(Bloomberg) — China Vanke Co. faces mounting concerns about its ability to repay debt after posting the first loss in two decades.

Most Read from Bloomberg

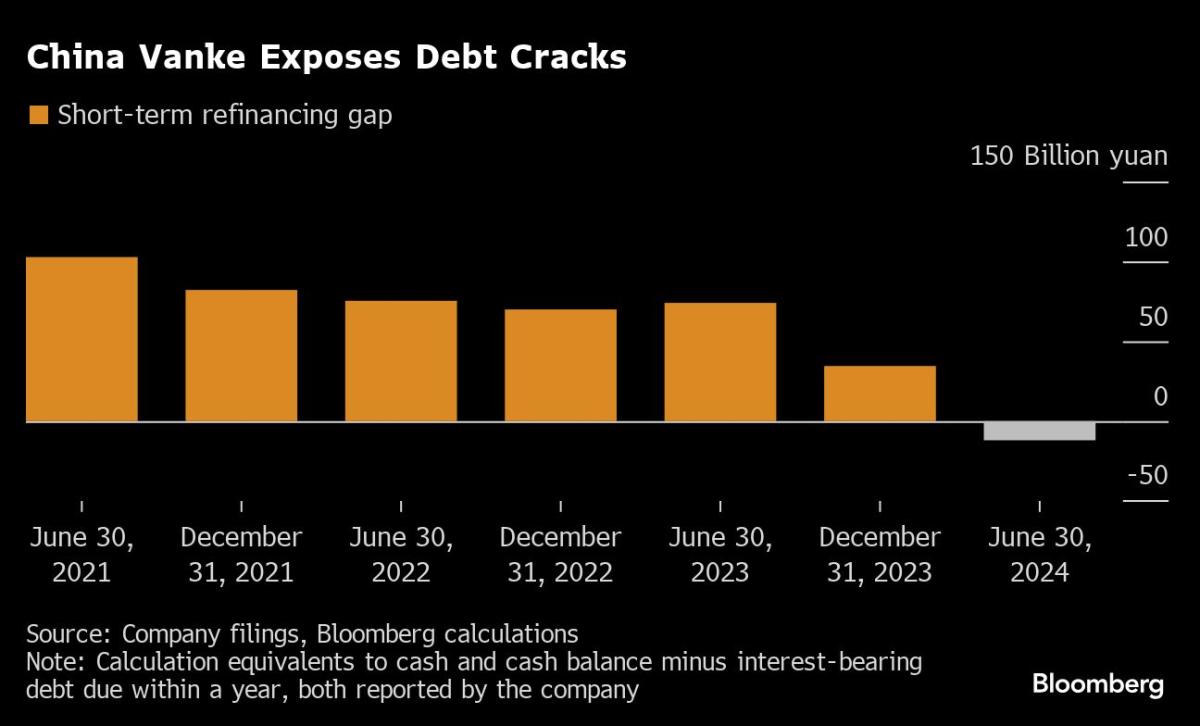

Vanke had a short-term refinancing gap of about 12 billion yuan ($1.69 billion) at the end of June due to a spike in long-term debt within a year, according to Bloomberg calculations based on company data. That’s the first time Vanke’s cash balance has failed to cover interest-bearing debt maturing in less than a year since at least 2014.

As a bellwether for China’s real estate crisis, Vanke’s debt troubles underscore how even the highest quality developers have been ensnared by the unprecedented property downturn. While it’s managed to avoid a default so far, Vanke’s connections with the nation’s financial and government-backed entities means its distress could eclipse the turmoil wreaked by defaults at rivals China Evergrande Group and Country Garden Holdings Co.

Vanke’s Hong Kong-traded shares closed 5.8% lower on Monday in its biggest decline in about six weeks, while its Shenzhen-traded shares plunged the most in more than three months. Its 3.15% 2025 due dollar notes were indicated 1.7 cents lower at 83.3 cents as of 16:40, according to Bloomberg-compiled data.

China’s housing rescue package in May is losing steam as home sales slump deepened in August and prices are expected to plummet further. Concerns intensified in recent weeks after a string of disappointing earnings reports from consumer companies and a cut to China’s growth forecast by UBS Group AG. The downgrade reflects an emerging consensus that the country may miss its growth target of around 5% in 2024.

Vanke, whose major shareholder is a state-owned firm in Shenzhen, is one of the few distressed developers that have yet to default amid the downtown. Country Garden and Shimao Group Holdings Ltd. face winding-up hearings in Hong Kong courts, while former giant Evergrande has been ordered to liquidate.

Vanke’s earnings report on Friday showed how much the extended housing slump is taking its toll on China’s fourth-biggest developer by sales. The company posted a net loss of 9.85 billion yuan for the six months ended June 30, its first semi-annual loss since at least 2003. That’s higher than the upper range flagged by the firm in July, and compares with an annual profit of 12.2 billion yuan last year.

Vanke’s loss signals its finances took a sharp hit in the second quarter, considering it lost just 362 million yuan in the first three months. The slowdown in China’s market has deepened since then, as sales and prices continue to fall. Local governments are dialing back intervention over pricing of new residential projects, driving developers to offer deep discounts to lure buyers.

Bond investors are betting Vanke isn’t at immediate risk of default, though its longer-term outlook is less certain. Moody’s Ratings, which had Vanke at investment grade as recently as March, downgraded the developer to B1 last month, four notches into junk territory.

Vanke to Exit Non-Core Business, Divest Assets for Liquidity

Vanke faces a 14 billion yuan funding gap if leases payable are included, according to Bloomberg Intelligence analysts Daniel Fan and Hui Yen Tay. That hole could be plugged by access to financing, they said, adding that the company can dispose more assets and raise secured debt.

For the remainder of this year, Vanke has only 2 billion yuan worth of public debt that matures, Chief Executive Officer Zhu Jiusheng said Friday. The firm has notified some investors that it has enough cash to repay a yuan bond due Sept. 6, according to a Bloomberg report last week. Vanke doesn’t have dollar bonds due this year and has a combined 128.5 billion yuan of public bonds and loans outstanding, according to data compiled by Bloomberg.

What Bloomberg Intelligence says:

“Vanke could survive the current down cycle, given its ability to access funding from state-owned banks like Industrial and Commercial Bank of China and China Construction Bank.”

-Analysts Daniel Fan, Hui Yen Tay

Click here for the research

Vanke and the other developers may get some relief from a plan to allow homebuyers to shift to banks offering lower mortgage rates, as Bloomberg reported last week.

Despite the first-half loss, Vanke Chairman Yu Liang remains optimistic on China’s long-term housing outlook.

“China’s potential home-buying demand is still huge, even though it has fallen from peak,” Yu said. “It’s underestimated.”

–With assistance from Yuling Yang.

(Updates with stock, bond prices in the fourth paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.