(Bloomberg) — China should explain widening discrepancies in its balance of payments data that are obscuring growing global imbalances, a top US economist said.

Most Read from Bloomberg

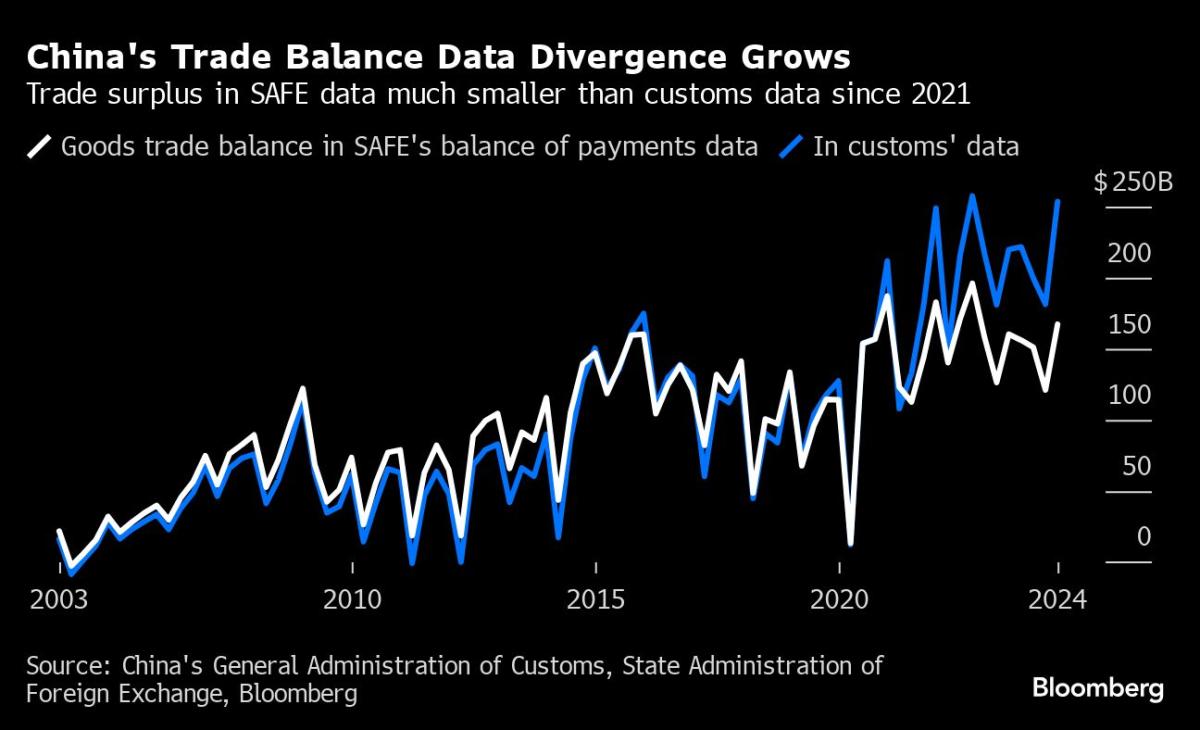

The country’s surplus in goods trade shown in the BoP data — compiled by its State Administration of Foreign Exchange — has significantly undershot the one reported by the customs since 2022, according to Brad Setser, senior fellow at the Council on Foreign Relations and a former US trade and Treasury official.

“These are enormous gaps that call into question some of the adjustments that China is making to that data,” Setser said on the sidelines of the Bund Summit in Shanghai on Thursday.

The gap is contentious as countries seek to gauge the true size of China’s trade surplus as they accuse Beijing of unfairly subsidizing exports to drive growth. The US Treasury in June called for clarifications from Beijing on the difference.

Data released last month showed that anomaly in the measurement of the trade surplus continued to grow, hitting a record $87 billion in the second quarter and taking it to almost $150 billion for the first half of the year.

Other puzzles include the rising deficit in China’s investment income even as interest rates have risen, according to Setser. He argued in a recent report that China looked to be undercounting its income from its trillions of dollars in overseas assets.

Taken together, Setser estimates that China’s external surplus is closer to $700 billion, more than double the reported current account surplus of $253 billion last year.

The US Treasury previously estimated the trade surplus discrepancy was equivalent to more than 1% of China’s gross domestic product in 2023.

The SAFE has attributed the goods surplus gap to the rise of “factoryless manufacturing,” whereby global companies outsource goods production to Chinese firms in special free trade zones.

This could lead to a deficit in the SAFE’s figures but not in customs’ because the former cover transactions between Chinese and foreign companies, while the latter is based on physical movement of goods across borders, according to the International Monetary Fund. This may largely explain the divergence based on information provided by the authorities, the Fund said in an August report.

But such a change in methodology should also entail corresponding adjustments in other parts of the BoP data, such as the multinationals’ profits generated in China. That hasn’t happened, Setser said.

Setser said SAFE should disclose more details of the statistical adjustments it’s made with numerical examples to illustrate why the data series diverged. The regulator should also provide a more detailed breakdown on the balance of investment income on foreign direct investment, bonds and bank loans, he said.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.