Insight into the Fund’s Latest Portfolio Adjustments and Key Stock Performances

Royce International Premier Fund (Trades, Portfolio), known for its selective investment in non-U.S. small-cap companies, recently disclosed its N-PORT filing for Q2 2024. The fund targets companies with strong competitive advantages, high returns on invested capital, and sustainable franchises. It prioritizes businesses that are a-cyclical growers, capable of generating significant free cash, and possessing a defensible moat, focusing on operational efficiency, financial track record, and corporate governance.

Summary of New Buys

Royce International Premier Fund (Trades, Portfolio) expanded its portfolio by adding three new stocks:

-

CTS Eventim AG & Co. KGaA (XTER:EVD) was the top new addition with 29,991 shares, making up 0.82% of the portfolio, valued at 2.5 million.

-

Sdiptech AB (OSTO:SDIP B) followed, with 69,496 shares, representing 0.69% of the portfolio, valued at kr2.12 million.

-

Robertet SA (XPAR:CBE) was also added with 1,961 shares, accounting for 0.56% of the portfolio, valued at 1.71 million.

Key Position Increases

The fund also increased its stakes in four stocks:

-

Vitec Software Group AB (OSTO:VIT B) saw a significant addition of 37,421 shares, bringing the total to 82,486 shares. This represents an 83.04% increase in share count, impacting the portfolio by 0.64%, with a total value of kr4.28 million.

-

NICE Ltd (NASDAQ:NICE) also saw an increase of 2,796 shares, bringing the total to 31,188 shares, valued at $5.36 million.

Summary of Sold Out Positions

The fund exited four positions during the quarter:

-

Miura Co Ltd (TSE:6005) was completely sold off, with all 434,400 shares liquidated, impacting the portfolio by -1.91%.

-

Embla Medical hf (OCSE:EMBLA) saw all 947,688 shares sold, impacting the portfolio by -1.05%.

Key Position Reductions

Significant reductions were made in 53 stocks, including:

-

BML Inc (TSE:4694) was reduced by 281,000 shares, a -45.31% decrease, impacting the portfolio by -1.23%. The stock traded at an average price of 2,874.23 during the quarter.

-

IPH Ltd (ASX:IPH) saw a reduction of 1,269,998 shares, a -43.81% decrease, impacting the portfolio by -1.19%. The stock traded at an average price of A$6.19 during the quarter.

