The recent rate cuts by the Federal Reserve and the Bank of Canada have created a favorable environment for equities, with both the S&P 500 and TSX reaching new highs. In this context, high-growth tech stocks in Canada are particularly compelling, as lower borrowing costs can fuel innovation and expansion.

Top 10 High Growth Tech Companies In Canada

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Docebo | 14.71% | 33.96% | ★★★★★☆ |

| HIVE Digital Technologies | 48.71% | 94.27% | ★★★★★☆ |

| Constellation Software | 16.17% | 23.55% | ★★★★★☆ |

| GameSquare Holdings | 38.08% | 86.64% | ★★★★★☆ |

| Blackline Safety | 22.38% | 162.50% | ★★★★★☆ |

| Medicenna Therapeutics | 62.37% | 57.20% | ★★★★★☆ |

| Cineplex | 7.29% | 179.27% | ★★★★☆☆ |

| Sabio Holdings | 12.97% | 122.50% | ★★★★☆☆ |

| BlackBerry | 20.61% | 76.74% | ★★★★★☆ |

| Alpha Cognition | 62.98% | 69.54% | ★★★★★☆ |

Click here to see the full list of 24 stocks from our TSX High Growth Tech and AI Stocks screener.

Here’s a peek at a few of the choices from the screener.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Constellation Software Inc., along with its subsidiaries, acquires, builds, and manages vertical market software businesses across Canada, the United States, Europe, and internationally with a market cap of CA$93.46 billion.

Operations: Constellation Software Inc. generates revenue primarily from its software and programming segment, amounting to CA$9.27 billion. The company focuses on acquiring and managing vertical market software businesses across various regions including Canada, the United States, and Europe.

Constellation Software’s recent performance underscores its robust position in the tech sector, with a notable increase in Q2 revenue to USD 2.47 billion, up from USD 2.04 billion year-over-year, and net income rising sharply to USD 177 million from USD 103 million. This growth trajectory is supported by a solid R&D investment strategy, aligning with industry shifts towards SaaS models which promise recurring revenue streams. Despite carrying higher levels of debt, the company’s strategic focus on expanding its software solutions across diverse industries has led to earnings projections that outpace the Canadian market average significantly—forecasted at an annual growth rate of 23.6%. Additionally, CSU maintains a commitment to shareholder returns as evidenced by its consistent dividend payout, set next at $1 per share on October 10th. Moving forward, these factors combined with a high forecasted Return on Equity of 26.1% suggest Constellation Software is well-positioned for sustained growth amidst evolving market demands.

