The Canadian market has experienced increased volatility in recent weeks, driven by concerns over a slowing economy and persistent inflation, yet overall stocks remain near record highs. In this environment, identifying high-growth tech stocks becomes crucial as they have the potential to outperform despite broader market swings.

Top 10 High Growth Tech Companies In Canada

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Docebo | 14.70% | 33.96% | ★★★★★☆ |

| Constellation Software | 16.17% | 23.55% | ★★★★★☆ |

| HIVE Digital Technologies | 54.20% | 100.27% | ★★★★★☆ |

| GameSquare Holdings | 38.08% | 86.64% | ★★★★★☆ |

| Blackline Safety | 22.54% | 162.50% | ★★★★★☆ |

| Medicenna Therapeutics | 62.37% | 57.20% | ★★★★★☆ |

| Cineplex | 7.33% | 179.27% | ★★★★☆☆ |

| Sabio Holdings | 12.97% | 122.50% | ★★★★☆☆ |

| BlackBerry | 20.61% | 76.74% | ★★★★★☆ |

| Alpha Cognition | 62.98% | 69.54% | ★★★★★☆ |

Click here to see the full list of 24 stocks from our TSX High Growth Tech and AI Stocks screener.

Here’s a peek at a few of the choices from the screener.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Constellation Software Inc., along with its subsidiaries, acquires, builds, and manages vertical market software businesses across Canada, the United States, Europe, and internationally with a market cap of CA$90.84 billion.

Operations: The company generates revenue primarily from its Software & Programming segment, which amounted to $9.27 billion.

Constellation Software’s revenue surged from $2.04 billion to $2.47 billion in Q2 2024, reflecting a 21% increase, while net income jumped by 72% to $177 million. The company’s forecasted annual earnings growth of 23.6% outpaces the Canadian market’s 15.3%, driven by strategic acquisitions and robust performance across its diverse software segments like Omegro, which serves over 15,000 customers globally. With R&D expenses at $0.42 billion in the last year, Constellation continues innovating to sustain its competitive edge in the tech sector.