Portfolio Overview

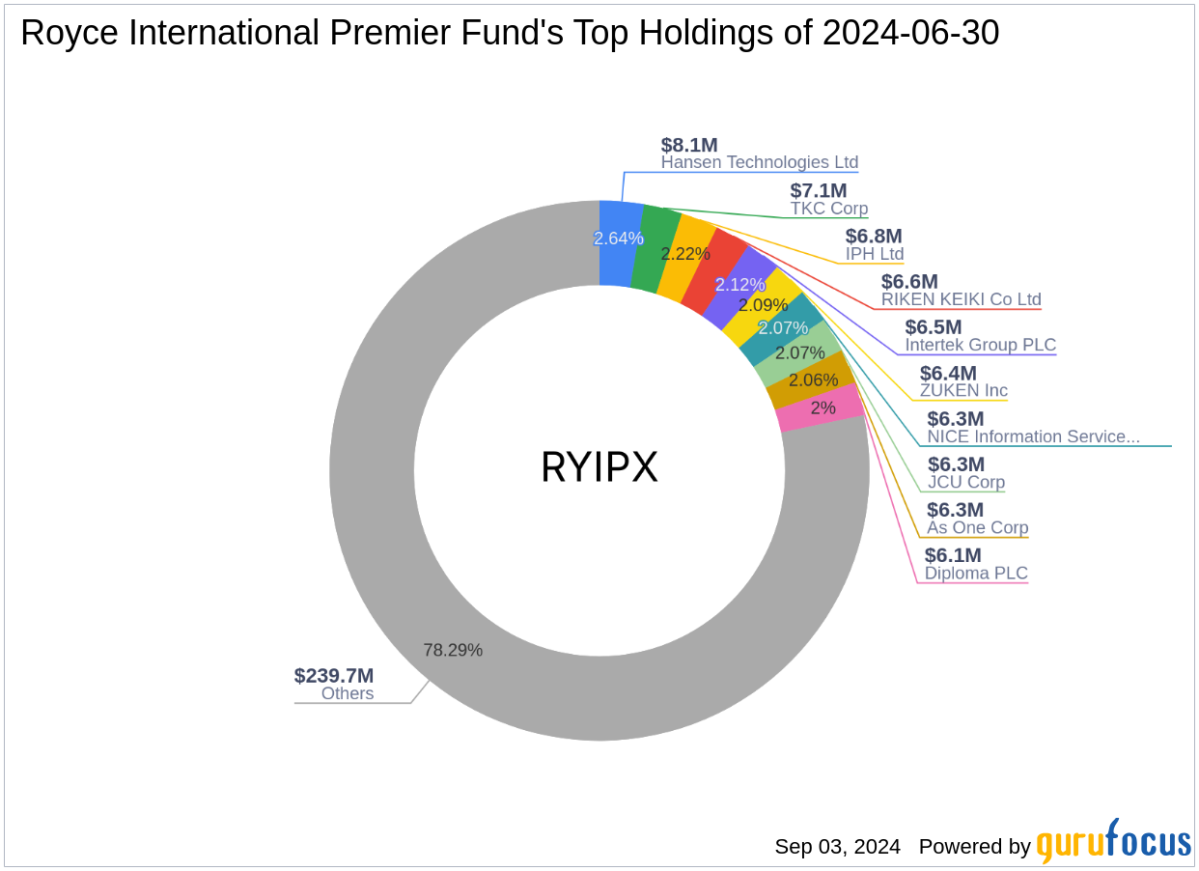

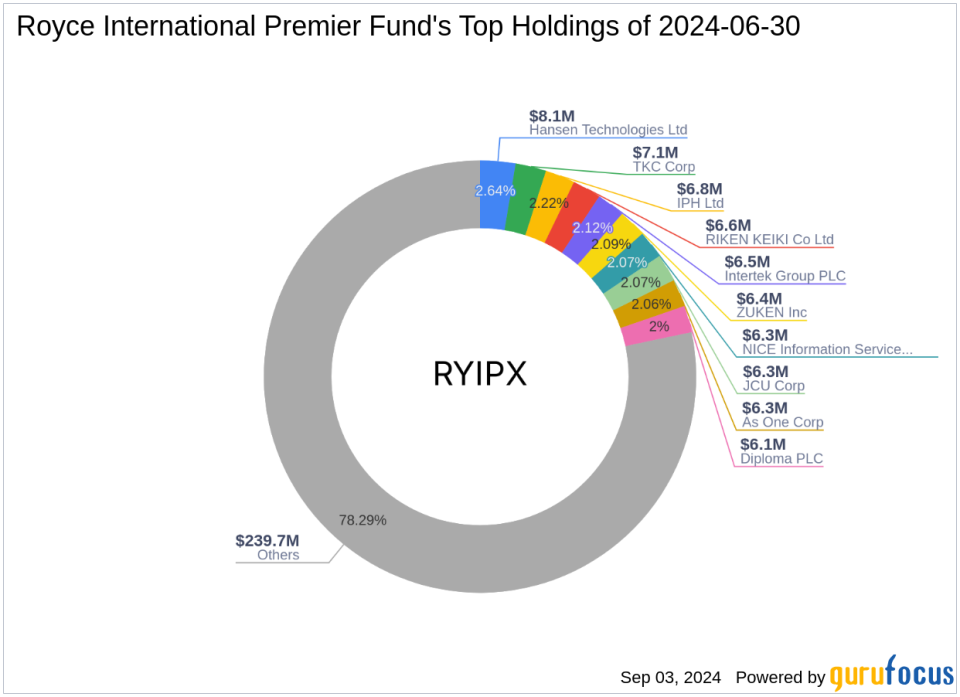

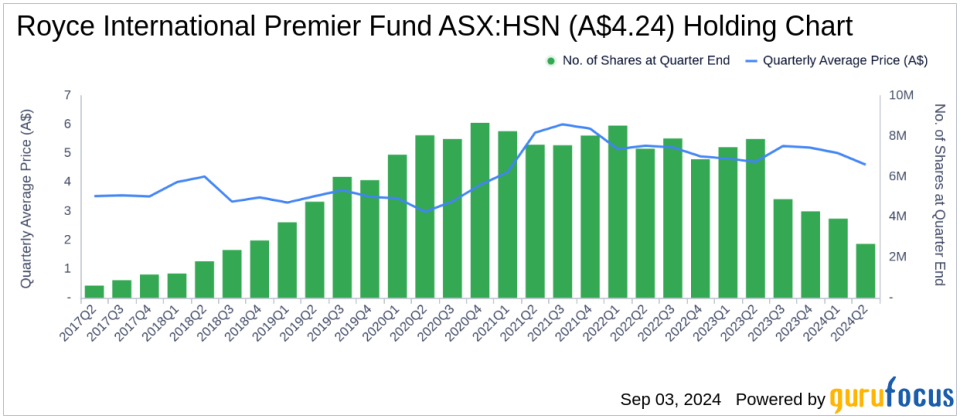

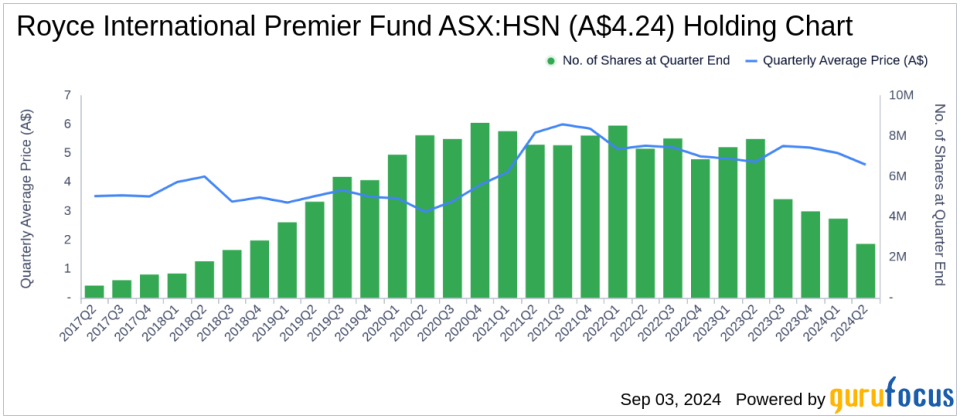

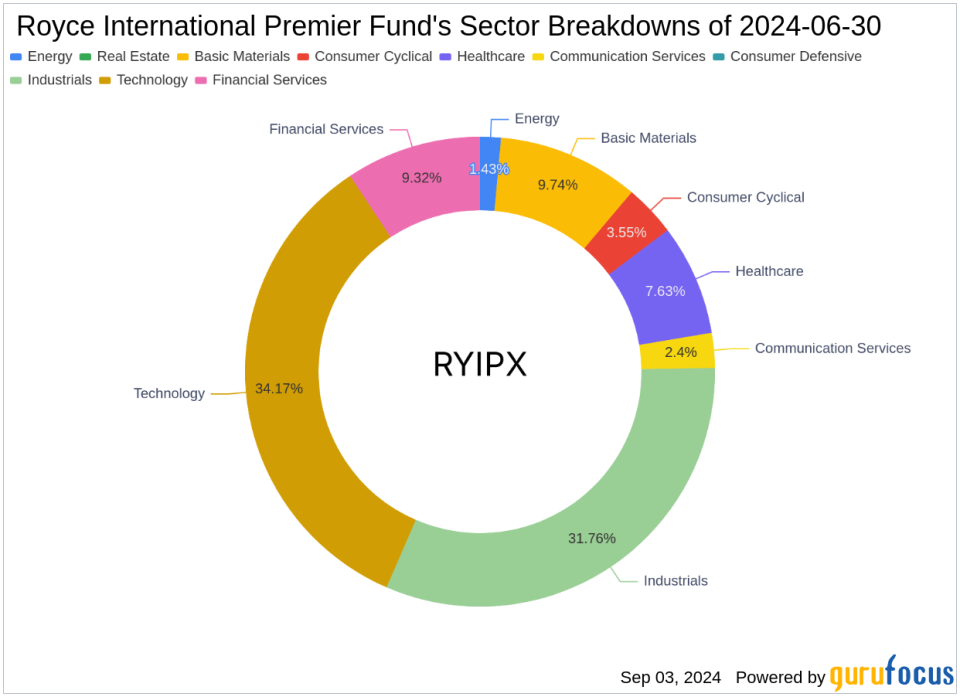

