Overview of Recent Transaction

On September 18, 2024, Orbimed Advisors LLC executed a significant transaction by reducing its holdings in Passage Bio Inc (NASDAQ:PASG), a company focused on genetic medicines for CNS disorders. The firm sold 2,290,707 shares, resulting in a decrease of 22.63% from its previous holding, bringing its total shares to 7,833,869. This move impacted the firm’s portfolio by a mere -0.03%, with the shares traded at a price of $0.73 each.

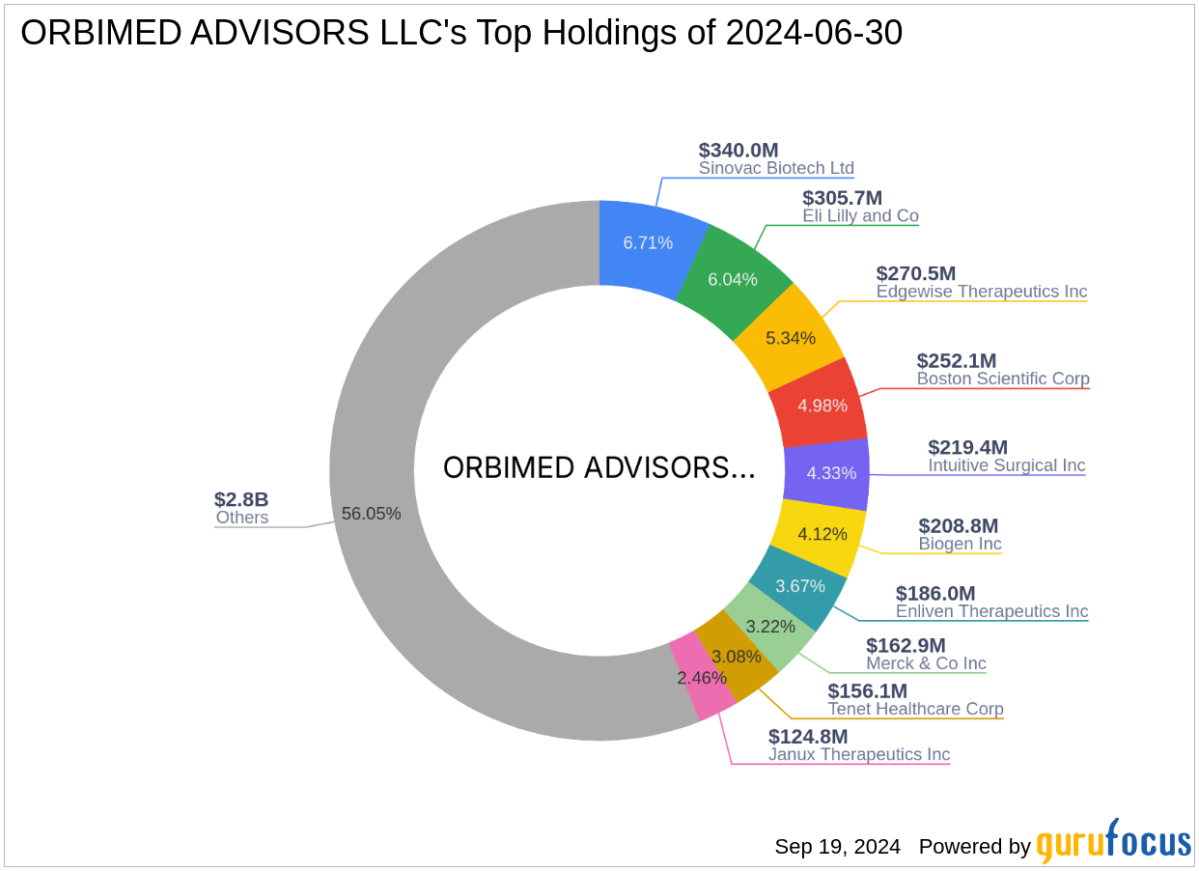

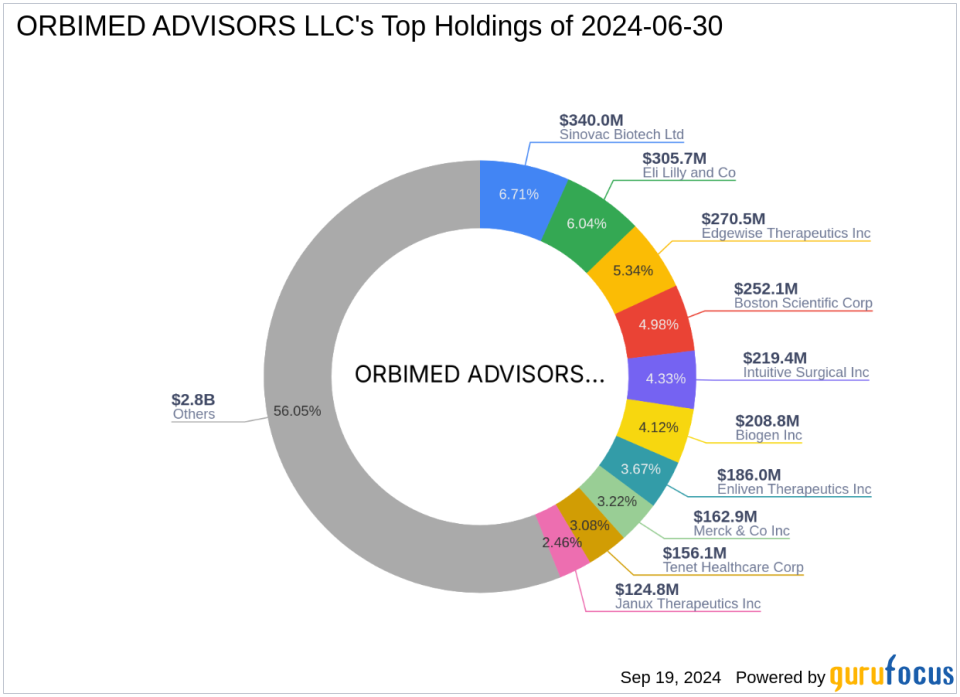

Profile of Orbimed Advisors LLC

Founded in 1989, Orbimed Advisors LLC has grown from a public equity fund into a global leader with approximately $15 billion in assets under management. The firm specializes in healthcare investments, ranging from venture capital start-ups to large multinational companies. Orbimed has expanded its reach globally, with offices in Asia, the Middle East, and beyond, focusing on a variety of investment strategies including long/short equity and private equity.

Impact of the Trade on Orbimeds Portfolio

The recent sale marks a notable reduction in Orbimeds investment in Passage Bio Inc, adjusting its portfolio’s exposure to the biotechnology sector. The firm now holds a 12.68% stake in Passage Bio, reflecting a strategic shift in its investment approach towards the company.

Introduction to Passage Bio Inc

Passage Bio Inc, listed under the symbol PASG, operates within the biotechnology industry in the USA. Since its IPO on February 28, 2020, the company has been dedicated to developing therapies for rare, monogenic CNS disorders, including diseases like GM1 Gangliosidosis and Krabbe Disease. Despite its innovative pipeline, the company’s financial health has been under scrutiny, reflected in its current market capitalization of approximately $43.707 million.

