Job vacancy rates in Western Canada have overtaken Central and East.

Key Points

- As of Q2 2024, Canadian job vacancy rates were still above early-2020 levels in the Prairies and Nova Scotia, overtaking Ontario and most of Eastern Canada (which were down), according to Statistics Canada.

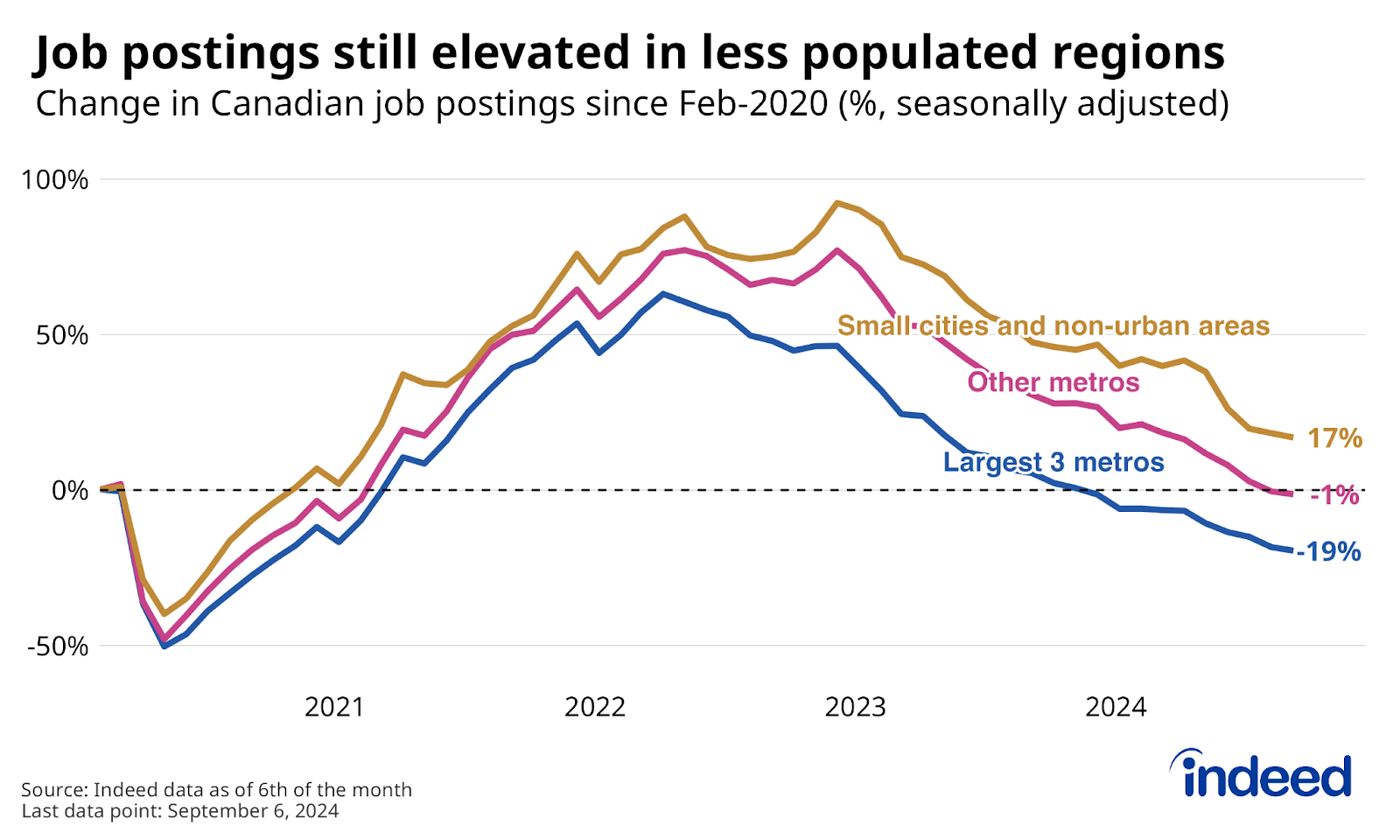

- Through early September, job postings on Indeed were up 17% from their pre-pandemic levels in small cities and rural areas, compared to a 19% drop across the combined Toronto, Vancouver, and Montreal metro areas. Other metro areas were down slightly (-1%), weighed down by sharper drops in several Ontario cities.

