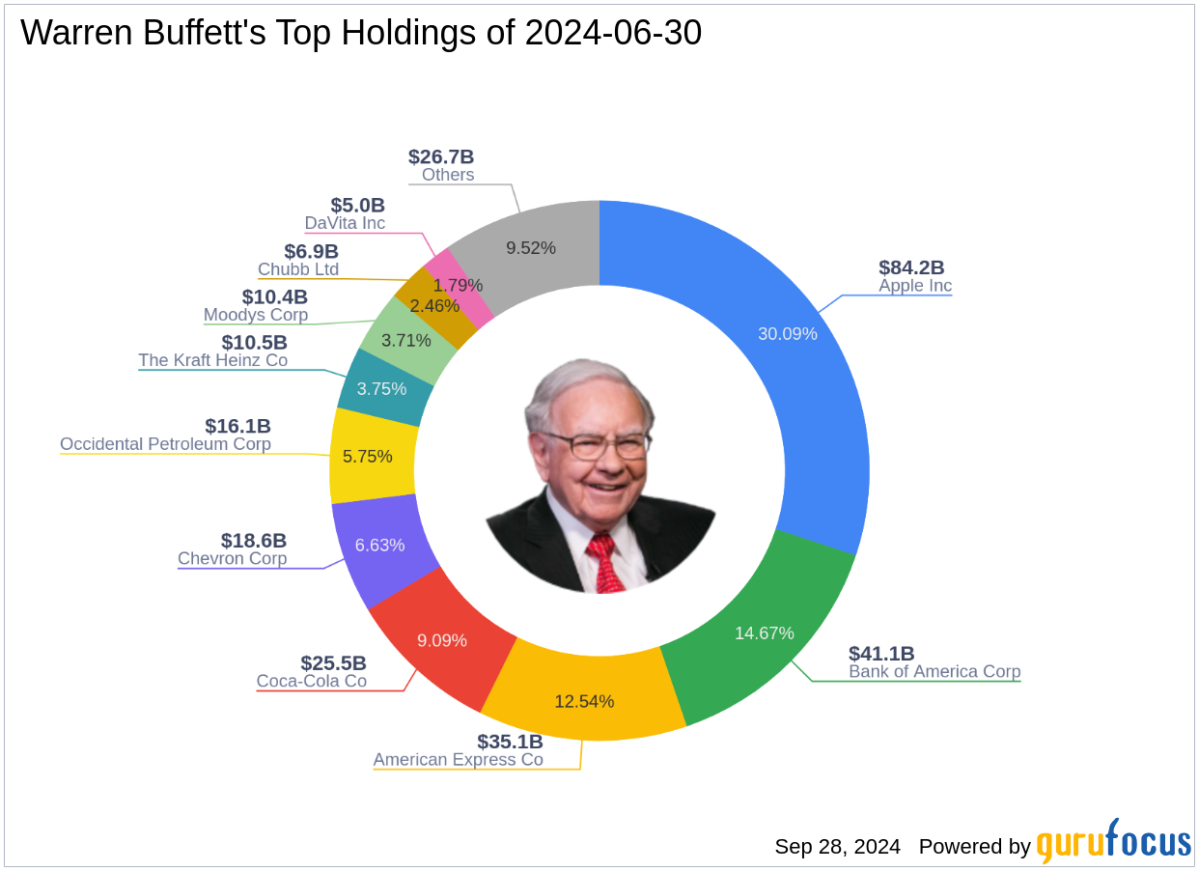

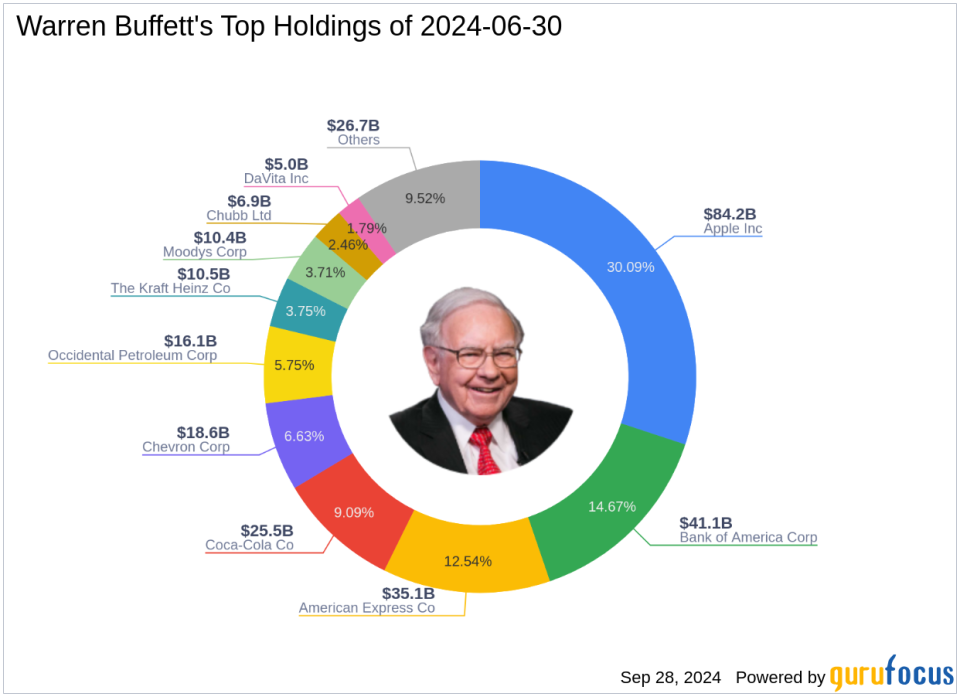

On September 27, 2024, Warren Buffett (Trades, Portfolio)’s firm made a significant adjustment to its investment portfolio by reducing its stake in Bank of America Corp (NYSE:BAC). The transaction involved the sale of 11,678,366 shares at a price of $39.45 each. This move decreased the firm’s holding in the bank to 802,668,860 shares, impacting the portfolio by -0.16% and adjusting the position size to 11.33% of the total portfolio.

Profile of Warren Buffett (Trades, Portfolio)

Warren Buffett (Trades, Portfolio), often referred to as “The Oracle of Omaha,” is a hallmark of investment success. As the chairman of Berkshire Hathaway, Buffett transformed a textile company into a major conglomerate, primarily focusing on insurance and other diverse investments. Buffett’s investment philosophy, deeply rooted in Benjamin Graham’s principles of value investing, emphasizes understanding a business deeply, investing with a margin of safety, and choosing companies with long-term value. His strategies have consistently outperformed the market, making his investment moves a focal point for investors globally.

Understanding Bank of America

Bank of America, one of the leading financial institutions in the United States, boasts over $3.0 trillion in assets. It operates across several segments including consumer banking, global wealth and investment management, and global markets. The company’s significant scale and its operation in both retail and wholesale banking allow it to serve millions of customers worldwide. As of the latest data, Bank of America holds a market capitalization of approximately $305.73 billion, with a PE ratio of 13.87, indicating a stable financial posture in the industry.

Analysis of the Trade Impact

