Most currencies closed the week little changed, as tensions in the Middle East abated, while the CAD lost 2 cents, as USD/CAD surged to 1.3780s. The uptrend this week was quite straightforward for this pair, with retraces lower being very minimal, and the dip after the strong Canadian employment numbers for September was bought pretty quickly.

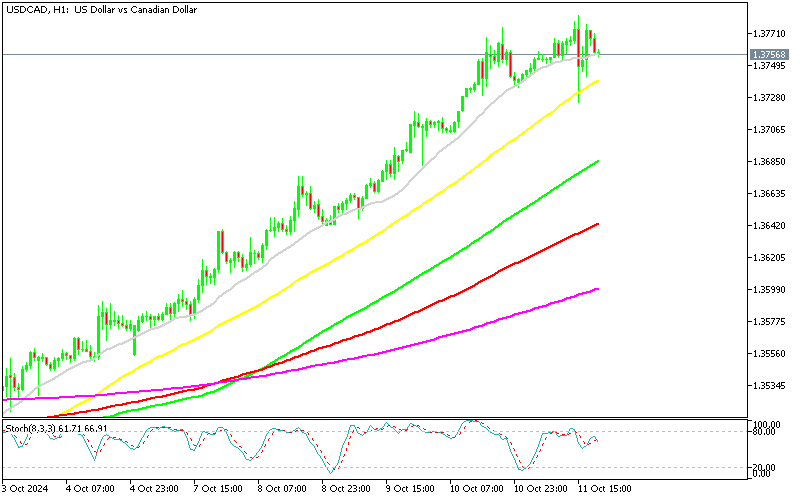

Since early October, the USD/CAD has been steadily advancing, reaching close to the 1.38 mark last Friday just before Canada released its employment data. Following the report, the pair saw its biggest drop, falling roughly 60 pips. However, support was found at the 50 SMA (yellow) on the hourly chart, where buyers quickly stepped back in, pushing the price up towards recent highs. The upward trend remains strong, with the 20 SMA providing consistent support on the H1 chart, underscoring robust buying momentum.

USD/CAD Chart H1 – MAs Keeping the Dips Shallow

Canada’s economy is feeling the strain from elevated interest rates and mortgage costs, which are reducing available jobs and applying pressure on the housing sector. Despite the jobs data, the market’s expectations for a 50 basis point rate cut from the Bank of Canada on October 23 haven’t shifted. The next target range for this pair is likely between 1.3800 and 1.3960.

Before the employment data, markets were pricing in around 55% chance that the Bank of Canada (BoC) would cut interest rates by 0.50% at this month’s meeting, which was the reason for the notable rise in the USD/CAD pair. However, after the release of the employment data, the USD/CAD dropped by 60 pips, surprising the market. Despite this, the market reassessed the BoC’s potential rate cut, and the USD/CAD rebounded from the 50 SMA level.

Canada Employment Report for September

Canada Unemployment Rate

- Employment Change: +46.7K jobs added in September, surpassing expectations of +27.0K

- Previous month saw an increase of +22.1K jobs

- Unemployment Rate: 6.5%, lower than the anticipated 6.7%

- Previous month’s rate was 6.6%

- Full-Time Employment: +112.0K, a significant increase, and the largest gain since May 2022

- Prior month showed a decrease of -43.6K

- Part-Time Employment: Decreased by -65.3K, reversing last month’s increase of +65.7K

- Participation Rate: 64.9%, slightly below the expected 65.1%

- Average Hourly Wages (Year-over-Year): 4.5%, down from 4.9% in the previous month

- Sector Breakdown:

- Private Sector Employment: Increased by +61K

- Public Sector Employment: Declined by -24K

The employment-to-population ratio also fell by 0.1% to 60.7%, and although the unemployment rate decreased, this was partially offset by a lower participation rate. Therefore, the data presents a mixed picture for the Canadian economy. Employment gains were notable among women in the core working age group of 25 to 54, who saw an increase of 21,000 jobs (+0.3%). Young people aged 15 to 24 also experienced significant job growth, with an increase of 33,000 positions (+1.2%). In terms of industry growth, the culture and recreation sector added the most jobs, with an increase of 22,000 positions, matching the gains seen in wholesale and retail trade.

USD/CAD Live Chart

USD/CAD