(Bloomberg) — Asian stocks were steady early Tuesday following a mixed session on Wall Street where traders boosted bets the Federal Reserve will this week deliver a half-point rate cut.

Most Read from Bloomberg

Equities in Sydney and Tokyo fluctuated. Futures for US stocks were little changed after the S&P 500 closed 0.1% higher and the Nasdaq 100 slid 0.5%, with investors maintaining a rotation out of the tech megacaps that has powered the bull market in stocks. Markets in China and South Korea remain shut for public holidays.

The dollar held around its lowest level since January as traders position for a potentially large interest-rate cut from the Fed Wednesday. Treasury 10-year yields were steady after dropping on Monday.

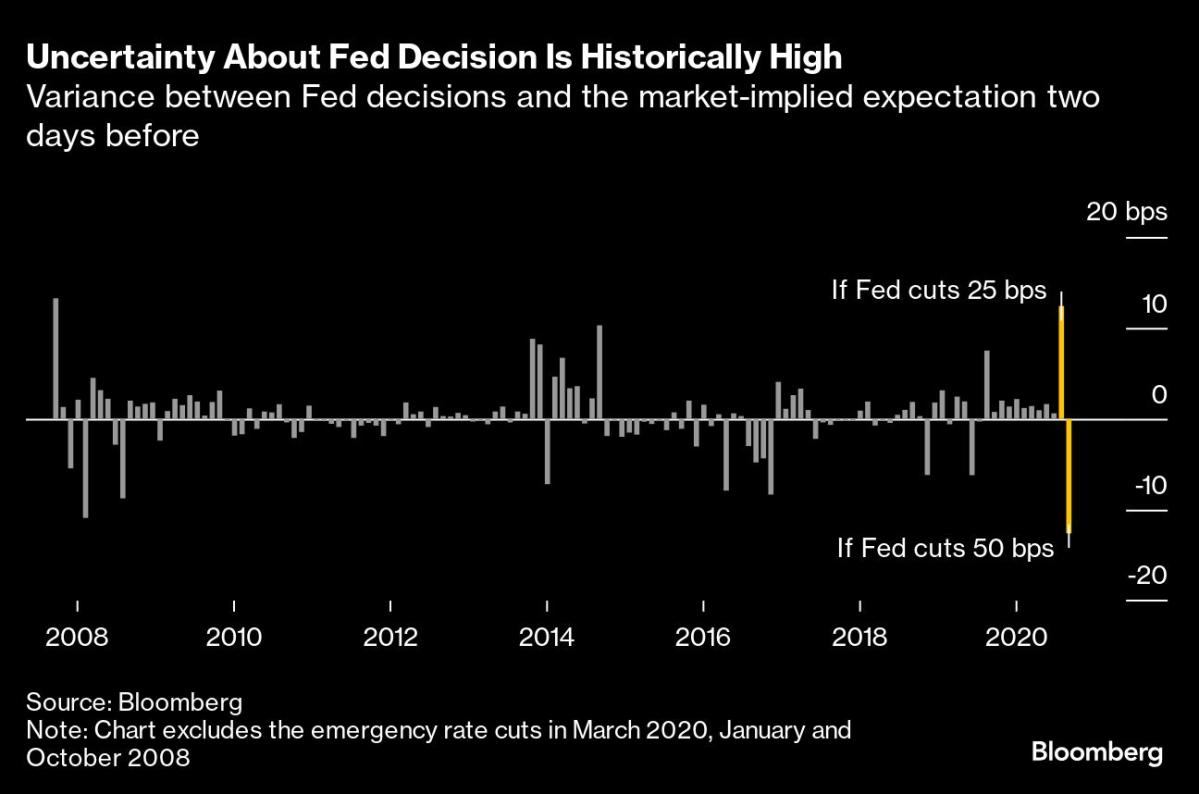

Money continued to flow into economically sensitive corners of the market, even as bond traders remained divided about whether policymakers will cut interest rates by a quarter point or a half point on Wednesday. Except for the central bank’s emergency rate cut in March 2020 at the onset of the pandemic, that’s the greatest amount of doubt in interest-rate swap markets for any scheduled Fed decision since 2007, according to data compiled by Bloomberg.

Still, strategists from Morgan Stanley to Goldman Sachs Group Inc. and JPMorgan Chase & Co. are saying that the size of the reduction is less relevant for stocks than the health of the US economy.

“We’re getting a rate cut of some sort this week absent an act of God,” said Callie Cox at Ritholtz Wealth Management. “The economic impact of one rate cut – regardless of whether it’s 25 or 50 basis points – will likely be insignificant. The path and degree of cuts over the next year or so matters the most.”

In Asia, where markets in Indonesia and Malaysia will reopen after being shut Monday, concern is growing about the strength of China’s economy. Disappointing economic data over the weekend is adding pressure on the authorities to ramp up fiscal and monetary stimulus if the nation is to reach this year’s growth target.

Investors will be on the watch for the trading debut of Chinese appliance giant Midea Group Co. in Hong Kong, after robust demand for the biggest public stock offering in three years revives hopes for the city’s languishing market.

Meanwhile, the yen was steady after strengthening beyond 140 per dollar for the first time since July 2023 on Monday as the Japanese currency extended its rally from the weakest point in nearly 38 years in July. The Bank of Japan is expected to stay on hold on Friday after raising rates twice this year.

The Bloomberg “Magnificent Seven” gauge of megacaps slipped 0.7% on Monday. The Russell 2000 of small firms added 0.3%. Microsoft Corp. unveiled a $60 billion stock-buyback program, matching its largest-ever repurchase authorization, and raised its quarterly dividend 10%. The shares rose less than 1% in extended trading.

“We remain positive on equities,” said John Stoltzfus at Oppenheimer Asset Management. “The broad rotation which began in the rally from last year’s S&P 500 low has deflected volatility repeatedly. Pullbacks experienced thus far this year have mostly looked like ‘trims’ and ‘haircuts’ for the S&P 500.”

However, since the S&P 500 peaked on July 16, the so-called Magnificent Seven have mostly slumped, with the cohort of tech megacaps falling over 6%. Meantime, other industries have gained traction.

In commodities, gold held near a record high, as traders’ uncertainty about the Federal Reserve’s interest-rate decision is the highest since 2007. Oil climbed for a second session.

Key events this week:

-

Germany ZEW, Tuesday

-

US business inventories, industrial production, retail sales, Tuesday

-

Eurozone CPI, Wednesday

-

Fed rate decision, Wednesday

-

UK rate decision, Thursday

-

US US Conf. Board leading index, initial jobless claims, US existing home sales, Thursday

-

FedEx earnings, Thursday

-

Japan rate decision, Friday

-

Euro-zone consumer confidence, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures were little changed as of 9:16 a.m. Tokyo time

-

Hang Seng futures fell 0.1%

-

Japan’s Topix fell 0.2%

-

Australia’s S&P/ASX 200 rose 0.3%

-

Euro Stoxx 50 futures fell 0.4%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.1129

-

The Japanese yen was little changed at 140.61 per dollar

-

The offshore yuan was little changed at 7.0971 per dollar

Cryptocurrencies

-

Bitcoin rose 1.2% to $58,337.53

-

Ether rose 1% to $2,297.77

Bonds

Commodities

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.