Over the last 7 days, the Canadian market has risen by 1.3%, contributing to a substantial 23% climb over the past year, with earnings forecasted to grow by 15% annually. In this dynamic environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation and adaptability to capitalize on these favorable conditions.

Top 10 High Growth Tech Companies In Canada

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Docebo | 14.54% | 34.05% | ★★★★★☆ |

| HIVE Digital Technologies | 49.31% | 94.00% | ★★★★★☆ |

| Constellation Software | 16.17% | 23.55% | ★★★★★☆ |

| GameSquare Holdings | 38.08% | 86.64% | ★★★★★☆ |

| Medicenna Therapeutics | 62.37% | 57.20% | ★★★★★☆ |

| Sabio Holdings | 12.97% | 122.50% | ★★★★☆☆ |

| Blackline Safety | 22.29% | 121.23% | ★★★★★☆ |

| BlackBerry | 24.17% | 79.50% | ★★★★★☆ |

| Alpha Cognition | 62.98% | 69.54% | ★★★★★☆ |

| Sernova | 76.56% | 74.04% | ★★★★★☆ |

Click here to see the full list of 22 stocks from our TSX High Growth Tech and AI Stocks screener.

We’re going to check out a few of the best picks from our screener tool.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Constellation Software Inc., along with its subsidiaries, focuses on acquiring, building, and managing vertical market software businesses across Canada, the United States, Europe, and internationally with a market capitalization of CA$93.59 billion.

Operations: The company generates revenue primarily from its software and programming segment, amounting to $9.27 billion. It operates in various geographical regions, including Canada, the United States, and Europe.

Constellation Software demonstrates robust growth trends, with earnings surging by 33.5% over the past year, significantly outpacing the software industry’s modest 1.9% increase. This performance is underpinned by a strategic focus on R&D, where investment has been pivotal in fostering innovation and maintaining competitive advantage—evident from its recent revenue jump to USD 2,468 million from USD 2,039 million in the previous year’s quarter. Looking ahead, CSU’s revenue and earnings are projected to grow annually by 16.2% and 23.6%, respectively, outstripping broader Canadian market forecasts of 7% for revenue and 14.7% for earnings growth.

Despite these positive indicators, potential investors should note significant insider selling over the last quarter which may warrant caution. However, with a forecasted Return on Equity of an impressive 26.1% in three years’ time and ongoing substantial investments in R&D—critical for sustaining long-term growth—the company remains well-positioned within Canada’s tech landscape to capitalize on emerging opportunities while navigating market challenges effectively.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Docebo Inc. is a learning management software company offering an AI-powered learning platform across North America and internationally, with a market cap of CA$1.85 billion.

Operations: The company generates revenue primarily from its educational software segment, amounting to $200.24 million. With a market capitalization of approximately CA$1.85 billion, the focus is on providing AI-powered learning solutions internationally.

Docebo’s recent partnership with TEDAI as the official business learning partner underscores its strategic focus on integrating AI to revolutionize enterprise learning—a move that aligns with industry shifts towards digital transformation. This collaboration is poised to enhance Docebo’s visibility and market reach, especially as it showcases its capabilities at a global forum. Financially, Docebo has shown resilience and growth, transitioning from a net loss to reporting $53.05 million in sales this quarter, up from $43.59 million the previous year—an increase of 21.7%. The company also repurchased shares worth CAD 6.92 million, reflecting confidence in its financial health and future prospects. With R&D expenses consistently fueling innovation—evidenced by a robust projected annual revenue growth of 14.5%—Docebo is strategically positioned to leverage emerging tech trends within the learning sector.

