The Canadian market has experienced a notable upswing, with a 1.2% increase over the last week and a substantial 28% rise over the past year, while earnings are projected to grow by 16% annually. In this thriving environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation and scalability potential to capitalize on these favorable market conditions.

Top 10 High Growth Tech Companies In Canada

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Docebo | 14.60% | 34.05% | ★★★★★☆ |

| Constellation Software | 16.17% | 23.55% | ★★★★★☆ |

| Stingray Group | 4.94% | 69.22% | ★★★★☆☆ |

| GameSquare Holdings | 38.08% | 86.64% | ★★★★★☆ |

| HIVE Digital Technologies | 49.31% | 94.00% | ★★★★★☆ |

| Medicenna Therapeutics | 62.37% | 57.20% | ★★★★★☆ |

| Sabio Holdings | 12.97% | 122.50% | ★★★★☆☆ |

| Blackline Safety | 22.29% | 121.23% | ★★★★★☆ |

| BlackBerry | 21.68% | 81.78% | ★★★★★☆ |

| Sernova | 78.22% | 74.04% | ★★★★★☆ |

Click here to see the full list of 22 stocks from our TSX High Growth Tech and AI Stocks screener.

Let’s dive into some prime choices out of from the screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Computer Modelling Group Ltd. is a software and consulting technology company that specializes in developing and licensing reservoir simulation and seismic interpretation software, with a market cap of CA$997.33 million.

Operations: The company generates revenue primarily through the development and licensing of reservoir simulation and seismic interpretation software, amounting to CA$90.29 million. It operates with a market cap of CA$997.33 million.

Computer Modelling Group Ltd. (CMG) has demonstrated a robust commitment to innovation, particularly with its recent launch of Focus CCS, a simulation tool enhancing CO2 storage site selection. This aligns with their strategic inclusion in the S&P Global BMI Index, signaling recognition within broader markets. Financially, CMG reported a 47% increase in quarterly sales to CAD 30.52 million but saw net income dip to CAD 3.96 million from CAD 6.9 million year-over-year, reflecting investment back into R&D and new technologies crucial for long-term growth in the tech sector. With earnings expected to grow at an annual rate of 23.2%, above the Canadian market average of 15.7%, CMG is poised for significant advancements, leveraging high-quality earnings and strategic initiatives like their Trudvang project collaboration for CO2 storage solutions in the Norwegian North Sea.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Docebo Inc. is a company that offers an AI-powered learning management software platform, serving clients in North America and globally, with a market capitalization of CA$1.93 billion.

Operations: The company generates revenue primarily from its educational software, which brought in $200.24 million.

Docebo’s strategic positioning in the tech landscape is underscored by its robust R&D investment, with a notable emphasis on integrating AI to revolutionize enterprise learning solutions. The company recently announced a significant partnership at TEDAI Vienna, highlighting its role in leveraging AI for educational advancements. Financially, Docebo has shown impressive growth with a 130.2% increase in earnings over the past year, outpacing the software industry’s growth of 1.9%. This financial vigor is complemented by an aggressive expansion strategy as evidenced by recent executive appointments and global conference presentations aimed at enhancing its market presence and operational efficiency. With expected annual earnings growth of 34% and revenue projections increasing by 14.6%, Docebo is not just keeping pace but setting benchmarks within the tech sector.

Simply Wall St Growth Rating: ★★★★★☆

Overview: HIVE Digital Technologies Ltd. is involved in the mining and sale of digital currencies across Canada, Sweden, and Iceland, with a market cap of CA$624.78 million.

Operations: HIVE Digital Technologies Ltd. focuses on the mining and sale of digital currencies, generating revenue primarily from this activity, which amounted to $123.14 million. The company operates across Canada, Sweden, and Iceland.