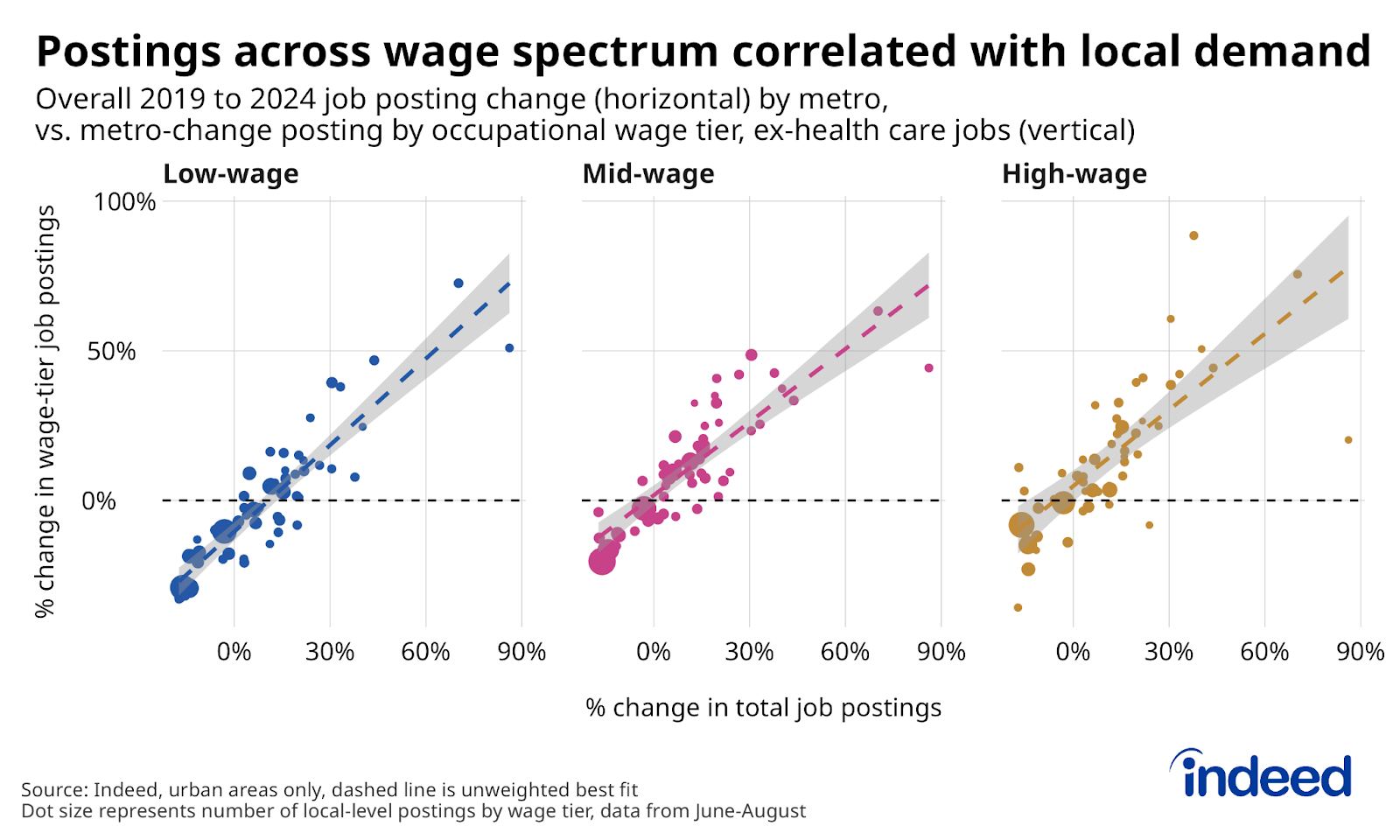

- Local-level posting trends of individual sectors often resemble the overall posting trends of their respective area. For example, metros where postings for lower-paying occupations were relatively elevated in summer 2024 compared to 2019 often looked similar for mid- and higher-paying jobs as well.

