The market has been flat in the last week but is up 13% over the past year, with earnings expected to grow by 15% per annum. In this environment, identifying high-growth tech stocks that can outperform becomes crucial for investors looking to capitalize on Canada’s promising tech sector.

Top 10 High Growth Tech Companies In Canada

|

Name |

Revenue Growth |

Earnings Growth |

Growth Rating |

|---|---|---|---|

|

Docebo |

14.74% |

34.09% |

★★★★★☆ |

|

Constellation Software |

16.17% |

23.55% |

★★★★★☆ |

|

HIVE Digital Technologies |

54.20% |

100.27% |

★★★★★☆ |

|

GameSquare Holdings |

38.08% |

86.64% |

★★★★★☆ |

|

Stingray Group |

4.94% |

69.22% |

★★★★☆☆ |

|

Medicenna Therapeutics |

62.37% |

57.20% |

★★★★★☆ |

|

Sabio Holdings |

12.97% |

122.50% |

★★★★☆☆ |

|

BlackBerry |

20.61% |

76.74% |

★★★★★☆ |

|

Cineplex |

8.05% |

179.27% |

★★★★☆☆ |

|

Alpha Cognition |

62.98% |

69.54% |

★★★★★☆ |

Click here to see the full list of 22 stocks from our TSX High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cineplex Inc., together with its subsidiaries, operates as an entertainment and media company in Canada and internationally, with a market cap of CA$689.70 million.

Operations: Cineplex generates revenue primarily from three segments: Media (CA$120.16 million), Location-Based Entertainment (CA$132.08 million), and Film Entertainment and Content (CA$1.05 billion). The company operates in both Canada and internationally, focusing on diverse entertainment offerings.

Cineplex reported CAD 277.34 million in revenue for Q2 2024, a significant drop from CAD 367.92 million the previous year. Despite this, earnings are forecast to grow by an impressive 179.27% annually over the next three years, highlighting potential profitability ahead. The company also announced a share repurchase program to buy back up to 6,318,346 shares by August 2025. Box office revenues for June reached $51.36 million, representing 92% of the same month in 2023 and showcasing resilience amidst industry challenges.

Simply Wall St Growth Rating: ★★★★☆☆

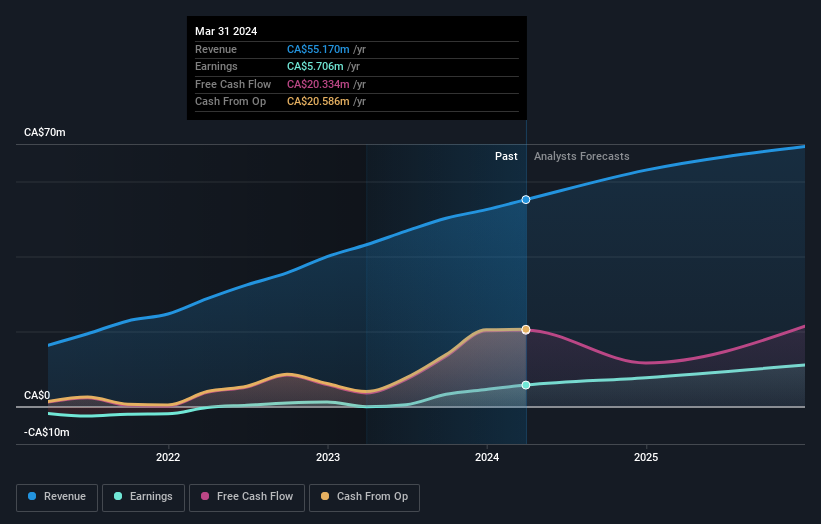

Overview: Kinaxis Inc. offers cloud-based subscription software for supply chain operations across the United States, Europe, Asia, and Canada, with a market cap of CA$4.21 billion.

Operations: Kinaxis Inc. generates revenue primarily from its cloud-based subscription software, amounting to $457.72 million. The company operates across the United States, Europe, Asia, and Canada.

Kinaxis, a supply chain management software company, has seen its earnings grow by 137.9% over the past year, outpacing the software industry’s 1.9%. Forecasts suggest annual earnings growth of 47.4%, significantly higher than the Canadian market’s 15.4%. With R&D expenses at $48 million in the last fiscal year, Kinaxis continues to innovate with AI-powered solutions like its Maestro platform. Recent executive changes and strategic client acquisitions signal robust future prospects as it aims for $1 billion in revenue amidst a $16 billion market opportunity.

Simply Wall St Growth Rating: ★★★★☆☆

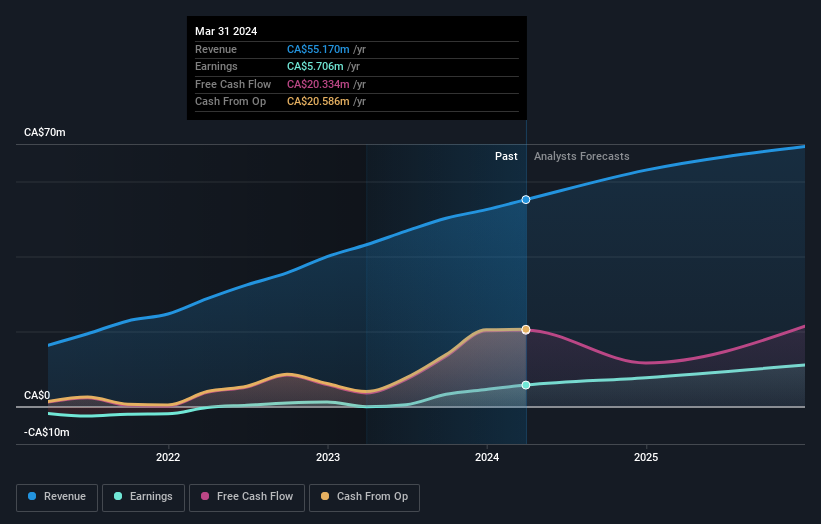

Overview: Vitalhub Corp., along with its subsidiaries, delivers technology solutions for health and human service providers across Canada, the United States, the United Kingdom, Australia, Western Asia, and other international markets with a market cap of CA$404.79 million.

Operations: Vitalhub Corp. generates revenue primarily from its healthcare software segment, which accounts for CA$58.32 million. The company operates internationally, offering technology solutions to health and human service providers across multiple regions including Canada, the United States, the United Kingdom, Australia, and Western Asia.

Vitalhub, a healthcare software provider, reported a 24.05% revenue increase to CAD 31.49 million for the first half of 2024. Despite a net loss of CAD 0.34 million in Q2, the company forecasts earnings growth at an impressive 65.9% annually over the next three years, outpacing Canada’s market average of 15.4%. Notably, R&D expenses reflect their commitment to innovation with CAD 6 million spent last year, contributing to their robust pipeline and future prospects in digital health solutions.

Turning Ideas Into Actions

-

Unlock more gems! Our TSX High Growth Tech and AI Stocks screener has unearthed 19 more companies for you to explore.Click here to unveil our expertly curated list of 22 TSX High Growth Tech and AI Stocks.

-

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St’s portfolio, where intuitive tools await to help optimize your investment outcomes.

-

Streamline your investment strategy with Simply Wall St’s app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:CGX TSX:KXS and TSX:VHI.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com