The recent reduction in Bank of America shares by Buffett’s firm has adjusted its portfolio’s exposure to the financial services sector, where it holds a significant position. The reduction of approximately 1.43% in BAC shares suggests a strategic realignment or cashing in on potential gains, as the stock has seen a year-to-date increase of 16.22%. This move might reflect Buffett’s assessment of the stock reaching its intrinsic value, aligning with his investment philosophy of buying undervalued assets.

Comparative Analysis with Other Gurus

Other notable investors like Dodge & Cox, Ken Fisher (Trades, Portfolio), and Richard Pzena (Trades, Portfolio) also hold significant positions in Bank of America. Each investor has unique strategies, but like Buffett, they often seek value in large, stable companies. Buffett’s recent sell-off might influence other investors’ perceptions and strategies towards BAC, given his noted influence in the investment community.

Future Outlook and Market Context

The financial services sector is currently experiencing various macroeconomic pressures including interest rate changes and regulatory adjustments, which could affect Bank of America’s performance. However, the bank’s strong market position and recent financial metrics suggest resilience. Investors will be keenly watching the next moves of Buffett and other major investors, which could signal broader economic trends or shifts in the financial sector.

In conclusion, Warren Buffett (Trades, Portfolio)’s recent transaction in Bank of America shares marks a notable realignment in his investment strategy, reflecting his ongoing assessment of the financial landscape and intrinsic stock values. This move provides a critical insight into his long-term investment approach, potentially signaling to the market both caution and opportunity.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.