- Weaker posting trends in the three major metro areas (Toronto, Vancouver, and Montreal) and other Ontario cities could reflect their greater exposure to hiring freezes in the tech sector, as well as challenges dealing with the higher interest rate environment. Meanwhile, the relative improvement in vacancy rates in the Prairies could be a sign that employer hiring appetite is finally shaking off the effects of the mid-2010s oil-price crash.

Canadian employers’ cooling hiring appetite has been one of the defining labour market trends over the past two years. The national job vacancy rate fell from a peak of 5.7% in May 2022 to 3.1% in June 2024, below its early 2020 rate of 3.4%, according to Statistics Canada’s Job Vacancy and Wage Survey (JVWS). Job postings on Indeed have evolved similarly, and as of early September were down 6% from their February 2020 level.

While job opportunities have been down nationwide since mid-2022, growth compared to pre-pandemic levels has been mixed across regions, showing two main patterns. First, job vacancy rates in the Prairies are up, overtaking Ontario, Quebec, and most of Atlantic Canada, where they are down. Second, job postings on Indeed remain elevated in smaller cities and non-urban areas, while medium and larger metro areas are mixed, with substantial declines in several Ontario cities, Vancouver, and Montreal.

Prairies rise, BC still strong, Eastern Canada lags

As of Q2 2024, job vacancy rates still notably exceeded their February 2020 levels in four of ten provinces: Saskatchewan, Alberta, Manitoba, and Nova Scotia. Part of this growth reflects their low starting points: Vacancy rates were below 3% in all four at the start of 2020, lagging the national average. However, after spiking along with the rest of Canada, hiring appetite in the Prairies and Nova Scotia has held up better compared to earlier levels than elsewhere. Not only were job vacancy rates in these provinces above 3% (on average) in Q2, they were also above the Canada-wide rate.

In almost every other province, job vacancy rates in Q2 were down from early-2020 levels (except Newfoundland, which has been roughly flat). The vacancy rate in Quebec experienced a major pullback from mid-2022, when it exceeded 6%, to mid-2024, when it stood just above 3%, near the Canada-wide average. The vacancy rate in New Brunswick has slipped to 3% and is even lower in Ontario. British Columbia is the only province in which the vacancy rate has declined but still remains above the national average, in part because the province entered 2020 with easily the highest job vacancy rate.

These different regional trajectories are evident across a range of industries. For example, in Alberta and Saskatchewan, vacancy rates in Q1 2024 (the most recent data available by industry) were above pre-pandemic levels in retail, manufacturing, and professional services alike. In Ontario, all three industries were down.

Job postings still elevated in less-populated areas, lower in the big three metros

Indeed job postings show similar cross-provincial patterns as the JVWS (though Atlantic Canada fares better in the posting data), and also provide an up-to-date view of how trends are evolving among different occupations across more fine-grained geographic areas.

On average, the smaller the size of the labour market, the stronger job postings are compared to pre-pandemic levels. Grouping census agglomerations (CAs) and rural areas, overall job postings in early September in these less-populated regions were up a solid 17% from February 2020. In contrast, taking the Toronto, Montreal, and Vancouver areas together, postings in Canada’s three largest metros were down 19% over the same period, while other metro areas had slipped just 1%.

Postings in less-populated areas have dropped a tad less year-over-year through early September than elsewhere (-21% vs. -24%). However, most of the current spread reflects earlier divergences: Non-metro areas fell less at the start of the pandemic than metro areas, a gap which has persisted. Postings in the three largest metro areas started falling in mid-2022, partly reflecting their greater exposure to hiring freezes in the tech sector, while job ads in other regions only started dropping in 2023.