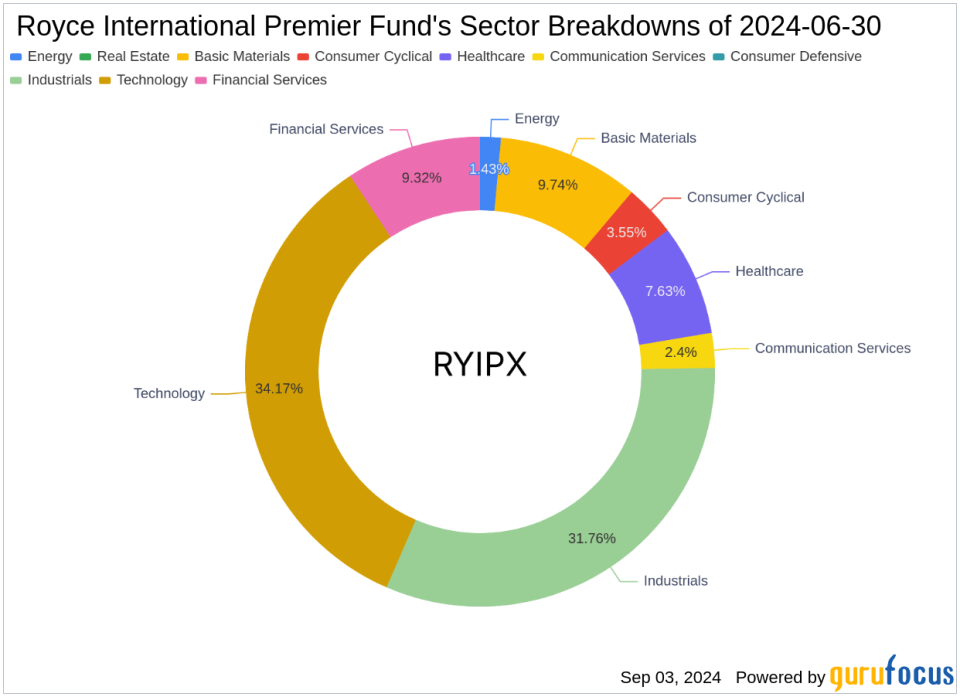

As of Q2 2024, Royce International Premier Fund (Trades, Portfolio)’s portfolio included 60 stocks. The top holdings were 2.64% in Hansen Technologies Ltd (ASX:HSN), 2.3% in TKC Corp (TSE:9746), and 2.22% in IPH Ltd (ASX:IPH). The holdings are mainly concentrated in eight industries: Technology, Industrials, Basic Materials, Financial Services, Healthcare, Consumer Cyclical, Communication Services, and Energy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.