Simply Wall St Growth Rating: ★★★★★☆

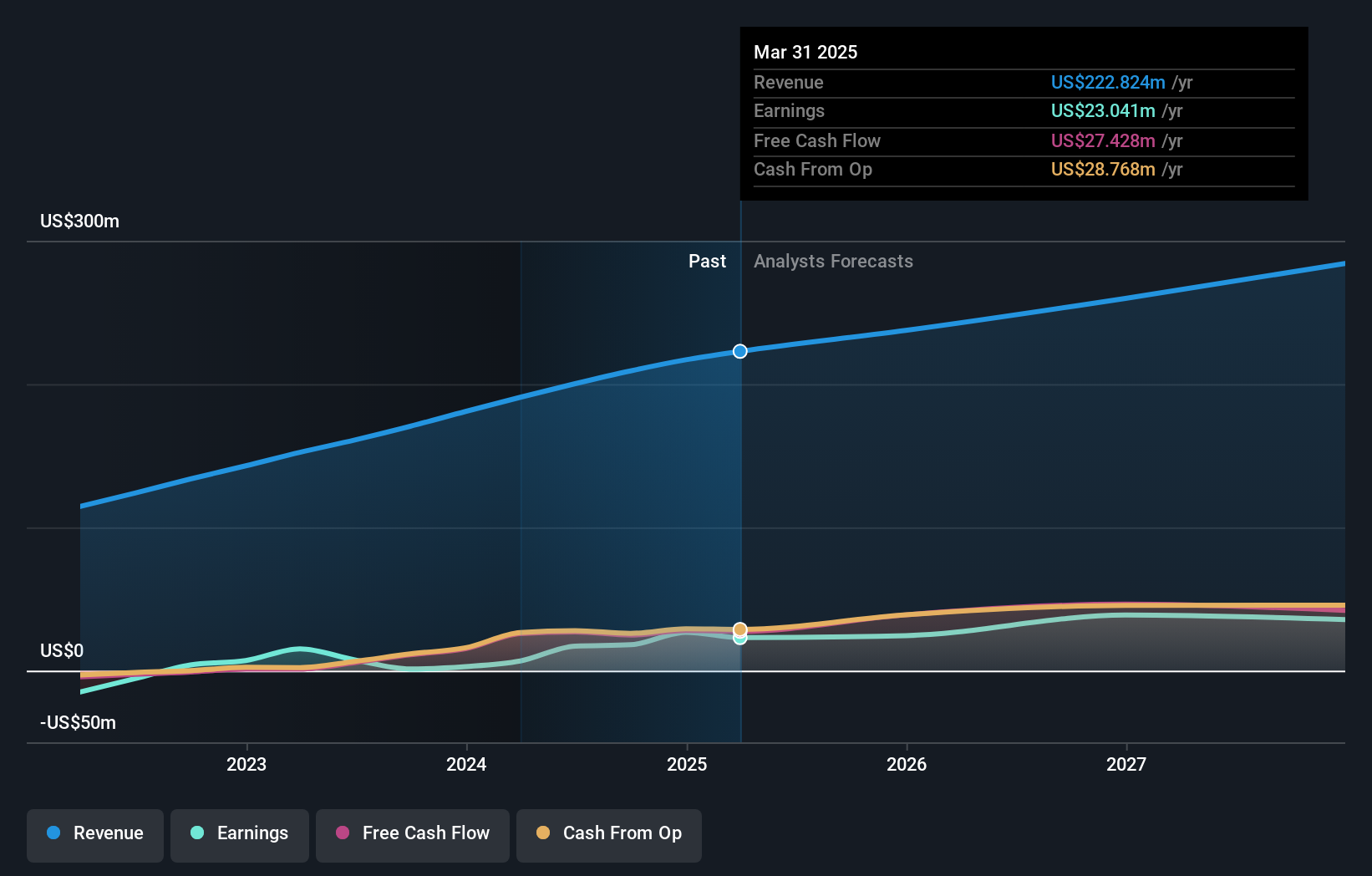

Overview: Docebo Inc. operates as a learning management software company that provides artificial intelligence (AI)-powered learning platforms in North America and internationally, with a market cap of CA$1.83 billion.

Operations: Docebo generates revenue primarily from its educational software segment, totaling CA$200.24 million. The company leverages artificial intelligence to enhance its learning management platforms across North America and international markets.

Docebo has demonstrated a robust turnaround with its Q2 sales surging to USD 53.05 million from USD 43.59 million year-over-year, reflecting a significant recovery and growth trajectory in the tech education sector. This performance is underpinned by strategic leadership changes, notably the appointment of Alessio Artuffo as CEO, who has been pivotal in expanding North American operations since 2012. The firm’s commitment to innovation is evident in its R&D spending, crucial for sustaining its competitive edge in the rapidly evolving e-learning market. With earnings expected to grow by 34% annually, outpacing the Canadian market average of 14.8%, and a forecasted revenue increase of up to 19% for the fiscal year, Docebo is positioning itself as a strong player in high-growth tech sectors despite broader industry challenges.

Simply Wall St Growth Rating: ★★★★★☆

Overview: HIVE Digital Technologies Ltd. focuses on the mining and sale of digital currencies across Canada, Sweden, and Iceland, with a market cap of CA$543.63 million.

Operations: HIVE Digital Technologies Ltd. generates revenue primarily from the mining and sale of digital currencies, with reported earnings of $123.14 million. The company operates in Canada, Sweden, and Iceland.

HIVE Digital Technologies, amid the dynamic landscape of Canadian tech, is making notable strides with its recent operational adjustments and strategic expansions. The company’s revenue growth is projected at an impressive 48.7% annually, significantly outpacing the broader market’s 6.9%. This surge is underpinned by a robust increase in earnings, expected to climb by 94.3% each year. Recent initiatives include a $300 million shelf registration and strategic infrastructure developments like the new 100 MW digital asset mining operation in Paraguay, which underscores HIVE’s proactive approach in scaling operations and tapping into emerging markets. These moves not only reflect HIVE’s agility in navigating tech’s volatile terrains but also highlight its commitment to leveraging R&D for sustained growth—evident from its substantial investment back into technological advancements and operational efficiency.

Where To Now?

- Discover the full array of 24 TSX High Growth Tech and AI Stocks right here.

- Shareholder in one or more of these companies? Ensure you’re never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St’s app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com