Simply Wall St Growth Rating: ★★★★★☆

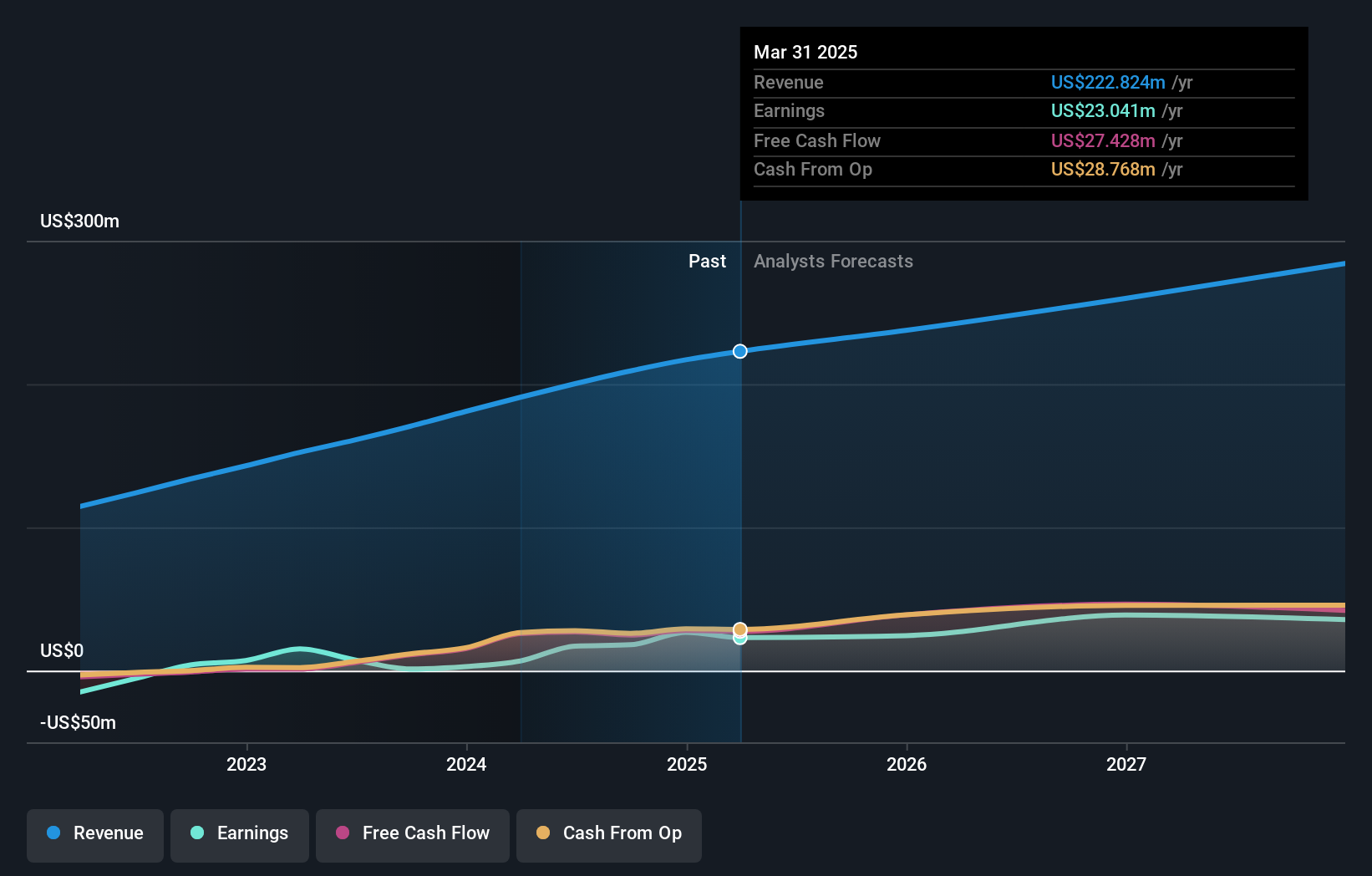

Overview: Docebo Inc. operates as a learning management software company that provides an artificial intelligence (AI)-powered learning platform in North America and internationally, with a market cap of CA$1.74 billion.

Operations: The company generates revenue primarily from its educational software segment, which brought in $200.24 million. The business leverages an AI-powered learning platform to serve clients across North America and internationally.

Docebo’s earnings are projected to grow at 34% per year, significantly outpacing the Canadian market’s 15.3%. Revenue growth is forecasted at 14.7% annually, faster than the national average of 6.9%. Recent financials show a net income of $4.7 million in Q2 2024, reversing a $5.67 million loss from the previous year, and R&D expenses have been instrumental in this turnaround with substantial investments driving innovation. The company repurchased 138,186 shares worth CAD $6.92 million between May and June this year, signaling confidence in its future trajectory.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kinaxis Inc. offers cloud-based subscription software for supply chain operations across the United States, Europe, Asia, and Canada with a market cap of CA$4.39 billion.

Operations: Kinaxis Inc. generates revenue primarily from its cloud-based subscription software for supply chain operations, amounting to CA$457.72 million. The company operates in regions including the United States, Europe, Asia, and Canada.

Kinaxis has demonstrated robust growth, with earnings expected to grow 46.8% annually, significantly outpacing the Canadian market’s 15.3%. The company’s revenue is forecasted to increase by 14.9% per year, driven by its AI-powered supply chain solutions like the Maestro platform. With R&D expenses accounting for CAD $51 million in recent quarters, innovation remains a priority. Kinaxis repurchased 333,152 shares worth CAD $51.28 million this year, reflecting confidence in its future prospects amidst executive transitions and investor activism calls for strategic review or sale exploration.

Turning Ideas Into Actions

Contemplating Other Strategies?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com