Upbeat report would reduce odds of bigger Bank of Canada rate cut

Article content

Job numbers out this Friday could be a “material catalyst” for the Canadian dollar, say analysts with Bank of America.

BofA Global Research expects that Statistics Canada data will show the economy gained 35,000 jobs in September and the jobless rate remained steady at 6.6 per cent.

Unemployment has been rising for the past 17 months, and historically upward trends last for 22 months, it said. If the jobless rate remains unchanged amid a rise in employment it may lead market participants to speculate that unemployment has peaked in this cycle.

Advertisement 2

Article content

“Emergence of such narrative would be idiosyncratically bullish for CAD,” said FX strategist Howard Du.

The Canadian dollar has been on a downward slope since rising geopolitical risks and blockbuster job numbers out of the United States last week boosted the American greenback.

So far declines in the USD/CAD spot has been driven by “bearish USD catalysts rather than bullish CAD narratives,” but that could change if Bank of America’s jobs forecast plays out, said Du.

An upbeat surprise in September’s jobs data would also reduce the chance of the Bank of Canada opting for a bigger interest rate cut this month, another positive for the Canadian dollar, he said.

The market still expects Canada’s central bank to end its rate 50 basis points below the Federal Reserve, but the jobs report could sway opinion toward a smaller gap, which the Bank of America favours.

Other economists, however, are more pessimistic about Friday’s jobs reading.

Royal Bank of Canada expects the economy to gain only 15,000 jobs in September and for the unemployment rate to tick up to 6.7 per cent, raising the odds of a larger interest rate cut.

Article content

Advertisement 3

Article content

Bank of America expects the Canadian dollar to rise to 74 US cents by the end of the year and hit 75.75 US cents in 2025.

Its forecast matches that of a recent Reuters poll, which predicts the loonie will rally next year as lower interest rates boost the economy and increase investors’ appetite for risk.

“Domestic rate cuts will begin to noticeably stimulate the domestic economy, while Fed easing should also be a boost for risk conditions more generally, all of which offers a constructive backdrop for the loonie in the new year,” Nick Rees, senior FX market analyst at Monex Europe told Reuters.

Sign up here to get Posthaste delivered straight to your inbox.

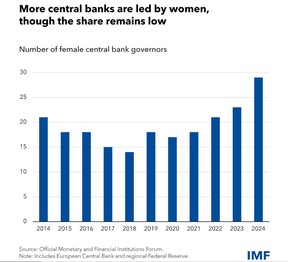

Women are now at the helm of a record number of the world’s central banks, but these institutions, and the economic discipline in general, are still a long way from gender parity.

Twenty-nine women are now in governor roles, up from 23 last year, but that represents just 16 per cent of the world’s 185 central banks, says the International Monetary Fund.

A first-of-its-kind survey done by the IMF last year on the European Central Bank and its G7 counterparts found that fewer than half of employees at those institutions were women, and on average only a third of women were economists or managers.

Advertisement 4

Article content

Appointments of female bank governors this year in Bosnia and Herzegovina and Papua New Guinea are examples of how smaller economies are driving more progress on gender balance, said the IMF.

Last year Michele Bullock became the first woman to lead the Reserve Bank of Australia and Cambodia, Georgia, Moldova and Montenegro also appointed women as the heads of their monetary authorities.

- Today’s Data: Canada international merchandise trade, United States trade balance, NFIB small business optimism

- Earnings: PepsiCo Inc.

Recommended from Editorial

Most successful investors have become so by investing for the long term since compounding gains over decades can result in some very impressive returns, but there are short-term gains to be made as well. Financial Post columnist Peter Hodson highlights five stocks that have been big winners this year. Find out more

Advertisement 5

Article content

Build your wealth

Are you a Canadian millennial (or younger) with a long-term wealth building goal? Do you need help getting there? Drop us a line with your contact info and your goal and you could be featured anonymously in a new column on what it takes to build wealth.

McLister on mortgages

Want to learn more about mortgages? Mortgage strategist Robert McLister’s Financial Post column can help navigate the complex sector, from the latest trends to financing opportunities you won’t want to miss. Plus check his mortgage rate page for Canada’s lowest national mortgage rates, updated daily.

Today’s Posthaste was written by Pamela Heaven, with additional reporting from Financial Post staff, The Canadian Press and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Article content