Simply Wall St Growth Rating: ★★★★☆☆

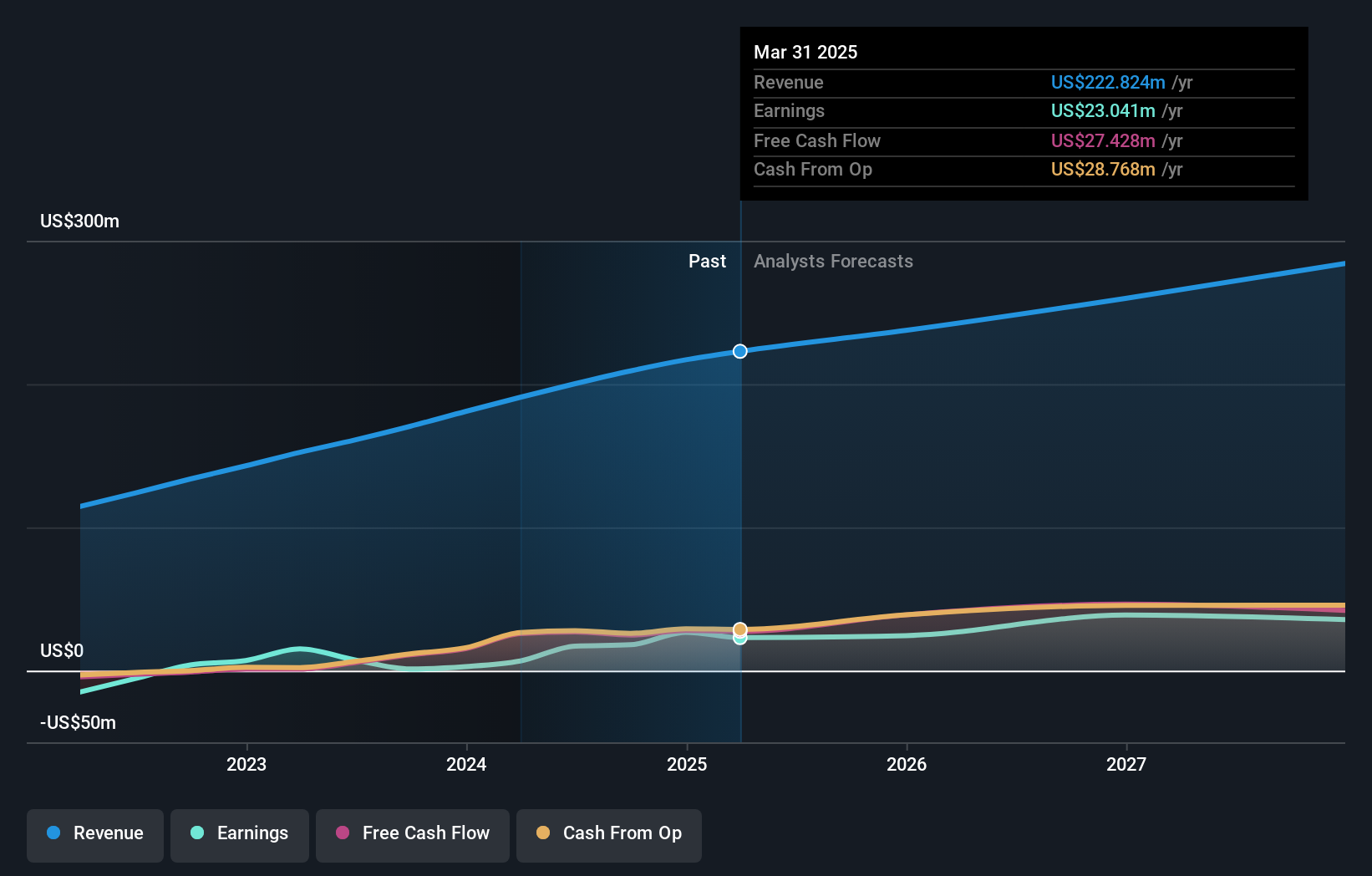

Overview: Vitalhub Corp., along with its subsidiaries, offers technology solutions for health and human service providers across Canada, the United States, the United Kingdom, Australia, Western Asia, and other international markets with a market cap of CA$487.36 million.

Operations: Vitalhub Corp. generates revenue primarily from its healthcare software segment, which accounts for CA$58.32 million. The company operates internationally, delivering technology solutions to health and human service providers across various regions including Canada, the United States, and the United Kingdom.

Vitalhub, recently added to the S&P Global BMI Index, is demonstrating robust growth in a competitive tech landscape, with earnings forecast to surge by 65.9% annually. This growth trajectory is supported by a significant investment in R&D, crucial for maintaining its innovative edge in healthcare technology solutions. Despite facing a net loss this quarter of CAD 0.335 million from CAD 16.24 million in revenue, the company’s strategic focus on expanding its market reach through recent presentations at high-profile conferences signals strong future prospects. Moreover, Vitalhub’s commitment to innovation is underscored by an R&D expense ratio that remains aggressive within the industry standards.

Key Takeaways

Contemplating Other Strategies?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com