As we head into the fourth quarter, the Canadian market has experienced a volatile start despite strong performances earlier in the year, with the TSX up over 14% and ongoing uncertainties surrounding geopolitical tensions and economic indicators. In this environment, identifying high-growth tech stocks requires careful consideration of their ability to adapt to changing market conditions while leveraging solid fundamentals and innovative capabilities.

Top 10 High Growth Tech Companies In Canada

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Docebo | 14.54% | 34.05% | ★★★★★☆ |

| HIVE Digital Technologies | 48.71% | 94.27% | ★★★★★☆ |

| Constellation Software | 16.17% | 23.55% | ★★★★★☆ |

| GameSquare Holdings | 38.08% | 86.64% | ★★★★★☆ |

| Medicenna Therapeutics | 62.37% | 57.20% | ★★★★★☆ |

| Cineplex | 7.22% | 179.27% | ★★★★☆☆ |

| Blackline Safety | 22.29% | 121.23% | ★★★★★☆ |

| BlackBerry | 24.19% | 79.50% | ★★★★★☆ |

| Alpha Cognition | 62.98% | 69.54% | ★★★★★☆ |

| Sernova | 76.56% | 74.04% | ★★★★★☆ |

Click here to see the full list of 24 stocks from our TSX High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Computer Modelling Group Ltd. is a software and consulting technology company that develops and licenses reservoir simulation and seismic interpretation software, with a market cap of CA$961.80 million.

Operations: CMG generates revenue primarily through the development and licensing of reservoir simulation and seismic interpretation software, amounting to CA$90.29 million. The company’s operations focus on providing specialized software solutions for the oil and gas industry, contributing significantly to its financial performance.

Computer Modelling Group Ltd. (CMG) is navigating the high-growth tech landscape with notable strides in innovation, particularly through its recent launch of Focus CCS, a simulation tool for CO2 storage sites. This product underscores CMG’s commitment to supporting global net-zero goals and positions it at the forefront of environmental tech within Canada. Despite facing a dip in net income from CAD 6.9 million to CAD 3.96 million year-over-year as per Q1 results, CMG’s revenue surged by nearly 47% to CAD 30.52 million, reflecting strong market demand for its specialized software solutions.

Looking ahead, CMG is poised for significant growth with earnings expected to increase by an impressive 24.6% annually over the next three years, outpacing the broader Canadian market forecast of 14.4%. Moreover, revenue projections indicate an annual growth rate of 11.5%, further highlighting its robust position within the tech sector despite some challenges like a recent decrease in profit margins from 29.2% to 19.7%. These figures suggest that while there are areas for improvement, CMG’s innovative contributions and strategic product developments could drive its future success in both financial and operational terms.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Docebo Inc. is a learning management software company offering an AI-powered learning platform across North America and internationally, with a market cap of CA$1.79 billion.