Declines sharp across Ontario cities; Alberta and rural regions show solid gains

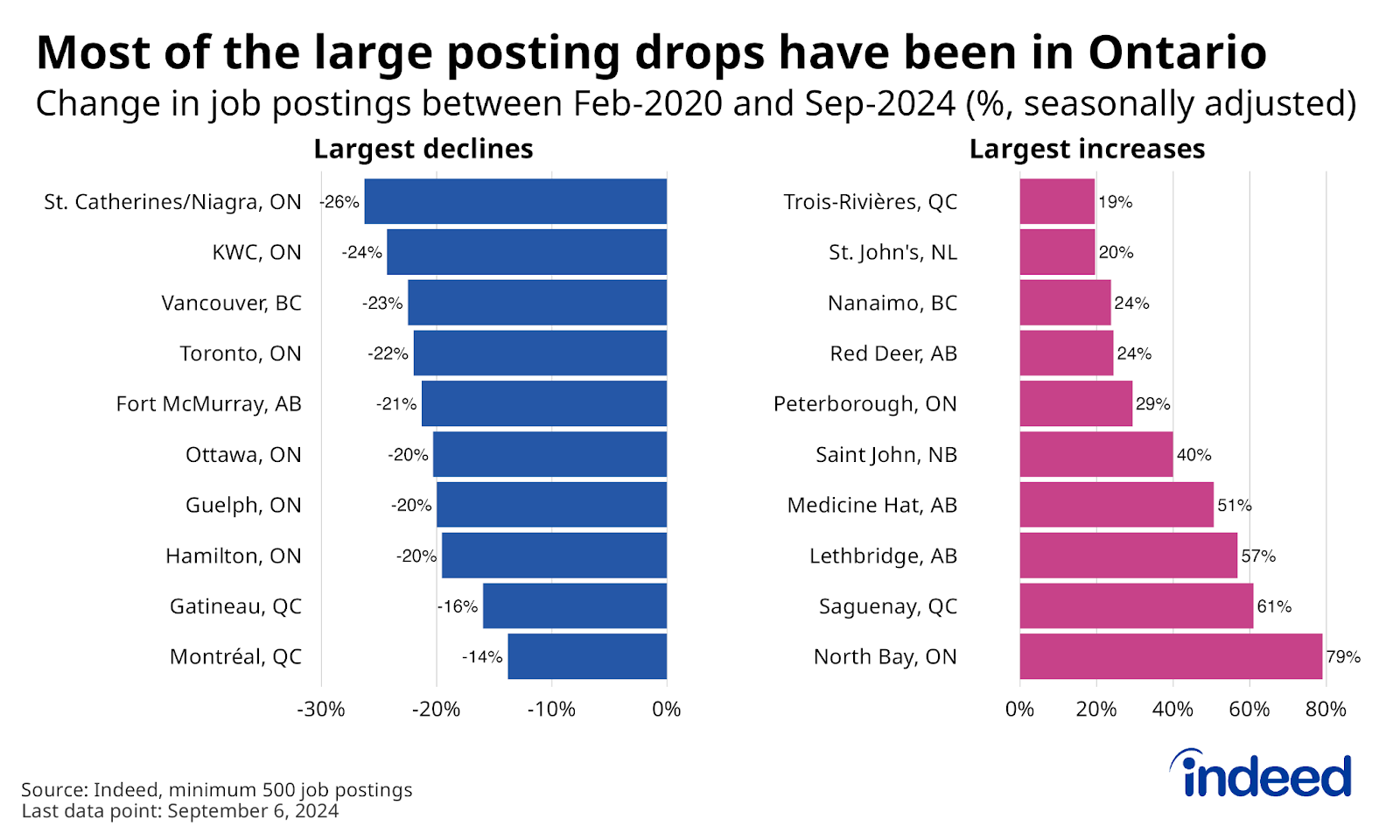

Focusing on net changes across specific locales, Canada’s largest metros cities all rank in the top ten in terms of largest declines in job postings between early 2020 and September 2024, including drops of 23% and 22% in Vancouver and Toronto, respectively. Several Ontario metros have also posted similar declines of near-20% or more, including Ottawa, Hamilton, and Kitchener-Cambridge-Waterloo.