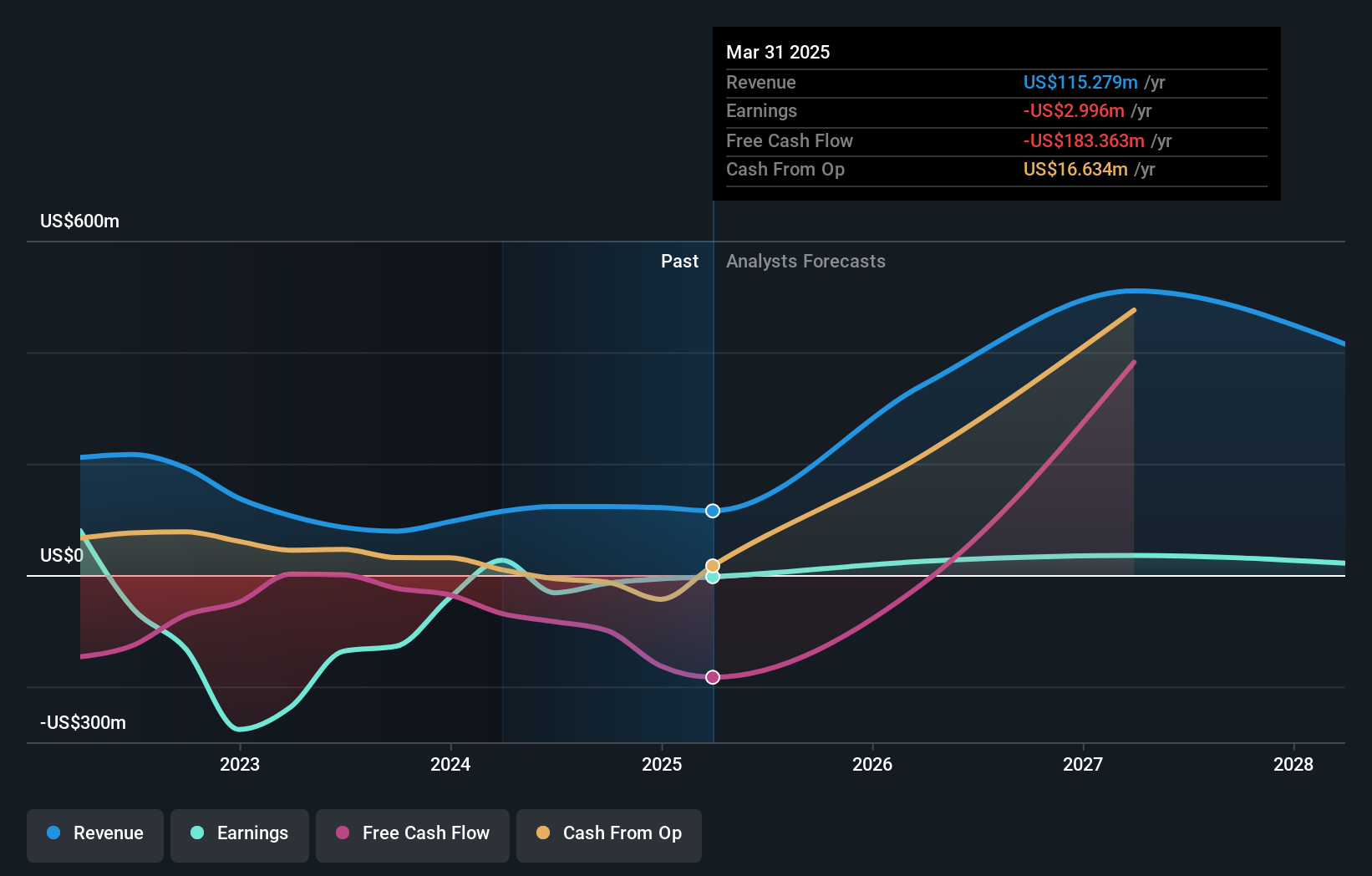

Amidst a dynamic tech landscape, HIVE Digital Technologies stands out with its strategic moves and robust operational metrics. Recently, the company announced significant plans to enhance its market footprint through potential acquisitions and an equity distribution agreement potentially worth up to $200 million. These developments are pivotal as HIVE’s revenue is projected to surge by 49.3% annually, showcasing a rapid expansion compared to the broader Canadian market’s growth of 7.2%. Moreover, earnings are expected to skyrocket by 94% per year, positioning HIVE for a profitable turnaround within three years despite current unprofitability. This financial trajectory is underpinned by substantial R&D investments aimed at advancing their technological capabilities in digital asset mining—an area where they’ve already demonstrated efficiency with an average daily production rate of 3.73 BTC from a consistent hashrate of 5.3 EH/s in September 2024.

Taking Advantage

Want To Explore Some Alternatives?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if HIVE Digital Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com