Overview of Recent Transaction by Saba Capital Management

On September 30, 2024, Saba Capital Management, L.P. (Trades, Portfolio), a prominent firm in the financial sector, executed a significant transaction involving the shares of First Trust Specialty Finance and Financial Opportunities Fund (NYSE:FGB). The firm reduced its holdings by 200,212 shares, resulting in a new total of 747,940 shares. This adjustment reflects a -21.12% change in their previous position, with a minor portfolio impact of -0.01%. The shares were traded at a price of $4.07 each.

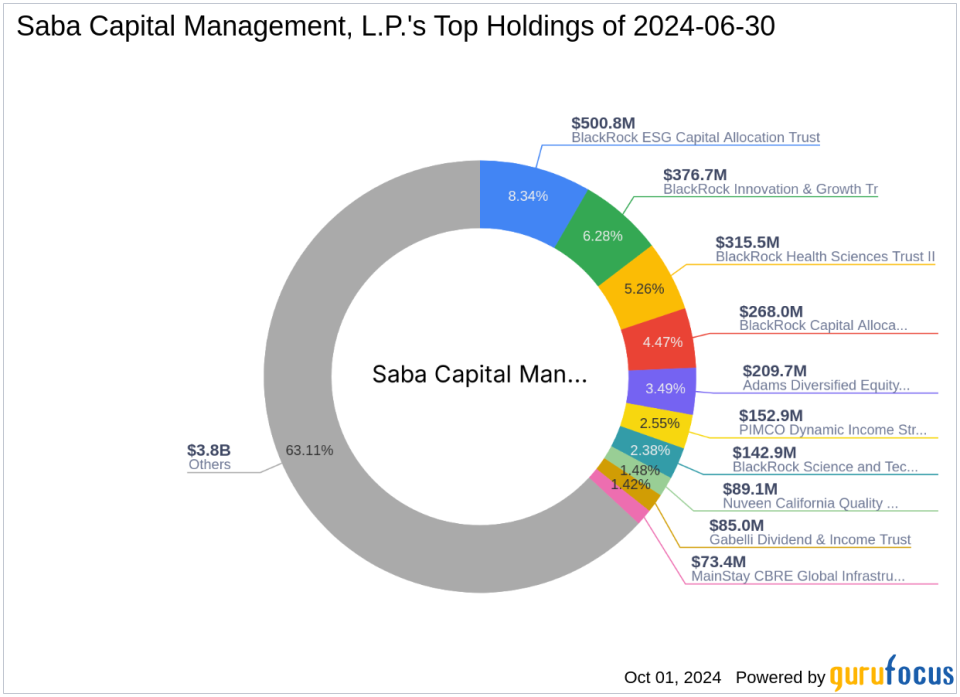

Profile of Saba Capital Management, L.P. (Trades, Portfolio)

Saba Capital Management, L.P. (Trades, Portfolio), based at 405 Lexington Avenue, New York, NY, is known for its strategic investments primarily in the financial services sector. With an equity portfolio amounting to $6 billion and top holdings in various high-profile funds, the firm maintains a robust presence in the market. Its investment philosophy focuses on maximizing returns through diversified and strategic asset allocations.

Insight into First Trust Specialty Finance and Financial Opportunities Fund

First Trust Specialty Finance and Financial Opportunities Fund is a U.S.-based closed-end management investment company. It aims to provide a high level of current income and, as a secondary objective, seeks a positive total return. The fund invests primarily in securities of specialty finance and other financial companies. As of the latest data, FGB has a market capitalization of approximately $58.477 million and a stock price of $4.07.

Financial Impact and Portfolio Adjustment

The recent transaction by Saba Capital Management has adjusted its exposure to FGB, now representing 0.05% of its total portfolio with a 5.21% ownership in the company. This move is indicative of the firm’s strategic realignment or response to market conditions, reflecting a nuanced approach to portfolio management in the financial services sector.

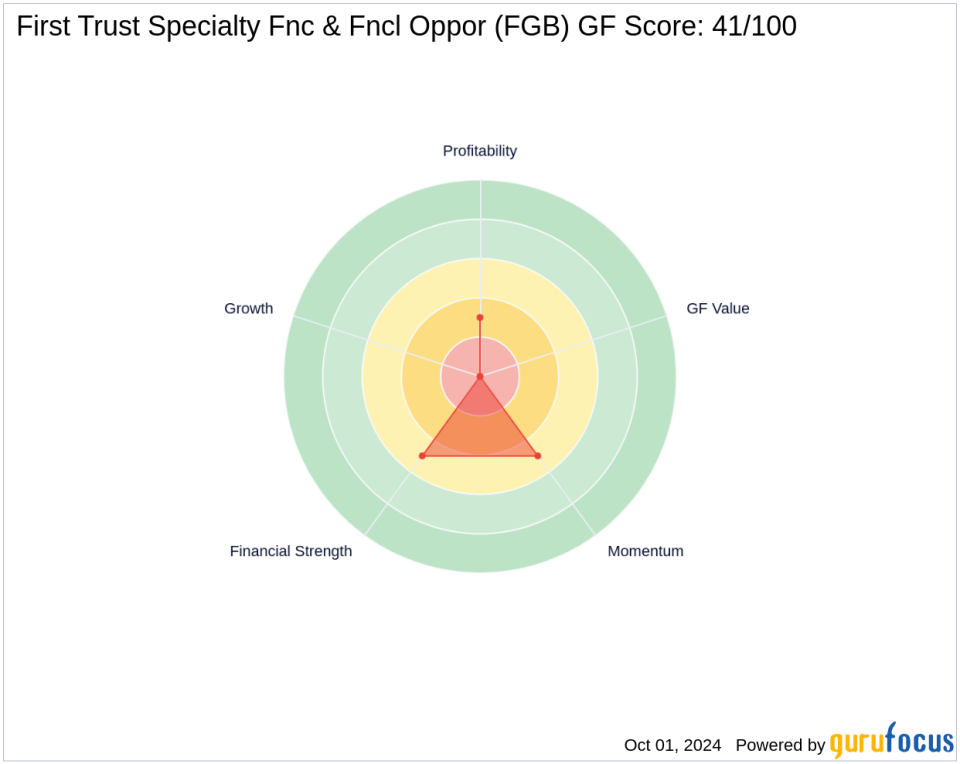

Performance and Valuation of FGB

FGB’s current stock price stands at $4.07, with a year-to-date performance increase of 14.97%. However, the stock’s GF Score of 41/100 suggests potential challenges ahead in terms of market performance. The GF Score components, such as Profitability Rank and Growth Rank, indicate a need for cautious assessment from investors.

Strategic Implications and Future Outlook

The reduction in FGB shares by Saba Capital Management might signal a strategic shift or a reallocation based on performance metrics and future market expectations. The asset management industry, including sectors like specialty finance, is subject to rapid changes and requires firms to adapt their strategies accordingly. Investors and market watchers will be keen on observing how Saba Capital adjusts its portfolio in response to these dynamics.

This transaction not only reflects the firm’s adaptive strategies in asset management but also highlights the importance of staying responsive to market conditions and valuation metrics. As the industry evolves, the moves by significant players like Saba Capital Management will be crucial indicators of broader market trends and investment opportunities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.