax receipts, but when he provided them the agency still wanted proof of payment, so he sent church envelopes.

In his view, those envelopes confirmed the payments, made partly by cheque and partly in cash. He said he also sent a spreadsheet from the church’s accountant to back them up.

“The next thing I hear is through email I get a bill for $5,600, without an explanation, and three days later they send an email explaining that they are not accepting my donations,” he said.

That figure has now risen to about $5,700 with interest.

“I appealed, and it goes back and forth, four times sending copies of the envelopes, four times sending a copy of our receipts, and in August of this year I get a letter from the appeal division,” Amesse said.

His objection was denied. The letter said his receipts did not have a registered charity number. Amesse found that absurd.

“Our receipt clearly has a charity number on it,” he said.

He provided CBC with copies of the receipts, which include the registered charity number of the basilica.

“That’s the frustrating part,” said Amesse. “I can see it, everyone can see it, but for some reason they can’t.”

‘They don’t seem to listen’

The CRA also pointed to a provision of the Income Tax Act stating that proof of payment is required when there is a “non-arm’s length relationship between the taxpayer and the charitable organization.” The letter claimed that the agency did not receive proof.

But Amesse said the envelopes are the proof. Each envelope has a number, uniquely assigned to him, and they record the date and the amount of each donation, which is counted and verified by church volunteers.

“They have been, for years, accepted by CRA as proof of donations because, again, many of our donations are cash,” he said.

Amesse said he’s met a brick wall when trying to contact the officers involved in his case.

“What’s frustrating is they don’t seem to listen,” he said. “It’s so obvious that there’s a registration number on it.”

In an email response to CBC, CRA declined to discuss specific details of the case but provided general comments about charitable donations. It confirmed that St. Patrick Basilica is a registered charity that can issue tax receipts.

The tax court offices in Ottawa happen to be directly across Gloucester Street from St. Patrick Basilica. (Arthur White-Crummey/CBC)

It said charities can issue receipts to their directors or employees as with any other donor. As for proof of payment, it said it may accept a cancelled cheque, a cheque image, a credit card slip, a pledge form or a stub.

Asked whether church envelopes are accepted, CRA simply repeated that same list of options. Amesse said he sees no difference between a pledge form, for example, and a church envelope.

“It’s not only frustrating — it’s scary, in a way,” he said. “It’s money that I don’t have, and it’s money that was given to a legitimate charity for legitimate reasons, all of which CRA is supposed to accept.”

Accountant says CRA taking firmer approach

Christine Prins, a chartered professional accountant and partner with Parker Prins Lebano, said CRA has become less lenient in recent years.

“Certainly they seem to be taking a much firmer stance in applying their policies in a more thorough way,” she said. “I think in this particular case, the issue is the relationship between the donor and the charity, and they’re using a higher level of scrutiny and skepticism.”

She said CRA is within its rights to not accept the church envelopes.

“I would suggest that unless the cash or the cheque is still in the envelope that probably isn’t sufficient, especially in this case where there could be some independence issues between the donor and the church,” said Prins.

Despite the ordeal he’s faced over his 2022 donations, Amesse said CRA has accepted his donations for the 2023 tax year.

“I got the same request to provide a receipt and they accepted it,” he said. “The receipt is the same.”

He said he’s had to pay $250 to apply at tax court, but can’t justify the cost of paying a lawyer to fight his case. He plans to represent himself.

“That’s always a little unnerving, because I’m not familiar with tax rules,” he said.

Prins said Amesse should be able to prove payment for the cheque amounts. The cash transactions will be far more difficult — though the tax court may be more forgiving than the officials at CRA.

“Certainly he has a higher chance of making his case in tax court and a judge has some leniency in terms of accepting evidence that might be outside the administrative abilities of the CRA,” she said.