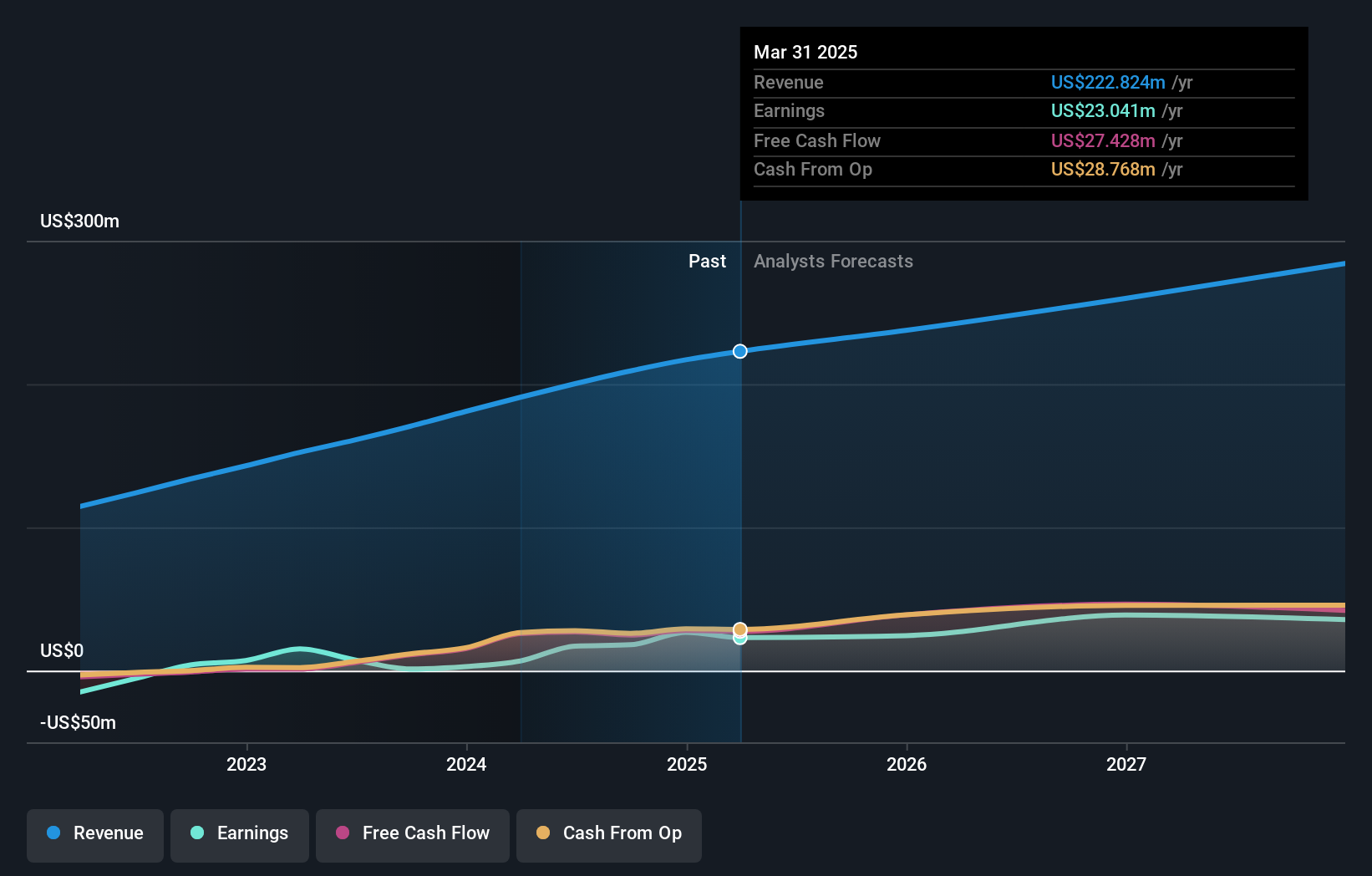

Operations: The company generates revenue primarily from its educational software segment, amounting to $200.24 million.

Docebo is making significant strides in the high-growth tech sector, particularly through its recent partnership with TEDAI, positioning it as a leader in AI-driven learning solutions. This collaboration underscores Docebo’s commitment to integrating cutting-edge technologies into workplace learning, aligning with industry trends towards digital and AI-enhanced education platforms. Financially, Docebo has shown robust performance with a 130.2% growth in earnings over the past year, outpacing the software industry’s average of 1.9%. Looking forward, the company is poised for continued expansion with revenue expected to grow by 14.5% annually and earnings anticipated to surge by 34% per year. These projections reflect not only Docebo’s solid market position but also its ability to capitalize on evolving technological advancements and client needs within the educational tech space.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kinaxis Inc. offers cloud-based subscription software solutions for supply chain operations across the United States, Europe, Asia, and Canada with a market capitalization of CA$4.54 billion.

Operations: The company generates revenue primarily through its cloud-based subscription software for supply chain operations, amounting to $457.72 million.

Kinaxis, a leader in supply chain management solutions, has demonstrated robust growth with earnings surging by 137.9% over the past year, significantly outpacing the software industry’s average of 1.9%. This growth is underpinned by strategic client acquisitions such as Ono Pharmaceutical and Mahindra & Mahindra, enhancing its presence in life sciences and automotive sectors respectively. The company’s commitment to innovation is evident from its R&D expenses which have been strategically allocated to enhance its AI-driven platform, Maestro™. With projected annual revenue and earnings growth at 14.7% and 48.5% respectively, Kinaxis is poised to capture more of the $16 billion market despite recent pressures for strategic corporate actions suggested by Irenic Capital Management.

Where To Now?

Seeking Other Investments?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Kinaxis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com