A man carries a copy of the Sydney Morning Herald in 2012.

(Rick Rycroft / Associated Press)

Three years ago, when Australian politicians took on the titans of Big Tech — crafting legislation to force Google and Facebook to pay for news articles they share on their sites — Google threatened to pull out of the country.

If the News Media Bargaining Code became law, Google Australia Managing Director Mel Silva said in a Senate hearing, the company would have “no real choice” but to stop making Google Search available in Australia.

Facebook’s parent went further. After the bill passed the lower house of parliament, Meta blocked Australian news outlets from posting content on Facebook and prevented users across Australia from linking to news sites for six days.

But Google and Facebook did not carry through with their threats in Australia.

By the time the bill became law, the government had made a key concession: It allowed digital platforms to bypass regulation if they volunteered to make private deals with media companies. The result: Google and Facebook rushed to negotiate agreements with most major news outlets to get around regulations in the law.

Ultimately, Australian officials estimate, Facebook and Google doled out $166 million a year to Australian newsrooms — a tiny fraction of Alphabet and Meta’s combined value of more than $3 trillion, but substantial payments for many ailing media groups.

The Australian law is now a model for legislators in Sacramento who are proposing the California Journalism Preservation Act, a bill that would require tech giants to compensate media companies for accessing their news content.

The California legislation, which would be a first for the United States, comes as news outlets large and small struggle with a precipitous decline, laying off staff as digital platforms commandeer increasing chunks of advertising revenue. While the fate of the bill is still unclear, Australia’s pioneering move to hold Google and Facebook accountable — along with a similar law passed last year in Canada — offers some early clues as to how things might fare in the Golden State.

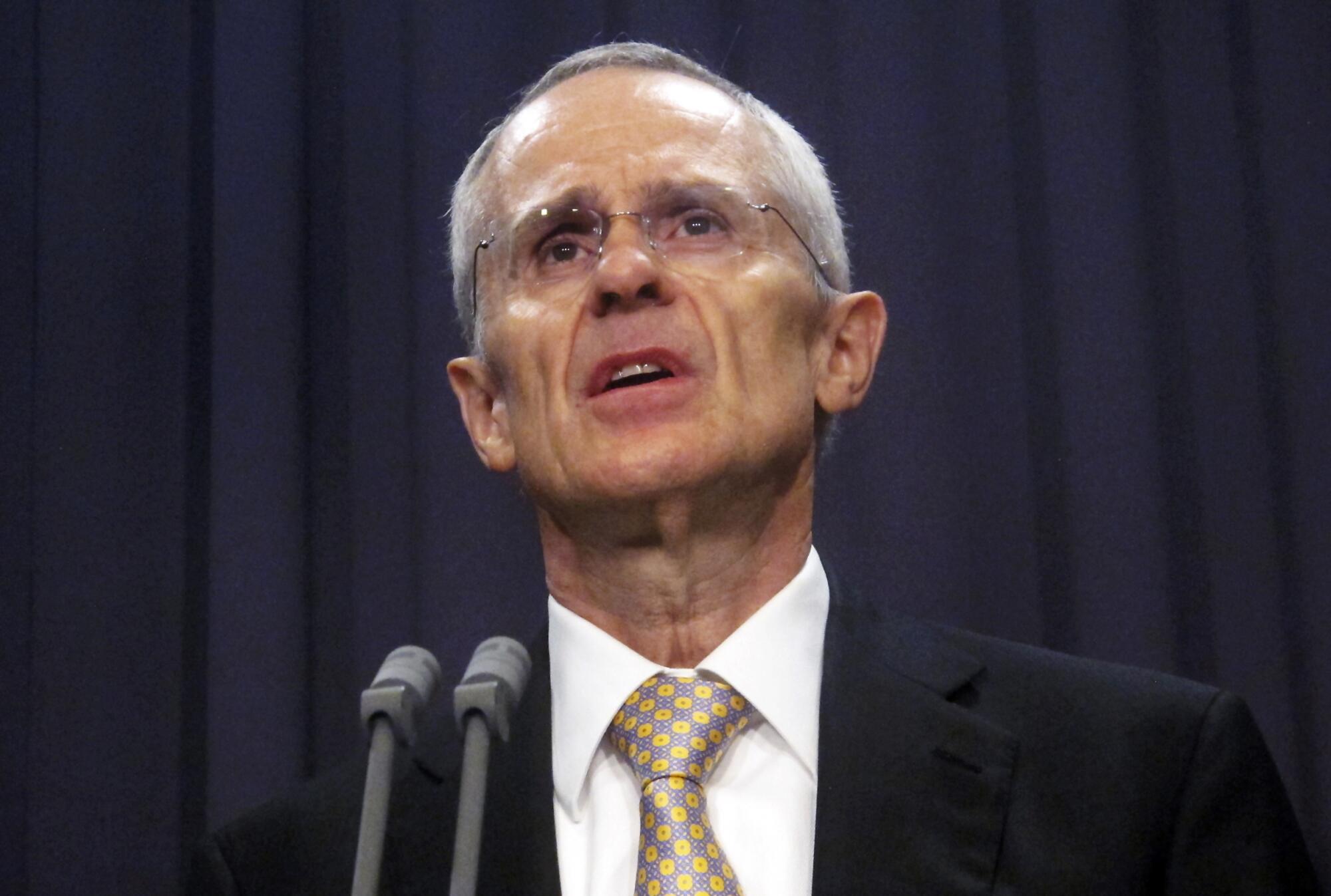

Rod Sims, shown in 2018, is an economist and former chair of the Australian Competition and Consumer Commission.

