Overview of the Recent Transaction

On September 18, 2024, Saba Capital Management, L.P. (Trades, Portfolio), a prominent investment firm, strategically increased its holdings in BlackRock Health Sciences Trust II (NYSE:BMEZ) by acquiring an additional 47,682 shares. This transaction not only underscores the firm’s confidence in BMEZ but also marks a significant enhancement of its portfolio, reflecting a trade impact of 0.01%.

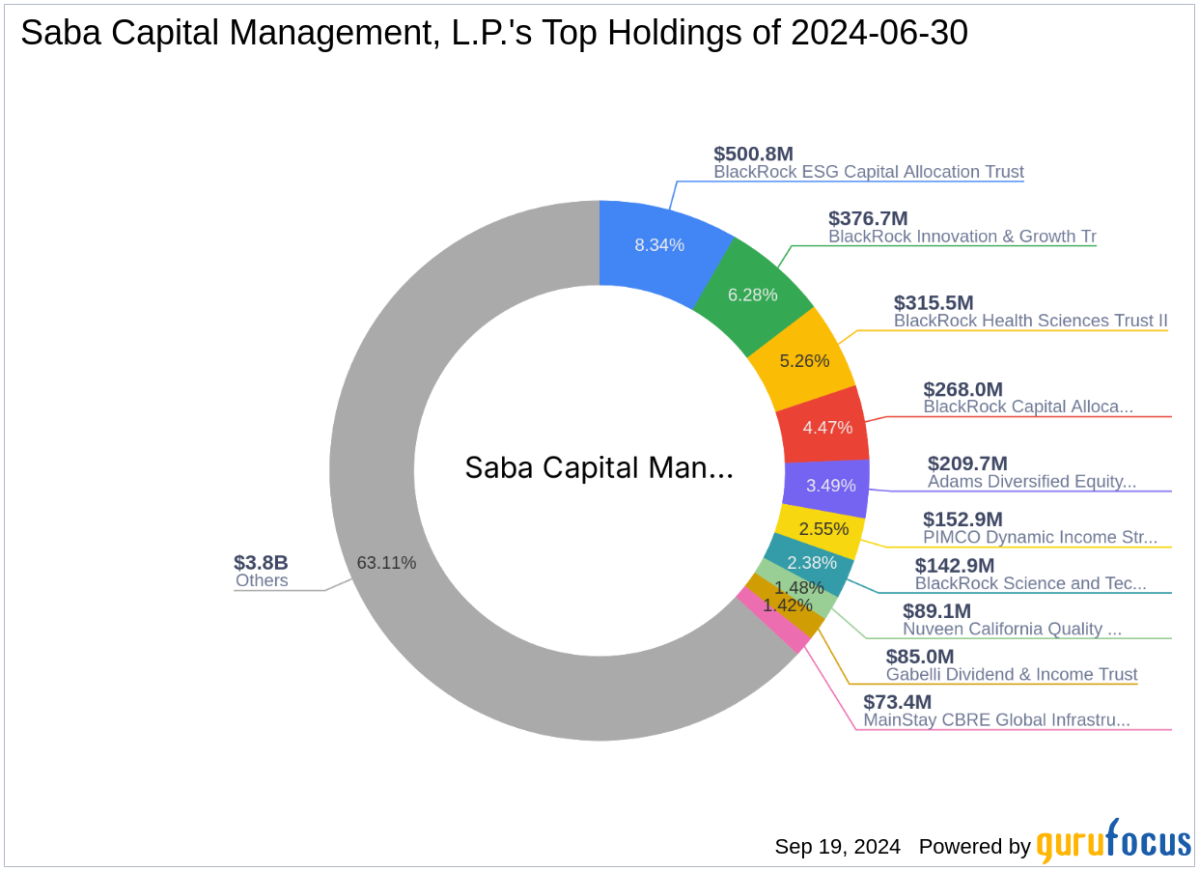

Profile of Saba Capital Management, L.P. (Trades, Portfolio)

Saba Capital Management, L.P. (Trades, Portfolio), based in New York, is renowned for its expertise in market dynamics and investment strategies. The firm manages a diverse portfolio with a strong emphasis on financial services and communication services sectors. With top holdings that include several high-profile funds, Saba Capital demonstrates a keen acumen for selecting high-potential investments.