Conversely, the largest increases in job postings have occurred in relatively small metros and census agglomerations. While postings in Calgary and Edmonton both exceed pre-pandemic levels, Alberta’s smaller cities — Lethbridge, Medicine Hat, and Red Deer — were up even more. Postings were up more than 25% in several other small and mid-size cities across the country, including North Bay, Sageuany, and Saint John. This pattern also extended outside urban areas: Job postings in non-urban areas were up more than 10% from early-2020 levels in all provinces except Prince Edward Island and Newfoundland and Labrador.

Local conditions predict trends for many individual occupations, but not healthcare

Employers in local labour markets are always trying to fill a wide range of job openings. However, for many occupations, how labour demand is faring in a given city as a whole is often a decent predictor of how postings for certain, otherwise disparate, job types are doing.

Grouping non-healthcare occupations (which tend to be less cyclical) into wage tiers based on median advertised pay, cities with stronger growth in total job postings since 2019 also tended to show stronger growth in postings for low-, mid-, and high-wage job types individually. For instance, Saguenay, Saskatoon, and Lethbridge all experienced solid posting growth across the three wage tiers, while Toronto, Vancouver, and Ottawa experienced declines across the board.

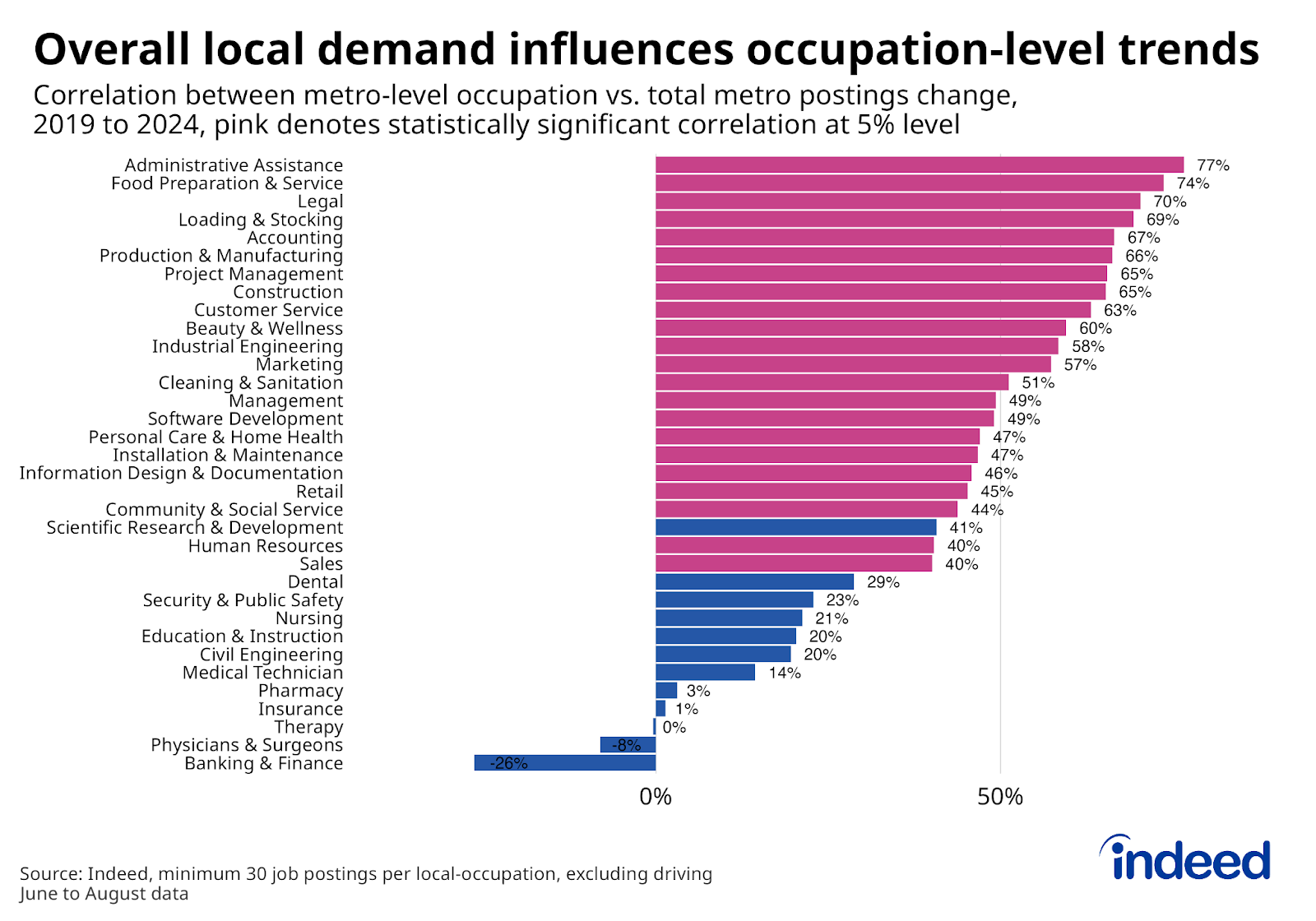

Trends for certain occupations are particularly correlated with the local labour market they’re in. Put another way, when a metro’s overall job postings are doing well, these sectors reliably tend to also be doing well, and vice-versa when local conditions are weak. Among higher-paying roles, postings for management, legal services, and industrial engineering have been especially sensitive to broader metro-area growth over the past five years, as have mid-wage jobs in accounting, construction, and manufacturing. Meanwhile, several of the tightest links between overall local trends and growth in postings for individual jobs were found in lower-paying roles, including administrative assistance, food services, and loading and stocking.

On the other hand, posting trends for certain jobs haven’t been particularly related to the overall health of local labour demand, especially in healthcare fields. Metro-level growth for most types of healthcare-related postings (including nursing, therapy, and dental services) had fairly weak correlations with overall metro-posting growth between 2019 and 2024 (personal care and home health being one exception).

This reflects how demand for healthcare workers has held strong across the country, even in metros where postings for other roles have dropped. It’s also consistent with trends across occupations at the national level, as healthcare-related job postings have been the field most immune from the cyclical downswing in employer hiring appetite that has hit most other sectors.