(Rod McGuirk / Associated Press)

Rod Sims, an economist and former chair of the Australian Competition and Consumer Commission who played a key role in crafting the Australian law, said its impact Down Under was “extremely, unambiguously positive.”

Yet a few years into Australia’s experiment, the future of government regulation of Big Tech — and news journalism as a viable business model — is precarious.

The deals Australian outlets struck with Google and Facebook last only three to five years, and many media players are nervous after watching the showdown between IT corporations and Canada last year: When legislators passed the Online News Act, a bill inspired by the Australian law, Facebook pulled news from its site.

“We’re at a very uncertain point in the history of legislating digital platforms and finding a way to support public interest journalism in the context of a media ecosystem that’s infected with misinformation,” said Misha Ketchell, editor of The Conversation Australia and New Zealand.

“It’s a problem we’re going to be facing for at least the next 15 to 20 years and I don’t think any solution will be total,” he added. “This is the start of a cycle of legislation all over the world.”

The clash between news outlets and Big Tech platforms stretches back more than a decade.

At its heart, the dispute is philosophical as well as financial. The platforms insist regulation goes against the spirit of the open internet, a point backed by the inventor of the World Wide Web, Tim Berners-Lee.

“The code risks breaching a fundamental principle of the web by requiring payment for linking between certain content online,” the computer scientist wrote to the Australian Senate.

Google has argued that regulating the internet would favor “a narrow range of sources for the diffusion of knowledge, … thereby undermining democratic discourse and media diversity.”

Critics argue that Google benefits from running advertising alongside news content that others produce, eroding the financial basis of journalism.

(Jeff Chiu / Associated Press)

Critics of Big Tech counter that the internet isn’t exactly open: Google, through its algorithms, controls what users see. They argue that Google benefits from running advertising alongside news content that others produce, eroding the financial basis of journalism that is vital for the public good and creating news deserts as newspapers close their doors.

“This isn’t like Kodak being put out of business by the digital camera,” Sims said. “Facebook is not doing news. It is taking it without paying for it.”

In the early 2010s, regulation was proposed across Europe. French publishers pushed the government in 2012 for legislation that would charge search engines for linking to their sites, prompting Google to threaten to stop linking to news sites. Google eventually agreed to put $64 million toward a fund to “support transformative digital publishing initiatives.” Publishers dropped the law.

“Google gave them a chunk of money, and the publishers and the legislation went away,” said Alfred Hermida, a professor of journalism at the University of British Columbia. “Ever since then, that has been Google’s strategy: paying off the news industry to avoid regulation.”

The movement to regulate tech in Australia began six and a half years ago when the Australian treasury tasked Sims with launching an inquiry into the impact of digital platforms on society.

After publishing a 623-page report, Sims played a key role in crafting the News Media Bargaining Code, a bill that proposed requiring Google and Meta to share a portion of the profits they make from news content with Australian news companies.

Google pushed back, saying the plan overlooked its existing commercial arrangements with Australian news publishers and would hurt internet users.

Front pages of Australian newspapers featuring stories about Facebook in 2021.

(Rick Rycroft / Associated Press)

But after Facebook blocked access to news — and critical emergency services and state health agencies — in the middle of wildfire season and as the government was rolling out COVID-19 vaccines, there was a public outcry. Australian Prime Minister Scott Morrison decried Facebook’s move to “unfriend Australia.”

Ultimately came the government deal that allowed platforms to avoid regulation, or designation under the code, if they negotiated with media companies to reach voluntary commercial agreements.

By some measures, news publishers saw successes.

A year after the act was passed, Guardian Australia had hired more than 40 journalists and opened a new Brisbane office. The Australian Broadcasting Co. hired 60 journalists and expanded its regional coverage area by 10 new locations. Colac Herald, a regional newspaper in Victoria, upgraded its camera equipment. The Conversation, the nonprofit, university-funded website, expanded its coverage of the environment and launched a new books and ideas section.

But not everyone got money from Facebook. Meta refused to strike a deal with The Conversation or the multicultural government broadcaster, Special Broadcasting Service.

Some media experts have criticized the lack of transparency in the commercial deals being struck between platforms and outlets. Publishers, they note, are not required to show they have spent the money.

Sims said that was “dopey.” Requiring commercial deals to be public, he argued, would hand the advantage to platforms that have more negotiating power.

Canadian legislators were inspired by Australia. But when they passed the Online News Act in June 2023 they determined to do things differently. Rather than allow Google and Facebook to avoid regulation by volunteering to negotiate, they insisted on mandatory regulation. Meta responded by blocking all news content from Facebook in Canada.

