Overview of the Recent Transaction

On September 24, 2024, Highbridge Capital Management LLC made a significant move in the stock market by acquiring 1,114,707 shares of Vertex Energy Inc (NASDAQ:VTNR). This transaction marked a new holding for the firm, purchased at a price of $0.361 per share. The total investment has a modest portfolio impact of 0.06%, representing 4.99% of the company’s shares. This strategic acquisition reflects Highbridge’s ongoing efforts to diversify and capitalize on market opportunities.

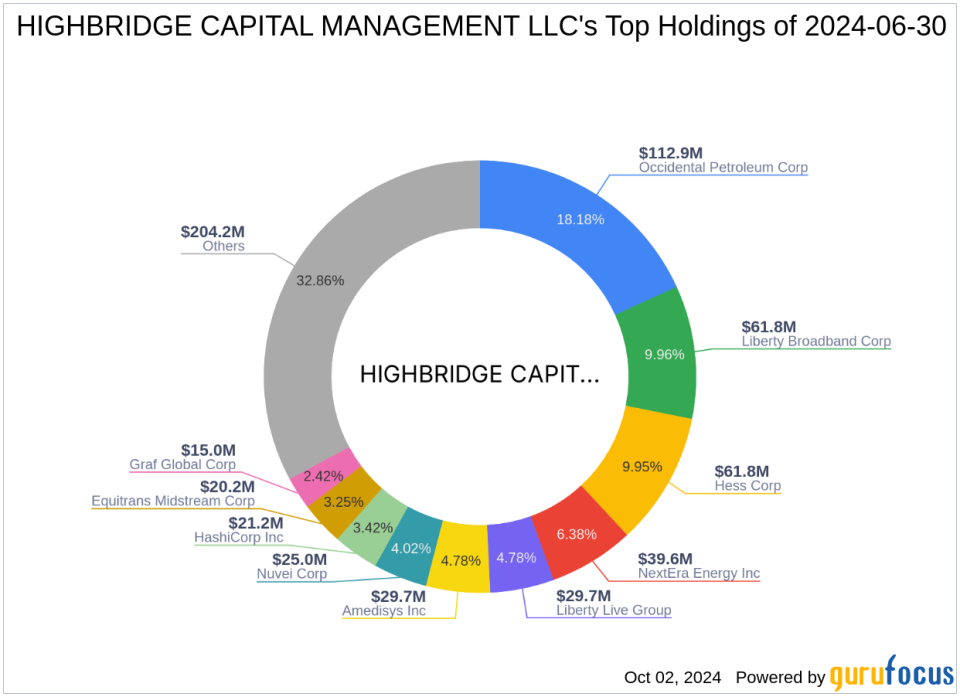

Highbridge Capital Management LLC Profile

Founded in 1992, Highbridge Capital Management is a renowned hedge fund sponsor based in New York and a subsidiary of JPMorgan Chase & Co. Under the leadership of CEO Scott B. Kapnick, the firm boasts a robust team of 336 employees, including 130 investment professionals. Highbridge employs a multi-strategy investment approach, focusing on consistent capital appreciation through diverse arbitrage and absolute return strategies. With a significant focus on the healthcare sector, the firm manages over $31.5 billion in assets, primarily serving pooled investment vehicles and high net worth individuals.

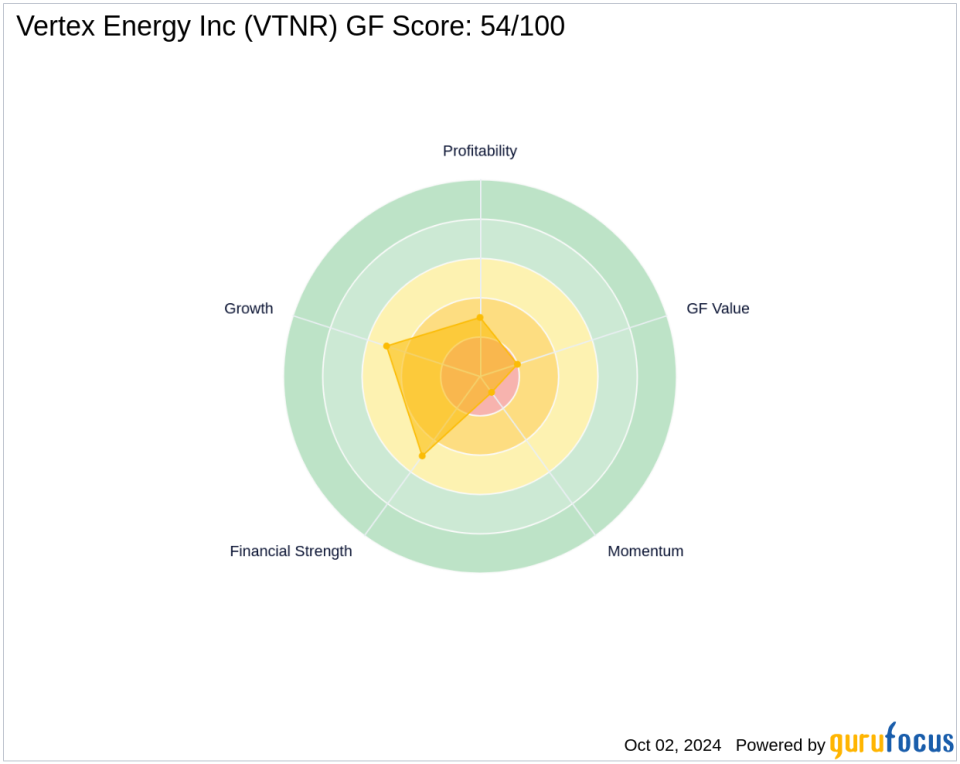

Vertex Energy Inc Company Insights

Vertex Energy Inc, an environmental services company, specializes in the recycling of industrial waste streams and off-specification commercial chemical products. With its primary operations in Refining and Marketing, and Black Oil and Recovery, Vertex generates most of its revenue from the refining segment. Despite its innovative business model, the company faces financial challenges, reflected in its market capitalization of $12.512 million and a stock price of $0.1338, significantly below its GF Value of $7.41.

Analysis of the Trade’s Impact

The acquisition by Highbridge Capital Management LLC introduces a new dynamic to its portfolio, given Vertex Energy’s current market position and financial health. Holding 4.99% of Vertex’s shares, Highbridge now plays a pivotal role in the company’s investor landscape. This move could signal a strategic interest in the environmental sector, aligning with broader market trends towards sustainability and recycling technologies.

Market Context and Investment Rationale

The timing of Highbridge’s investment coincides with fluctuating conditions in the oil and gas industry, where Vertex operates. Despite the company’s struggling financial metrics, such as a -57.79% ROE and a stock price decline of 62.94% since the transaction, Highbridge might see potential for turnaround or undervalued assets, especially in a sector ripe for regulatory changes and technological advancements.

Comparative Insights and Future Outlook

Comparing Highbridge’s new stake with other major holders, such as Hotchkis & Wiley Capital Management LLC, reveals differing investment approaches and confidence levels in Vertex Energy’s future. As the market observes Highbridge’s next moves, the implications for its portfolio strategy and Vertex’s operational strategies will be closely monitored. The future trajectory for Vertex will depend significantly on market conditions and the company’s ability to innovate and manage its financial health.

In conclusion, Highbridge Capital Management LLC’s recent acquisition of Vertex Energy shares is a calculated move that aligns with its strategic investment goals. While the immediate impact on its portfolio is modest, the long-term implications and potential influence on Vertex’s business strategies could be substantial, depending on how market conditions evolve.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.