Business conditions impact local labour markets

Similar local-level job posting trends among otherwise disparate occupations highlight how regional-level business conditions have broad labour market impacts. Whether local consumers and businesses are spending and investing impacts both desired staffing levels in different industries directly, as well as, more broadly, the availability of labour supply throughout the economy.

In this context, the weaker trends in Vancouver, Toronto, and other Ontario cities likely reflect a few factors. First, given the industry-mix of these centers, they had greater exposure to hiring freezes in the tech sector (which began in mid-2022), helping explain why their postings started falling earlier than others. Second, these areas were likely also vulnerable to the higher interest rate environment that kicked off during this time, due to their elevated home prices and household indebtedness. Consumer spending in Toronto and Vancouver in particular has been relatively weak lately, while less-populated areas were likely to be more insulated from the same shocks.

The other key trend in labour demand has been a relative increase in job opportunities in the Prairies. This could be a sign of a “regression to the mean.” Job vacancy rates in Alberta, Saskatchewan, and Manitoba were quite low in the years after the 2014 oil-price crash. While they’ve also taken a hit during the latest labour market slowdown, their improvement relative to the national average is a potential sign that the shadow of the mid-2010s downturn in hiring appetite in these areas is finally fading.

Methodology

All job posting figures in this blog post are grouped by Canadian census metropolitan areas (CMAs) and select census agglomerations (CAs). Daily data reported are seasonally adjusted job posting levels, grouped by different geographic classifications. We seasonally adjust each series based on historical patterns in 2017, 2018, and 2019. Local-level postings by occupation are aggregated over the June to August periods for 2019 and 2024, respectively. Local occupations with relatively few observations are dropped from the correlational analysis. Occupations are grouped into wage tiers based on their 2019 median posted salaries.

The number of job postings on Indeed, whether related to paid or unpaid job solicitations, is not indicative of potential revenue or earnings of Indeed, which comprises a significant percentage of the HR Technology segment of its parent company, Recruit Holdings Co., Ltd. Job posting numbers are provided for information purposes only and should not be viewed as an indicator of performance of Indeed or Recruit. Please refer to the Recruit Holdings investor relations website and regulatory filings in Japan for more detailed information on revenue generation by Recruit’s HR Technology segment.