Detailed Insights into the Trade

The recent acquisition was executed at a price of $15.91 per share, slightly below the current market price of $16.1692, suggesting a timely and strategic addition by Saba Capital. This move has increased the firm’s total shares in BMEZ to 20,586,113, making up 5.46% of their portfolio and representing 19.82% of the total shares outstanding of BMEZ.

Introduction to BlackRock Health Sciences Trust II

BlackRock Health Sciences Trust II operates as a closed-ended management investment company, focusing on equity securities of companies in the health sciences sector. With a market capitalization of $1.68 billion, BMEZ aims to deliver total return through both current income and long-term capital appreciation.

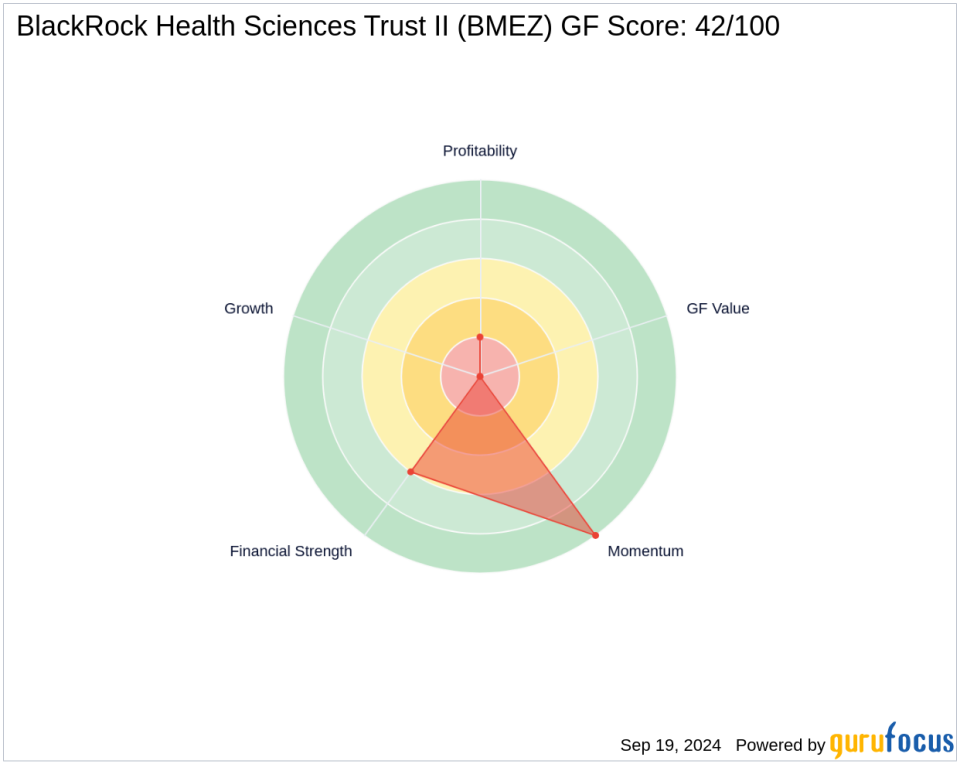

Analysis of Market Performance and Stock Metrics

BMEZ has shown a year-to-date price increase of 9.99%, despite a decline of 19.19% since its IPO. The stock’s performance is further characterized by a GF Score of 42/100, indicating potential challenges in future performance. The stock also exhibits a strong Momentum Rank of 10/10, suggesting recent positive trends in its trading activity.

Strategic Impact of the Investment

This recent acquisition by Saba Capital Management significantly bolsters its position in the health sciences sector, aligning with its broader investment strategy. The addition of BMEZ shares is poised to enhance the firm’s portfolio diversification and potential for long-term growth, reflecting a calculated move to capitalize on the evolving dynamics of the health sciences industry.

Comparative Analysis and Future Outlook

Despite its current challenges, BMEZ’s strategic focus on the health sciences sector positions it well within an industry poised for growth. The firm’s increased stake in BMEZ may leverage industry trends favorably, potentially offsetting some of the stock’s recent underperformance and aligning with Saba Capital’s investment philosophy of targeting sectors with robust growth prospects.

In conclusion, Saba Capital Management, L.P. (Trades, Portfolio)’s recent expansion of its stake in BlackRock Health Sciences Trust II reflects a strategic enhancement of its investment portfolio, with potential implications for both the firm and the broader market in the health sciences sector. This move underscores the firm’s proactive approach to capitalizing on industry trends and optimizing its investment strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.