For some small news organizations and digital start-ups that depend on Facebook to generate traffic and develop an audience, Meta’s pullout from Canada was catastrophic.

Unique visitors to Eagle Feather News, a tiny aboriginal newspaper in Saskatchewan, plummeted from about 20,000 to 12,000 a month in the five months after the Facebook ban. Ad sales revenue dropped from $19,000 to $11,000 a month during the same period.

“It’s been devastating,” said Kerry Benjoe, Eagle Feather News’ managing editor.

While some big Canadian publishers blame the tech giants for their woes, Benjoe said she and other small publishers had been too reliant on Facebook. “We weren’t pushing people to our news site,” she said.

When Meta pulled out, the Canadian government scrambled to make sure Google didn’t leave.

Canadian Heritage Minister Pascale St-Onge speaks with reporters in 2023.

(Adrian Wyld / Associated Press)

At the last minute, they negotiated behind the scenes with Google and changed the legislation from Australia’s bargaining code model to a set fund that would be distributed to outlets according to their number of employees.

Google agreed to pay $73 million a year, indexed to inflation and in perpetuity, into a fund for the news industry.

The money has yet to be disbursed, but experts estimate qualifying outlets should get about $14,600 per journalist a year.

“The Canadian government placed a very big bet that this was all a bluff from the tech companies and they could not live without Canadian news and they would huff and puff but would ultimately cave,” said Michael Geist, the Canada research chair in internet and e-commerce law at the University of Ottawa. “I think they failed to read the market.”

Others argue that the law had a net benefit across the industry.

“The vast majority of publishers will see real dollars flowing to their news business,” said Paul Deegan, president and chief executive of News Media Canada, a national group representing more than 550 regional news outlets. Before the law, he noted, Google had deals with about a dozen publishers in Canada.

Still, some major supporters of the legislation ended up feeling let down by the government.

Ryan Adam, vice president of government and public affairs at the Toronto Star, Canada’s largest daily print newspaper, helped craft the language of the bill. But he said he was not sure the law would ultimately help his publication financially.

Before the law went into effect, the Star had already negotiated content license agreements with Google and Meta. When the government switched to a fund model, he said, his company lost its ability to bargain directly with the tech giants.

“The government materially changed the legislation at the last minute and folded to Google,” Adam said. “The Online News Act has been largely a disappointment for us.”

As California weighs legislation, some media experts say Australia and Canada show the limits of tech giants paying news publishers.

“If you try to play chicken with these companies, they are not going to blink, because this is more than a story about California, or Canada,” Hermida said. “This is a global story.”

If Google accepted it had legal responsibility to pay news outlets in Canada, or California, Hermida said, that sets a precedent: “It can’t afford to do that; it will change the nature of its global business.”

So far, no government has managed to craft an enduring system to regulate Big Tech.

“Nothing in the Australian legislation forces Google or Meta to bargain; the only reason they came to the bargaining table was the threat that they would be designated,” said Diana Bossio, professor of media and communications at Swinburne University. “Canada went one step further and they designated, they forced Google and Meta to bargain, and as a result Canadians didn’t have access to news.”

In April, researchers at McGill University and the University of Toronto published a report that found that six months after Facebook’s ban, Canada’s local news outlets had lost 85% of their Facebook engagement and national news outlets had lost 64%. But politically engaged Facebook users did not leave the platform.

Meta is also shifting tack in Australia. As many of the deals it struck with Australian news companies three years ago are set to expire, Meta announced in March that it would not renew.

Sims no longer leads the Australian Competition and Consumer Commission, but he questioned whether Meta would ultimately get away from regulation by blocking news. The government, he said, could require Facebook to show news from media outlets it deemed trustworthy.

“Do we want prominent social media platforms where a lot of people get their news — Facebook or Instagram — not having any trusted news sources?” he said.

With the California law pending in Sacramento, Google has already flexed its muscles.

The California state Capitol building in Sacramento.

(Arturo Holmes / Getty Images for National Urban League)

In April, Google removed links to California news websites as a “short-term test” to measure the effect of potential state legislation. California’s proposed regulation, it warned, would put “support of the news ecosystem at risk.”

Google argues that the proposed law would favor big media companies and hedge funds at the expense of smaller, local publishers. It also argues it would create “uncapped financial exposure” and “a level of business uncertainty that no company could accept” for Alphabet, which reported revenue last year of $307.4 billion.

California lawmakers revised their bill in June to make it closer to the Canadian model: Under the current proposal, platforms would pay into a fund that would distribute money to news media based on the number of journalists the outlet employs. Lawmakers are also considering another bill to bolster journalism that would give news outlets a tax credit for employing full-time journalists by levying a new tax on large tech platforms.

Whatever happens with Facebook, Sims said, he is “99.9% confident” Google will cut deals as it faces mounting competition from Microsoft’s Bing, powered by ChatGPT.

“It’s not all gloom and doom,” Sims said. “I imagine Bing would be licking their lips if Google left California.”

Sims urged legislators pushing for regulation in Sacramento to hold firm.

“Google needs news,” he said. “You’ve got to be absolutely resolute: This is going to happen. But if there’s something they want, which is no skin off your nose, compromise.”