In the midst of a historic interest rate hiking cycle over 2021-2023, a persistent concern has been that a mortgage renewal “cliff” would derail the Canadian consumer and broader economy along with it.

While those mortgage renewals will certainly act as a brake on the economy as a whole, we made the point as far back as almost a year ago that 2025’s mortgage renewal wave would be manageable as long as (1) the Bank of Canada was cutting rates and (2) the job market doesn’t soften too much. That first condition has clearly been met, but we are more concerned about the second as a slew of labor market data continues to weaken.

Less concerned about mortgage renewals

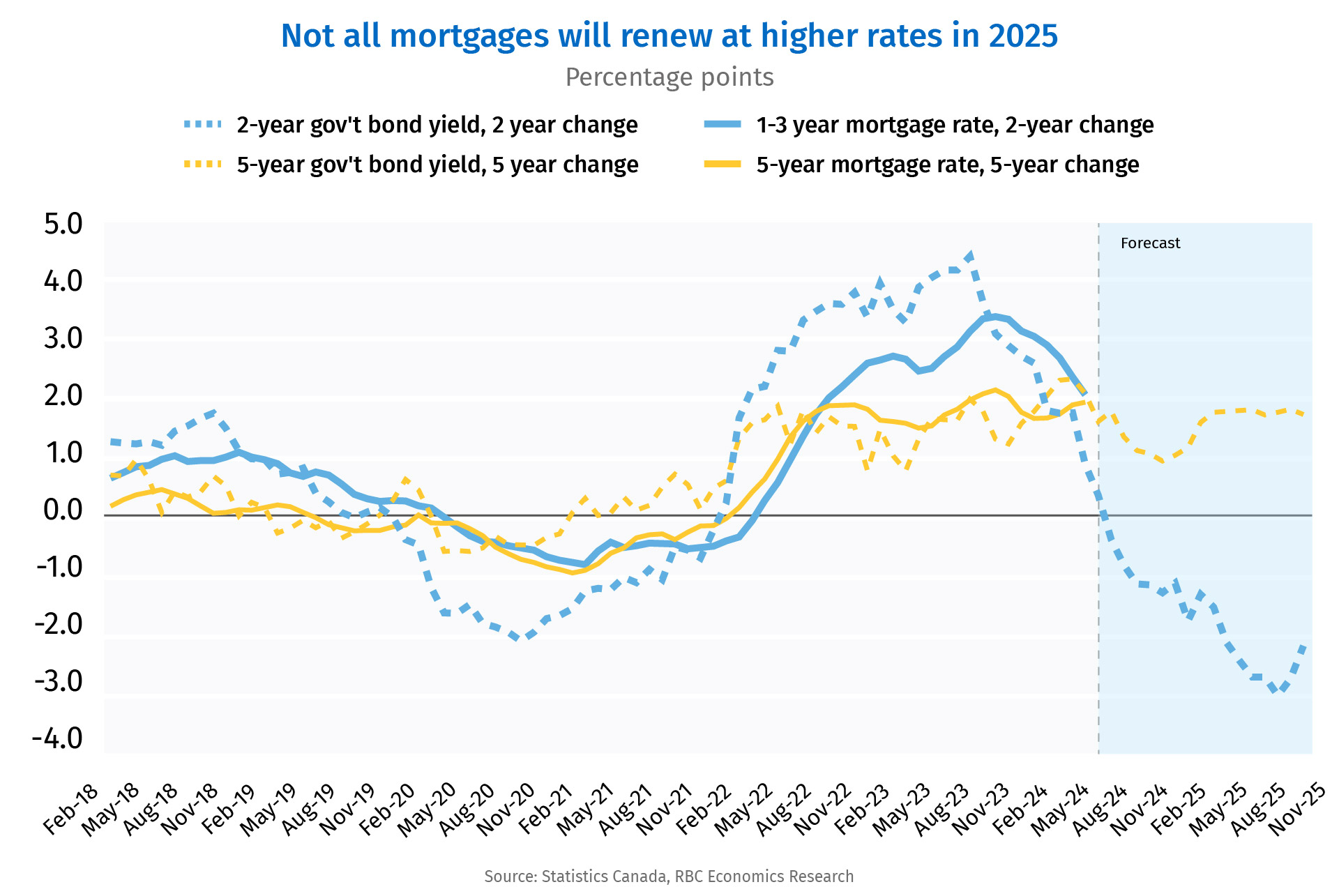

The BoC’s 75 basis points of rate cuts so far (with much more to come) have already produced some rate relief for mortgage holders. Five-year government bond yields, which drive the five-year fixed mortgage rates, have correspondingly dropped and two-year Canadian government bond yields, the main driver of changes in borrowing costs in one to three-year mortgages are below levels from two years ago. A large chunk of one to three-year mortgages will likely renew at lower interest rates and variable rate mortgage holders are already seeing some relief—either from lower debt payments (for variable rate, variable payment mortgages) or lower interest costs and larger principal payments (for variable rate fixed payment mortgages).

Payments are still likely to rise sharply for four and five-year fixed-rate mortgages as interest rates remain above previous levels. Those challenges, particularly for some individual households, shouldn’t be dismissed. But, the increase will be smaller than it would have been without BoC interest rate cuts, and will increase total mortgage payments in 2025 by about 0.1% of total household disposable income, by our count. There are also other offsetting supports. Home prices are still high and homeowners have significant equity in their homes. That leaves more options for borrowers, for example, to refinance at a longer amortization to make monthly payments more affordable if needed.

More concerned about possible labor market weakness

Higher mortgage payments certainly hurt the total amount of income available in the economy to spend, but higher unemployment does as well. We anticipate a 1 percentage point rise in the unemployment rate typically lowers household disposable income in the economy by 0.5%. Our forecast calls for continued modest rises in Canada’s unemployment rate from its low of 5% in mid-2022 to 7% by early 2025. That’s a significant increase and more than a percentage point above pre-pandemic levels. But, we’re watching for deterioration that might extend beyond that.

The total amount of job openings in the economy is 25% below where it was a year ago and if it weakens further, it will cause the unemployment rate to rise more than our base case expectations. Initially, there were more job vacancies than people looking for work, so the drop in openings didn’t have a material impact on the economy. But, that’s no longer the case. The unemployment rate is now above pre-pandemic levels, and the job vacancy rate is lower. Any further drop in hiring demand raises the risk of the unemployment rate rising more.

Nathan Janzen is an Assistant Chief Economist, leading the macroeconomic analysis group. His focus is on analysis and forecasting macroeconomic developments in Canada and the United States

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.