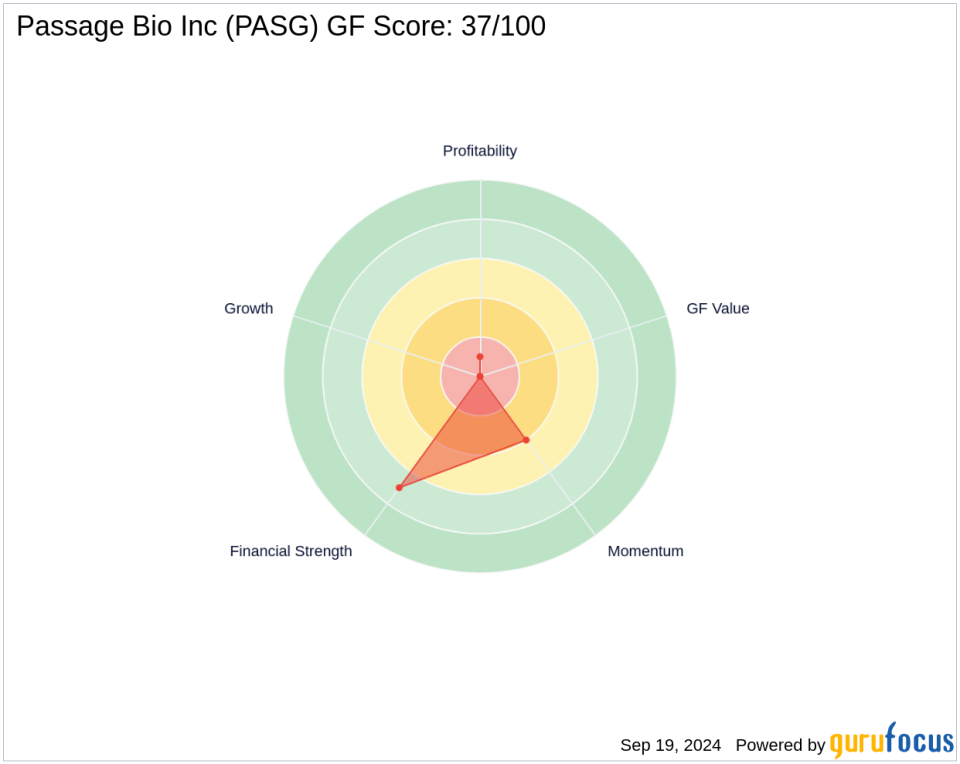

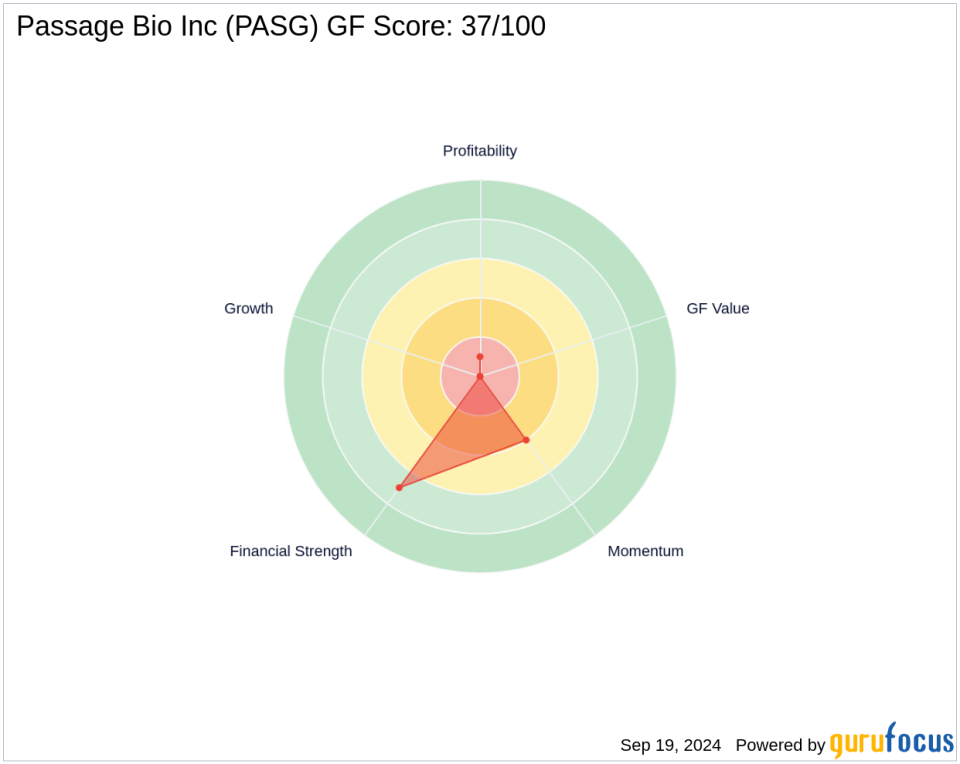

Analysis of Passage Bios Market Performance

Passage Bios stock has experienced a significant downturn, with a year-to-date price decrease of 21.47% and a staggering 96.82% drop since its IPO. The company’s current stock price stands at $0.7076, with a GF Score of 37/100, indicating poor future performance potential. The financial strength and profitability of Passage Bio are notably weak, with a Profitability Rank of 1/10 and a Financial Strength rank of 7/10.

Strategic Implications Behind Orbimeds Decision

The decision by Orbimed Advisors LLC to reduce its stake in Passage Bio Inc may be influenced by the company’s underwhelming financial performance and bleak market outlook. This strategic move could be an attempt to reallocate resources to more promising investments within the healthcare sector, aligning with the firm’s robust investment philosophy.

Broader Market Context

The biotechnology sector has been facing volatility, influenced by regulatory changes and market dynamics. Companies like Passage Bio, focusing on high-risk, high-reward scenarios, are particularly susceptible to these changes, impacting investor sentiment and stock performance.

Conclusion

Orbimed Advisors LLC’s recent reduction in its holdings of Passage Bio Inc reflects a strategic adjustment in response to the company’s ongoing financial challenges and the broader biotechnology market’s instability. This move is indicative of Orbimeds adaptive investment strategy, aiming to optimize its portfolio amidst fluctuating market conditions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.