With the Canadian TSX up over 5% and positive market sentiment returning, investors are closely watching how central banks’ rate-cutting cycles will influence the broader economic landscape. Amid this backdrop, high-growth tech stocks in Canada, such as Computer Modelling Group and others, offer intriguing opportunities for those looking to capitalize on sectors poised for growth in a moderating inflation environment.

Top 10 High Growth Tech Companies In Canada

|

Name |

Revenue Growth |

Earnings Growth |

Growth Rating |

|---|---|---|---|

|

Docebo |

14.74% |

34.09% |

★★★★★☆ |

|

Bitfarms |

72.43% |

173.10% |

★★★★★☆ |

|

Constellation Software |

16.17% |

23.55% |

★★★★★☆ |

|

HIVE Digital Technologies |

51.21% |

109.14% |

★★★★★☆ |

|

GameSquare Holdings |

38.08% |

86.64% |

★★★★★☆ |

|

Medicenna Therapeutics |

62.37% |

57.20% |

★★★★★☆ |

|

Cineplex |

8.05% |

179.27% |

★★★★☆☆ |

|

Sabio Holdings |

12.86% |

117.06% |

★★★★☆☆ |

|

BlackBerry |

20.61% |

76.74% |

★★★★★☆ |

|

Alpha Cognition |

62.98% |

69.54% |

★★★★★☆ |

Click here to see the full list of 24 stocks from our TSX High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Simply Wall St Growth Rating: ★★★★☆☆

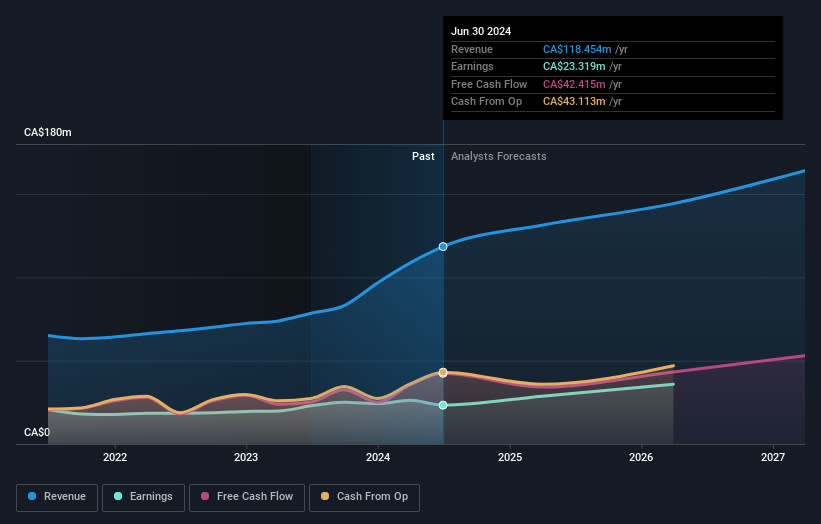

Overview: Computer Modelling Group Ltd. is a software and consulting technology company specializing in the development and licensing of reservoir simulation and seismic interpretation software, with a market cap of CA$1.03 billion.

Operations: The company generates revenue primarily through the development and licensing of reservoir simulation and seismic interpretation software, amounting to CA$90.29 million. Segment adjustments contribute an additional CA$28.16 million to the total revenue.

Computer Modelling Group (CMG) is poised for substantial growth, with earnings projected to increase by 24.6% annually over the next three years, outpacing the Canadian market’s 14.9%. Despite a recent dip in net profit margins from 29.2% to 19.7%, CMG’s revenue growth rate of 11.5% per year remains robust compared to the broader market’s 6.6%. Notably, their R&D expenditure reflects a commitment to innovation, highlighted by their comprehensive CCS solutions selected for Sval Energi AS’s Trudvang project in Norway.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Constellation Software Inc., along with its subsidiaries, acquires, builds, and manages vertical market software businesses across Canada, the United States, Europe, and internationally with a market cap of CA$89.37 billion.

Operations: CSU generates revenue primarily from its Software & Programming segment, amounting to CA$9.27 billion. The company focuses on acquiring and managing vertical market software businesses globally.

Constellation Software’s revenue surged to $2.47 billion in Q2 2024, a notable increase from $2.04 billion the previous year, while net income jumped to $177 million from $103 million. With earnings forecasted to grow at 23.6% annually, outpacing the Canadian market’s 14.9%, their commitment to innovation is underscored by substantial R&D investments; for instance, R&D expenses were approximately 16% of revenue last year. Omegro’s launch consolidates over 30 business units and serves more than 15,000 customers globally, enhancing Constellation’s growth prospects through diversified software applications like ERP and CRM systems.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vitalhub Corp., along with its subsidiaries, offers technology solutions for health and human service providers across Canada, the United States, the United Kingdom, Australia, Western Asia, and other international markets with a market cap of CA$433.78 million.

Operations: Vitalhub Corp. generates revenue primarily from its healthcare software segment, which contributed CA$58.32 million. The company operates across multiple international markets, including Canada, the United States, the United Kingdom, Australia, and Western Asia.

Vitalhub’s recent earnings report showed a revenue increase to CAD 16.24 million in Q2 2024 from CAD 13.09 million a year ago, despite a net loss of CAD 0.34 million compared to last year’s net income of CAD 0.62 million. Their R&D expenses accounted for approximately 13% of revenue, reflecting their commitment to innovation and technological advancement in healthcare software solutions like TREAT, which recently partnered with Lumenus Community Services to enhance data management and client tracking capabilities. Earnings are projected to grow at an impressive annual rate of 65.9%, outpacing the Canadian market’s average growth rate.

Taking Advantage

-

Unlock our comprehensive list of 24 TSX High Growth Tech and AI Stocks by clicking here.

-

Shareholder in one or more of these companies? Ensure you’re never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

-

Join a community of smart investors by using Simply Wall St. It’s free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:CMG TSX:CSU and TSX:VHI.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com